Berkshire Hathaway 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

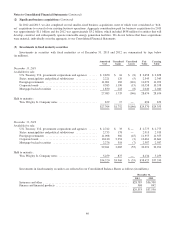

Notes to Consolidated Financial Statements (Continued)

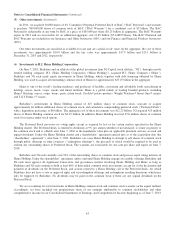

(2) Significant business acquisitions (Continued)

In 2012 and 2013, we also completed several smaller-sized business acquisitions, most of which were considered as “bolt-

on” acquisitions to several of our existing business operations. Aggregate consideration paid for business acquisitions for 2013

was approximately $1.1 billion and for 2012 was approximately $3.2 billion, which included $438 million for entities that will

develop, construct and subsequently operate renewable energy generation facilities. We do not believe that these acquisitions

were material, individually or in the aggregate, to our Consolidated Financial Statements.

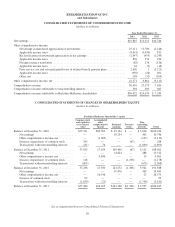

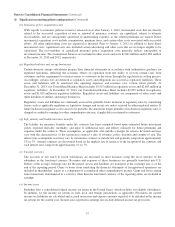

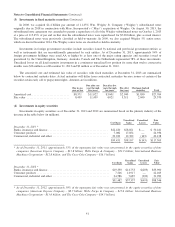

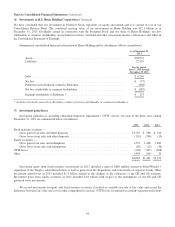

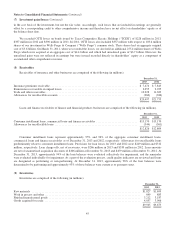

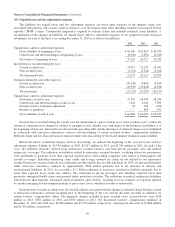

(3) Investments in fixed maturity securities

Investments in securities with fixed maturities as of December 31, 2013 and 2012 are summarized by type below

(in millions).

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

Carrying

Value

December 31, 2013

Available for sale:

U.S. Treasury, U.S. government corporations and agencies ...... $ 2,650 $ 16 $ (8) $ 2,658 $ 2,658

States, municipalities and political subdivisions ............... 2,221 129 (5) 2,345 2,345

Foreign governments .................................... 11,001 182 (110) 11,073 11,073

Corporate bonds ........................................ 9,383 1,190 (15) 10,558 10,558

Mortgage-backed securities ............................... 1,830 218 (8) 2,040 2,040

27,085 1,735 (146) 28,674 28,674

Held to maturity:

Wm. Wrigley Jr. Company notes ........................... 679 17 — 696 679

$27,764 $1,752 $(146) $29,370 $29,353

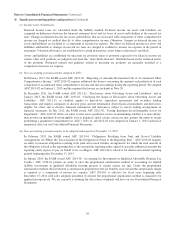

December 31, 2012

Available for sale:

U.S. Treasury, U.S. government corporations and agencies ...... $ 2,742 $ 33 $ — $ 2,775 $ 2,775

States, municipalities and political subdivisions ............... 2,735 178 — 2,913 2,913

Foreign governments .................................... 11,098 302 (45) 11,355 11,355

Corporate bonds ........................................ 10,410 2,254 (3) 12,661 12,661

Mortgage-backed securities ............................... 2,276 318 (7) 2,587 2,587

29,261 3,085 (55) 32,291 32,291

Held to maturity:

Wm. Wrigley Jr. Company notes ........................... 5,259 875 — 6,134 5,259

$34,520 $3,960 $ (55) $38,425 $37,550

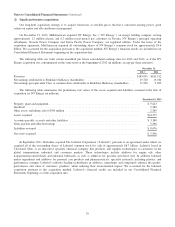

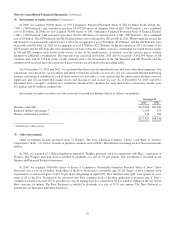

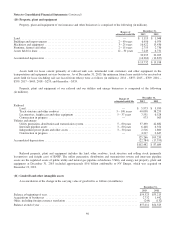

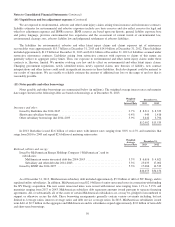

Investments in fixed maturity securities are reflected in our Consolidated Balance Sheets as follows (in millions).

December 31,

2013 2012

Insurance and other ............................................................ $28,785 $36,708

Finance and financial products ................................................... 568 842

$29,353 $37,550

40