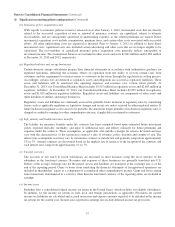

Berkshire Hathaway 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

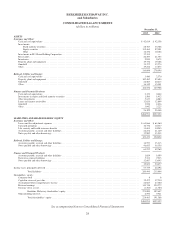

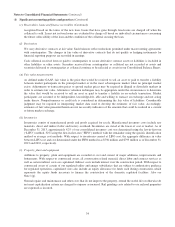

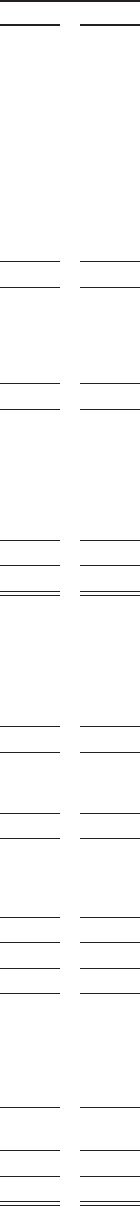

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions)

December 31,

2013 2012

ASSETS

Insurance and Other:

Cash and cash equivalents ................................................................................... $ 42,614 $ 42,358

Investments:

Fixed maturity securities ................................................................................. 28,785 36,708

Equity securities ....................................................................................... 115,464 87,081

Other ................................................................................................ 12,334 10,184

Investments in H.J. Heinz Holding Corporation ................................................................... 12,111 —

Receivables ............................................................................................... 20,497 21,753

Inventories ................................................................................................ 9,945 9,675

Property, plant and equipment ................................................................................ 19,732 19,188

Goodwill ................................................................................................. 33,372 33,274

Other .................................................................................................... 19,244 17,875

314,098 278,096

Railroad, Utilities and Energy:

Cash and cash equivalents ................................................................................... 3,400 2,570

Property, plant and equipment ................................................................................ 102,482 87,684

Goodwill ................................................................................................. 22,603 20,213

Other .................................................................................................... 16,149 13,441

144,634 123,908

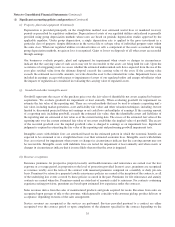

Finance and Financial Products:

Cash and cash equivalents ................................................................................... 2,172 2,064

Investments in equity and fixed maturity securities ................................................................ 1,506 1,432

Other investments .......................................................................................... 5,617 4,882

Loans and finance receivables ................................................................................ 12,826 12,809

Goodwill ................................................................................................. 1,036 1,036

Other .................................................................................................... 3,042 3,225

26,199 25,448

$484,931 $427,452

LIABILITIES AND SHAREHOLDERS’ EQUITY

Insurance and Other:

Losses and loss adjustment expenses ........................................................................... $ 64,866 $ 64,160

Unearned premiums ........................................................................................ 10,770 10,237

Life, annuity and health insurance benefits ...................................................................... 11,681 10,943

Accounts payable, accruals and other liabilities ................................................................... 22,254 21,149

Notes payable and other borrowings ............................................................................ 12,902 13,535

122,473 120,024

Railroad, Utilities and Energy:

Accounts payable, accruals and other liabilities ................................................................... 14,557 13,113

Notes payable and other borrowings ............................................................................ 46,655 36,156

61,212 49,269

Finance and Financial Products:

Accounts payable, accruals and other liabilities ................................................................... 1,024 1,099

Derivative contract liabilities ................................................................................. 5,331 7,933

Notes payable and other borrowings ............................................................................ 12,667 13,045

19,022 22,077

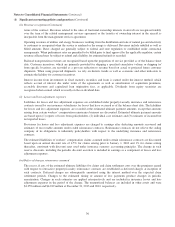

Income taxes, principally deferred ................................................................................. 57,739 44,494

Total liabilities .................................................................................... 260,446 235,864

Shareholders’ equity:

Common stock ............................................................................................ 8 8

Capital in excess of par value ................................................................................. 35,472 37,230

Accumulated other comprehensive income ...................................................................... 44,025 27,500

Retained earnings .......................................................................................... 143,748 124,272

Treasury stock, at cost ....................................................................................... (1,363) (1,363)

Berkshire Hathaway shareholders’ equity ............................................................... 221,890 187,647

Noncontrolling interests ..................................................................................... 2,595 3,941

Total shareholders’ equity ............................................................................ 224,485 191,588

$484,931 $427,452

See accompanying Notes to Consolidated Financial Statements

28