Berkshire Hathaway 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

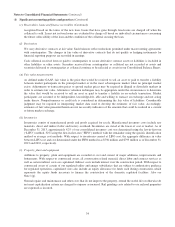

(s) Income taxes (Continued)

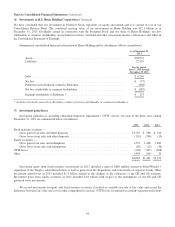

Deferred income taxes are calculated under the liability method. Deferred income tax assets and liabilities are

computed on differences between the financial statement bases and tax bases of assets and liabilities at the enacted tax

rates. Changes in deferred income tax assets and liabilities that are associated with components of other comprehensive

income are charged or credited directly to other comprehensive income. Otherwise, changes in deferred income tax

assets and liabilities are included as a component of income tax expense. The effect on deferred income tax assets and

liabilities attributable to changes in enacted tax rates are charged or credited to income tax expense in the period of

enactment. Valuation allowances are established for certain deferred tax assets where realization is not likely.

Assets and liabilities are established for uncertain tax positions taken or positions expected to be taken in income tax

returns when such positions are judged to not meet the “more-likely-than-not” threshold based on the technical merits

of the positions. Estimated interest and penalties related to uncertain tax positions are generally included as a

component of income tax expense.

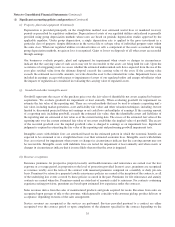

(t) New accounting pronouncements adopted in 2013

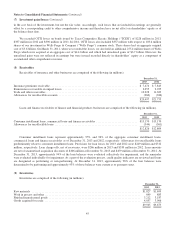

In February 2013, the FASB issued ASU 2013-02, “Reporting of Amounts Reclassified Out of Accumulated Other

Comprehensive Income.” ASU 2013-02 requires additional disclosures concerning the amounts reclassified out of each

component of accumulated other comprehensive income and into net earnings during the reporting period. We adopted

ASU 2013-02 on January 1, 2013 and the required disclosures are included in Note 20.

In December 2011, the FASB issued ASU 2011-11, “Disclosures about Offsetting Assets and Liabilities” and in

January 2013, the FASB issued ASU 2013-01, “Clarifying the Scope of Disclosures about Offsetting Assets and

Liabilities.” ASU 2011-11, as clarified, applies to derivatives, repurchase agreements and securities lending

transactions and requires companies to disclose gross and net information about financial instruments and derivatives

eligible for offset and to disclose financial instruments and derivatives subject to master netting arrangements in

financial statements. In July 2012, the FASB issued ASU 2012-02, “Testing Indefinite-Lived Intangible Assets for

Impairment.” ASU 2012-02 allows an entity to first assess qualitative factors in determining whether it is more-likely-

than not that an indefinite-lived intangible asset is impaired, and if certain criteria are met, permits the entity to forego

performing a quantitative impairment test. ASU’s 2011-11 and 2012-02 were adopted on January 1, 2013 and had an

immaterial effect on our Consolidated Financial Statements.

(u) New accounting pronouncements to be adopted subsequent to December 31, 2013

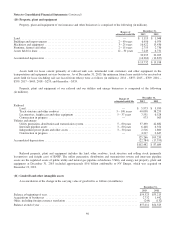

In February 2013, the FASB issued ASU 2013-04, “Obligations Resulting from Joint and Several Liability

Arrangements for Which the Total Amount of the Obligation Is Fixed at the Reporting Date.” ASU 2013-04 requires

an entity to measure obligations resulting from joint and several liability arrangements for which the total amount of

the obligation is fixed at the reporting date as the amount the reporting entity agreed to pay plus additional amounts the

reporting entity expects to pay on behalf of its co-obligors. ASU 2013-04 is effective for interim and annual reporting

periods beginning after December 15, 2013.

In January 2014, the FASB issued ASU 2014-01 “Accounting for Investments in Qualified Affordable Housing Tax

Credits.” ASU 2014-01 permits an entity to elect the proportional amortization method of accounting for limited

liability investments in qualified affordable housing projects if certain criteria are met. Under the proportional

amortization method, the investment is amortized in proportion to the tax benefits received and the amortization charge

is reported as a component of income tax expense. ASU 2014-01 is effective for fiscal years beginning after

December 15, 2014 with early adoption permitted. If elected, the proportional amortization method is required to be

applied retrospectively. We are currently evaluating the effect these standards will have on our Consolidated Financial

Statements.

38