Berkshire Hathaway 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Derivative contract liabilities (Continued)

municipality contracts are generally based on bond pricing data on the underlying bond issues and credit spread estimates. We

monitor and review pricing data and spread estimates for consistency as well as reasonableness with respect to current market

conditions. We make no significant adjustments to the pricing data or inputs obtained.

Prices in a current market trade involving identical (or sufficiently similar) risks and contract terms as our equity index put

option or credit default contracts could differ significantly from the fair values used in the financial statements. We do not

operate as a derivatives dealer and currently do not utilize offsetting strategies to hedge our equity index put option or credit

default contracts. We currently intend to allow these contracts to run off to their respective expiration dates.

Other Critical Accounting Policies

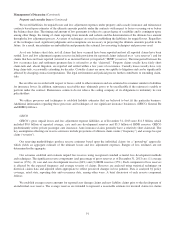

We record deferred charges with respect to liabilities assumed under retroactive reinsurance contracts. At the inception of

these contracts, the deferred charges represent the excess, if any, of the estimated ultimate liability for unpaid losses over the

consideration received. Deferred charges are amortized using the interest method over an estimate of the ultimate claim

payment period with the periodic amortization reflected in earnings as a component of losses and loss adjustment expenses.

Deferred charge balances are adjusted periodically to reflect new projections of the amount and timing of remaining loss

payments. Adjustments to deferred charge balances resulting from changes to these assumptions are determined retrospectively

from the inception of the contract. Unamortized deferred charges were approximately $4.35 billion at December 31, 2013.

Significant changes in the estimated amount and the timing of payments of unpaid losses may have a significant effect on

unamortized deferred charges and the amount of periodic amortization.

Our Consolidated Balance Sheet includes goodwill of acquired businesses of $57.0 billion, which includes approximately

$2.7 billion associated with our various acquisitions in 2013. We evaluate goodwill for impairment at least annually and we

conducted our most recent annual review during the fourth quarter of 2013. Our review includes determining the estimated fair

values of our reporting units. There are several methods of estimating a reporting unit’s fair value, including market quotations,

underlying asset and liability fair value determinations and other valuation techniques, such as discounted projected future net

earnings or net cash flows and multiples of earnings. We primarily use discounted projected future earnings or cash flow

methods. The key assumptions and inputs used in such methods may include forecasting revenues and expenses, operating cash

flows and capital expenditures, as well as an appropriate discount rate and other inputs. A significant amount of judgment is

required in estimating the fair value of a reporting unit and in performing goodwill impairment tests. Due to the inherent

uncertainty in forecasting cash flows and earnings, actual results may vary significantly from the forecasts. If the carrying

amount of a reporting unit, including goodwill, exceeds the estimated fair value, then, as required by GAAP, we estimate the

fair values of the individual assets (including identifiable intangible assets) and liabilities of the reporting unit. The excess of the

estimated fair value of the reporting unit over the estimated fair value of its net assets establishes the implied value of goodwill.

The excess of the recorded amount of goodwill over the implied value is charged to earnings as an impairment loss.

Market Risk Disclosures

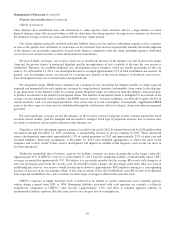

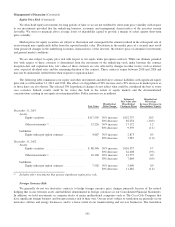

Our Consolidated Balance Sheets include a substantial amount of assets and liabilities whose fair values are subject to

market risks. Our significant market risks are primarily associated with interest rates, equity prices, foreign currency exchange

rates and commodity prices. The fair values of our investment portfolios and equity index put option contracts remain subject to

considerable volatility. The following sections address the significant market risks associated with our business activities.

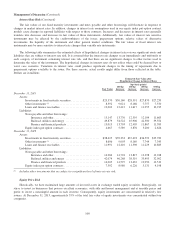

Interest Rate Risk

We regularly invest in bonds, loans or other interest rate sensitive instruments. Our strategy is to acquire such securities

that are attractively priced in relation to the perceived credit risk. Management recognizes and accepts that losses may occur

with respect to assets. We also issue debt in the ordinary course of business to fund business operations, business acquisitions

and for other general purposes. We strive to maintain high credit ratings so that the cost of our debt is minimized. We rarely

utilize derivative products, such as interest rate swaps, to manage interest rate risks.

99