Berkshire Hathaway 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 1995, we purchased the half of GEICO that we didn’t already own, paying $1.4 billion more than the net

tangible assets we acquired. That’s “goodwill,” and it will forever remain unchanged on our books. As GEICO’s

business grows, however, so does its true economic goodwill. I believe that figure to be approaching $20 billion.

************

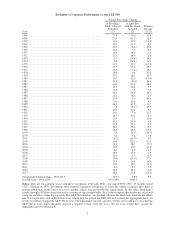

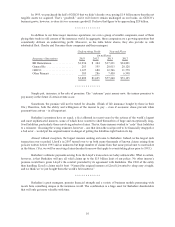

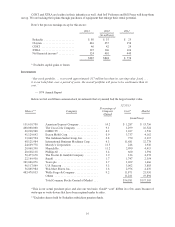

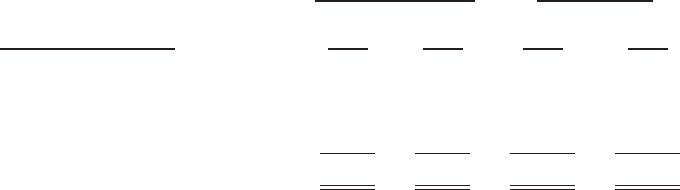

In addition to our three major insurance operations, we own a group of smaller companies, most of them

plying their trade in odd corners of the insurance world. In aggregate, these companies are a growing operation that

consistently delivers an underwriting profit. Moreover, as the table below shows, they also provide us with

substantial float. Charlie and I treasure these companies and their managers.

Underwriting Profit Yearend Float

(in millions)

Insurance Operations 2013 2012 2013 2012

BH Reinsurance .............. $1,294 $ 304 $37,231 $34,821

General Re .................. 283 355 20,013 20,128

GEICO ..................... 1,127 680 12,566 11,578

Other Primary ................ 385 286 7,430 6,598

$3,089 $1,625 $77,240 $73,125

************

Simply put, insurance is the sale of promises. The “customer” pays money now; the insurer promises to

pay money in the future if certain events occur.

Sometimes, the promise will not be tested for decades. (Think of life insurance bought by those in their

20s.) Therefore, both the ability and willingness of the insurer to pay – even if economic chaos prevails when

payment time arrives – is all-important.

Berkshire’s promises have no equal, a fact affirmed in recent years by the actions of the world’s largest

and most sophisticated insurers, some of which have wanted to shed themselves of huge and exceptionally long-

lived liabilities, particularly those involving asbestos claims. That is, these insurers wished to “cede” their liabilities

to a reinsurer. Choosing the wrong reinsurer, however – one that down the road proved to be financially strapped or

a bad actor – would put the original insurer in danger of getting the liabilities right back in its lap.

Almost without exception, the largest insurers seeking aid came to Berkshire. Indeed, in the largest such

transaction ever recorded, Lloyd’s in 2007 turned over to us both many thousands of known claims arising from

policies written before 1993 and an unknown but huge number of claims from that same period sure to materialize

in the future. (Yes, we will be receiving claims decades from now that apply to events taking place prior to 1993.)

Berkshire’s ultimate payments arising from the Lloyd’s transaction are today unknowable. What is certain,

however, is that Berkshire will pay all valid claims up to the $15 billion limit of our policy. No other insurer’s

promise would have given Lloyd’s the comfort provided by its agreement with Berkshire. The CEO of the entity

then handling Lloyd’s claims said it best: “Names [the original insurers at Lloyd’s] wanted to sleep easy at night,

and we think we’ve just bought them the world’s best mattress.”

************

Berkshire’s great managers, premier financial strength and a variety of business models possessing wide

moats form something unique in the insurance world. The combination is a huge asset for Berkshire shareholders

that will only get more valuable with time.

10