Berkshire Hathaway 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The four companies possess excellent businesses and are run by managers who are both talented and

shareholder-oriented. At Berkshire, we much prefer owning a non-controlling but substantial portion of a

wonderful company to owning 100% of a so-so business; it’s better to have a partial interest in the Hope

diamond than to own all of a rhinestone.

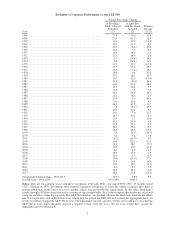

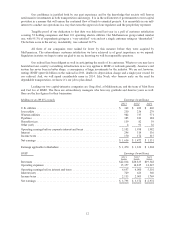

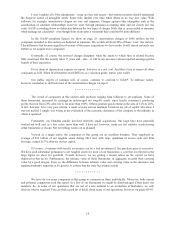

Going by our yearend holdings, our portion of the “Big Four’s” 2013 earnings amounted to $4.4 billion. In

the earnings we report to you, however, we include only the dividends we receive – about $1.4 billion last

year. But make no mistake: The $3 billion of their earnings we don’t report is every bit as valuable to us as

the portion Berkshire records.

The earnings that these four companies retain are often used for repurchases of their own stock – a move

that enhances our share of future earnings – as well as for funding business opportunities that usually turn

out to be advantageous. All that leads us to expect that the per-share earnings of these four investees will

grow substantially over time. If they do, dividends to Berkshire will increase and, even more important,

our unrealized capital gains will, too. (For the four, unrealized gains already totaled $39 billion at

yearend.)

Our flexibility in capital allocation – our willingness to invest large sums passively in non-controlled

businesses – gives us a significant advantage over companies that limit themselves to acquisitions they can

operate. Woody Allen stated the general idea when he said: “The advantage of being bi-sexual is that it

doubles your chances for a date on Saturday night.” Similarly, our appetite for either operating businesses

or passive investments doubles our chances of finding sensible uses for our endless gusher of cash.

************

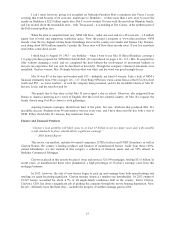

Late in 2009, amidst the gloom of the Great Recession, we agreed to buy BNSF, the largest purchase in

Berkshire’s history. At the time, I called the transaction an “all-in wager on the economic future of the United

States.”

That kind of commitment was nothing new for us: We’ve been making similar wagers ever since Buffett

Partnership Ltd. acquired control of Berkshire in 1965. For good reason, too. Charlie and I have always considered

a “bet” on ever-rising U.S. prosperity to be very close to a sure thing.

Indeed, who has ever benefited during the past 237 years by betting against America? If you compare our

country’s present condition to that existing in 1776, you have to rub your eyes in wonder. And the dynamism

embedded in our market economy will continue to work its magic. America’s best days lie ahead.

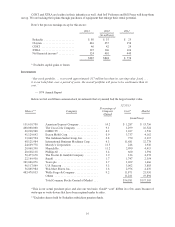

With this tailwind working for us, Charlie and I hope to build Berkshire’s per-share intrinsic value by

(1) constantly improving the basic earning power of our many subsidiaries; (2) further increasing their earnings

through bolt-on acquisitions; (3) benefiting from the growth of our investees; (4) repurchasing Berkshire shares

when they are available at a meaningful discount from intrinsic value; and (5) making an occasional large

acquisition. We will also try to maximize results for you by rarely, if ever, issuing Berkshire shares.

Those building blocks rest on a rock-solid foundation. A century hence, BNSF and MidAmerican Energy

will still be playing major roles in our economy. Insurance will concomitantly be essential for both businesses and

individuals – and no company brings greater human and financial resources to that business than Berkshire.

Moreover, we will always maintain supreme financial strength, operating with at least $20 billion of cash

equivalents and never incurring material amounts of short-term obligations. As we view these and other strengths,

Charlie and I like your company’s prospects. We feel fortunate to be entrusted with its management.

6