Berkshire Hathaway 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

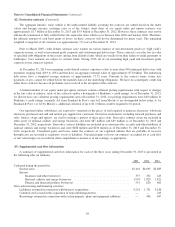

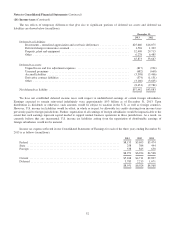

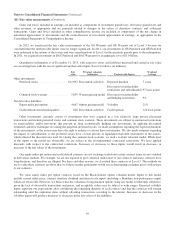

(14) Unpaid losses and loss adjustment expenses (Continued)

We are exposed to environmental, asbestos and other latent injury claims arising from insurance and reinsurance contracts.

Liability estimates for environmental and asbestos exposures include case basis reserves and also reflect reserves for legal and

other loss adjustment expenses and IBNR reserves. IBNR reserves are based upon our historic general liability exposure base

and policy language, previous environmental loss experience and the assessment of current trends of environmental law,

environmental cleanup costs, asbestos liability law and judgmental settlements of asbestos liabilities.

The liabilities for environmental, asbestos and other latent injury claims and claims expenses net of reinsurance

recoverables were approximately $13.7 billion at December 31, 2013 and $14.0 billion at December 31, 2012. These liabilities

included approximately $11.9 billion at December 31, 2013 and $12.4 billion at December 31, 2012 of liabilities assumed under

retroactive reinsurance contracts. Liabilities arising from retroactive contracts with exposure to claims of this nature are

generally subject to aggregate policy limits. Thus, our exposure to environmental and other latent injury claims under these

contracts is, likewise, limited. We monitor evolving case law and its effect on environmental and other latent injury claims.

Changing government regulations, newly identified toxins, newly reported claims, new theories of liability, new contract

interpretations and other factors could result in significant increases in these liabilities. Such development could be material to

our results of operations. We are unable to reliably estimate the amount of additional net loss or the range of net loss that is

reasonably possible.

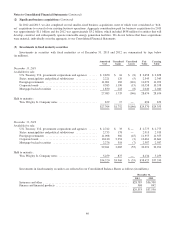

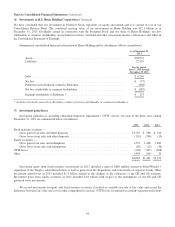

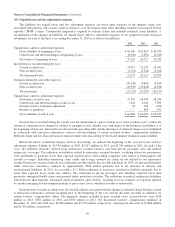

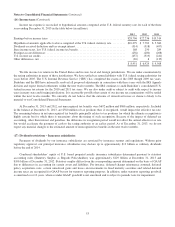

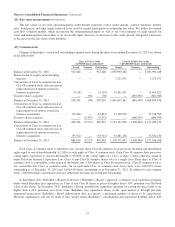

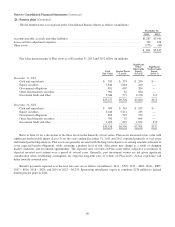

(15) Notes payable and other borrowings

Notes payable and other borrowings are summarized below (in millions). The weighted average interest rates and maturity

date ranges shown in the following tables are based on borrowings as of December 31, 2013.

Weighted

Average

Interest Rate

December 31,

2013 2012

Insurance and other:

Issued by Berkshire due 2014-2047 .......................................... 2.7% $ 8,311 $ 8,323

Short-term subsidiary borrowings ............................................ 0.4% 949 1,416

Other subsidiary borrowings due 2014-2035 ................................... 5.9% 3,642 3,796

$12,902 $13,535

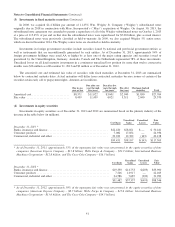

In 2013, Berkshire issued $2.6 billion of senior notes with interest rates ranging from 0.8% to 4.5% and maturities that

range from 2016 to 2043 and repaid $2.6 billion of maturing senior notes.

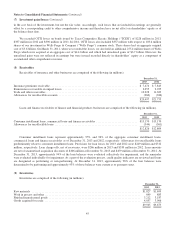

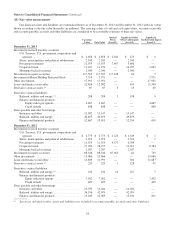

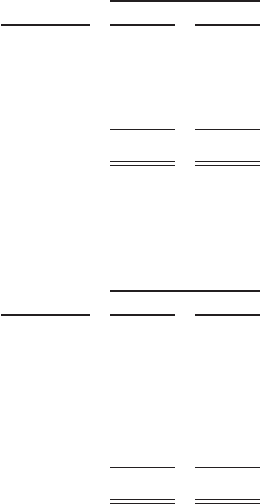

Weighted

Average

Interest Rate

December 31,

2013 2012

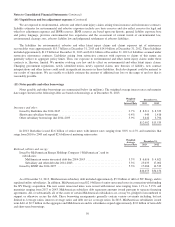

Railroad, utilities and energy:

Issued by MidAmerican Energy Holdings Company (“MidAmerican”) and its

subsidiaries:

MidAmerican senior unsecured debt due 2014-2043 ......................... 5.5% $ 6,616 $ 4,621

Subsidiary and other debt due 2014-2043 .................................. 5.3% 23,033 17,002

Issued by BNSF due 2014-2097 ............................................. 5.3% 17,006 14,533

$46,655 $36,156

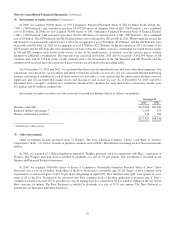

As of December 31, 2013, MidAmerican subsidiary debt included approximately $5.3 billion of debt of NV Energy and its

regulated utility subsidiaries. In addition, MidAmerican issued $2.0 billion of senior unsecured notes in connection with funding

the NV Energy acquisition. The new senior unsecured notes were issued with interest rates ranging from 1.1% to 5.15% and

maturities ranging from 2017 to 2043. MidAmerican subsidiary debt represents amounts issued pursuant to separate financing

agreements. All, or substantially all, of the assets of certain MidAmerican subsidiaries are, or may be, pledged or encumbered to

support or otherwise secure the debt. These borrowing arrangements generally contain various covenants including, but not

limited to, leverage ratios, interest coverage ratios and debt service coverage ratios. In 2013, MidAmerican subsidiaries issued

term debt of $2.5 billion in the aggregate and MidAmerican and its subsidiaries repaid approximately $2.0 billion of term debt

and short-term borrowings.

50