Berkshire Hathaway 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Utilities and Energy (“MidAmerican”) (Continued)

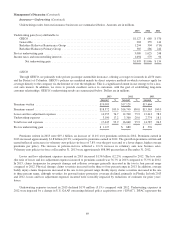

increased $165 million compared to 2012. The increase in regulated electric revenues was primarily due to higher regulatory

rates in Iowa and Illinois and increases in retail customer load. The increase in regulated natural gas revenues was primarily due

to higher retail volumes and increases in recoveries through adjustment clauses as a result of a higher average per-unit cost of

gas sold. Nonregulated and other operating revenues in 2013 declined $67 million in comparison with 2012 due primarily to

lower electricity volumes and prices. MEC’s EBIT in 2013 declined $6 million (3%) compared to 2012. The decline in EBIT

was due to lower regulated and nonregulated electric operating earnings, partially offset by higher natural gas earnings.

MEC’s revenues in 2012 declined $255 million (7%) compared to 2011, reflecting declines in natural gas revenues of $110

million and nonregulated and other operating revenues of $178 million. In 2012, MEC’s regulated electric revenues increased

2% to approximately $1.7 billion. The decline in natural gas revenues reflected lower average per-unit cost of natural gas sold

and lower volumes. The nonregulated and other operating revenues decline was due to generally lower electricity and natural

gas prices. MEC’s EBIT in 2012 declined $43 million (15%) compared to 2011 due primarily to increased depreciation expense

of $56 million and higher general and administrative expenses, partially offset by lower interest expense.

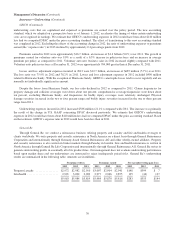

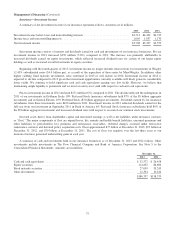

In 2013, natural gas pipelines’ revenues and EBIT were $971 million and $385 million, respectively, which were relatively

unchanged from 2012. In 2012, natural gas pipelines’ revenues and EBIT declined $15 million and $5 million, respectively,

compared to 2011. In 2012, natural gas revenues increased from expansion projects and from higher transportation and storage

rates in certain markets, which were more than offset by lower volumes of gas sales and the impact of contract expirations. In

2012, EBIT also reflected increased depreciation expense, partially offset by lower interest expense.

In 2013, Northern Powergrid revenues declined $10 million (1%) compared to 2012. EBIT in 2013 was $362 million, a

decline of $67 million versus 2012. EBIT in 2013 was negatively impacted by fourth quarter rebates to customers and higher

regulatory rate provisions in 2013, which reduced revenues, and from higher distribution operating expenses and the foreign

currency translation effect of a stronger U.S. Dollar versus the U.K. Pound Sterling. Operating expenses in 2013 included

increased pension costs and higher depreciation expenses. EBIT in 2013 also included a $9 million loss from the write-off of

hydrocarbon well exploration costs.

Northern Powergrid’s revenues in 2012 increased $20 million (2%) while EBIT declined $40 million (9%) compared to

2011. In 2012, revenues were negatively impacted by currency-related declines from a stronger U.S. Dollar. Excluding currency

related impacts, distribution revenues increased $28 million in 2012, reflecting higher tariff rates ($76 million), partially offset

by the impact of higher regulatory provisions in 2011 ($55 million). Northern Powergrid’s EBIT in 2012 was negatively

affected by increases in pension expense ($44 million) and distribution operating expenses ($21 million), which more than

offset the increase in distribution revenues.

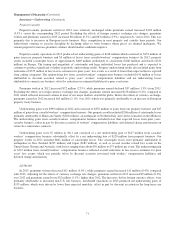

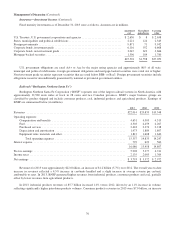

Real estate brokerage revenues in 2013 increased $489 million (37%) over 2012, while EBIT increased $57 million

(70%) versus 2012. The increases in revenues and EBIT were attributable to increases in closed brokerage transactions and

higher average home sales prices from existing business and the impact of businesses acquired during the last two years. Real

estate brokerage revenues in 2012 increased $326 million (32%) and EBIT increased $43 million (110%) over 2011. The

revenue increase included $123 million from businesses acquired in 2012. The increase in revenues in 2012 also reflected a 16%

increase in closed sales transactions and higher average home sale prices from existing businesses. The increase in real estate

brokerage EBIT in 2012 reflected the impact of business acquisitions in 2012 as well as the aforementioned increase in closed

sales transactions.

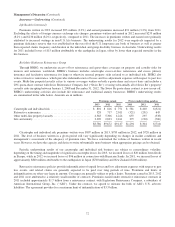

MidAmerican’s other activities primarily consist of a portfolio of independent power projects, including solar and wind-

powered electricity generation projects placed in service in late 2012 and throughout 2013. In 2013, other activities also

included the results of NV Energy since the December 19, 2013 acquisition date. The increase in revenues from other activities

in 2013 was $81 million, which was primarily attributable to revenues from the new solar and wind-powered facilities, partially

79