Berkshire Hathaway 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

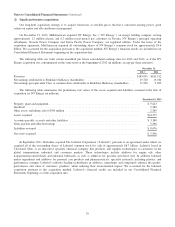

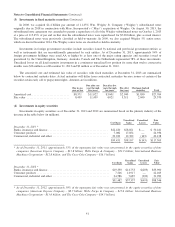

(4) Investments in equity securities (Continued)

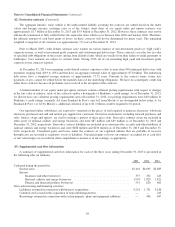

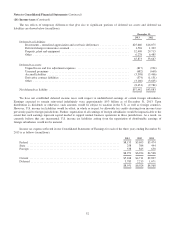

In 2008, we acquired 50,000 shares of 10% Cumulative Perpetual Preferred Stock of The Goldman Sachs Group, Inc.

(“GS”) (“GS Preferred”) and warrants to purchase 43,478,260 shares of common stock of GS (“GS Warrants”) for a combined

cost of $5 billion. In 2008, we also acquired 30,000 shares of 10% Cumulative Perpetual Preferred Stock of General Electric

(“GE”) (“GE Preferred”) and warrants to purchase 134,831,460 shares of common stock of GE (“GE Warrants”) for a combined

cost of $3 billion. The GS Preferred and GE Preferred shares were redeemed by GS and GE in 2011. When originally issued, the

GS Warrants were exercisable until October 1, 2013 for an aggregate cost of $5 billion ($115/share), and the GE Warrants were

exercisable until October 16, 2013 for an aggregate cost of $3 billion ($22.25/share). In the first quarter of 2013, the terms of the

GE Warrants and the GS Warrants were amended to provide solely for cashless exercises, whereupon we would receive shares

of GS and GE common stock based on the excess, if any, of the market prices, as defined, over the exercise prices, without

payment of additional consideration. The warrants were exercised in October 2013 and we received 13,062,594 shares of GS

common stock and 10,710,644 shares of GE common stock. Our investments in the GS Warrants and GE Warrants and the

common stock received upon the exercises of these warrants are included in the preceding tables.

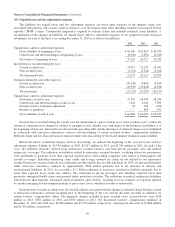

As of December 31, 2013 and 2012, we concluded that there were no unrealized losses that were other than temporary. Our

conclusions were based on: (a) our ability and intent to hold the securities to recovery; (b) our assessment that the underlying

business and financial condition of each of these issuers was favorable; (c) our opinion that the relative price declines were not

significant; and (d) our belief that market prices will increase to and exceed our cost. As of December 31, 2013 and 2012,

unrealized losses on equity securities in a continuous unrealized loss position for more than twelve consecutive months were

$52 million and $45 million, respectively.

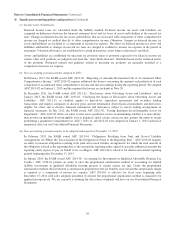

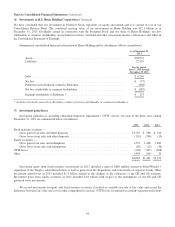

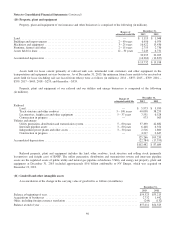

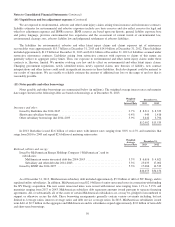

Investments in equity securities are reflected in our Consolidated Balance Sheets as follows (in millions).

December 31,

2013 2012

Insurance and other ..................................................................... $115,464 $87,081

Railroad, utilities and energy * ............................................................ 1,103 675

Finance and financial products ............................................................ 938 590

$117,505 $88,346

* Included in other assets.

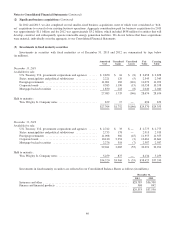

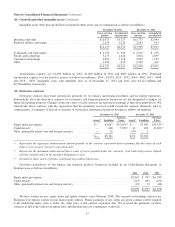

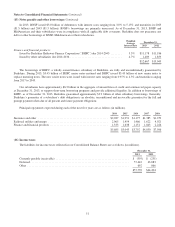

(5) Other investments

Other investments include preferred stock of Wrigley, The Dow Chemical Company (“Dow”) and Bank of America

Corporation (“BAC”) as well as warrants to purchase common stock of BAC. Information concerning each of these investments

follows.

In 2008, we acquired $2.1 billion liquidation amount of Wrigley preferred stock in conjunction with Mars’ acquisition of

Wrigley. The Wrigley preferred stock is entitled to dividends at a rate of 5% per annum. This investment is included in our

Finance and Financial Products businesses.

In 2009, we acquired 3,000,000 shares of Series A Cumulative Convertible Perpetual Preferred Stock of Dow (“Dow

Preferred”) for a cost of $3 billion. Each share of the Dow Preferred is convertible into 24.201 shares of Dow common stock

(equivalent to a conversion price of $41.32 per share). Beginning in April 2014, Dow shall have the right, at its option, to cause

some or all of the Dow Preferred to be converted into Dow common stock at the then applicable conversion rate, if Dow’s

common stock price exceeds $53.72 per share for any 20 trading days in a consecutive 30-day window ending on the day before

Dow exercises its option. The Dow Preferred is entitled to dividends at a rate of 8.5% per annum. The Dow Preferred is

included in our Insurance and Other businesses.

42