Berkshire Hathaway 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

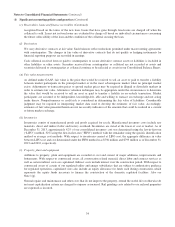

(1) Significant accounting policies and practices (Continued)

(i) Property, plant and equipment (Continued)

Depreciation is provided principally on the straight-line method over estimated useful lives or mandated recovery

periods as prescribed by regulatory authorities. Depreciation of assets of our regulated utilities and railroad is generally

provided using group depreciation methods where rates are based on periodic depreciation studies approved by the

applicable regulator. Under group depreciation, a single depreciation rate is applied to the gross investment in a

particular class of property, despite differences in the service life or salvage value of individual property units within

the same class. When our regulated utilities or railroad retires or sells a component of the assets accounted for using

group depreciation methods, no gain or loss is recognized. Gains or losses on disposals of all other assets are recorded

through earnings.

Our businesses evaluate property, plant and equipment for impairment when events or changes in circumstances

indicate that the carrying value of such assets may not be recoverable or the assets are being held for sale. Upon the

occurrence of a triggering event, we assess whether the estimated undiscounted cash flows expected from the use of the

asset plus residual value from the ultimate disposal exceeds the carrying value of the asset. If the carrying value

exceeds the estimated recoverable amounts, we write down the asset to the estimated fair value. Impairment losses are

included in earnings, except with respect to impairment of assets of our regulated utility and energy subsidiaries when

the impacts of regulation are considered in evaluating the carrying value of regulated assets.

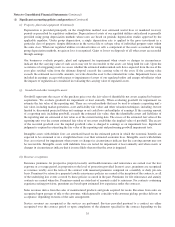

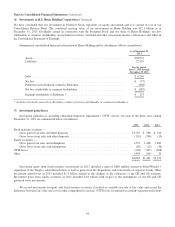

(j) Goodwill and other intangible assets

Goodwill represents the excess of the purchase price over the fair value of identifiable net assets acquired in business

acquisitions. We evaluate goodwill for impairment at least annually. When evaluating goodwill for impairment we

estimate the fair value of the reporting unit. There are several methods that may be used to estimate a reporting unit’s

fair value, including market quotations, asset and liability fair values and other valuation techniques, including, but not

limited to, discounted projected future net earnings or net cash flows and multiples of earnings. If the carrying amount

of a reporting unit, including goodwill, exceeds the estimated fair value, then the identifiable assets and liabilities of

the reporting unit are estimated at fair value as of the current testing date. The excess of the estimated fair value of the

reporting unit over the current estimated fair value of net assets establishes the implied value of goodwill. The excess

of the recorded goodwill over the implied goodwill value is charged to earnings as an impairment loss. Significant

judgment is required in estimating the fair value of the reporting unit and performing goodwill impairment tests.

Intangible assets with definite lives are amortized based on the estimated pattern in which the economic benefits are

expected to be consumed or on a straight-line basis over their estimated economic lives. Intangible assets with definite

lives are reviewed for impairment when events or changes in circumstances indicate that the carrying amount may not

be recoverable. Intangible assets with indefinite lives are tested for impairment at least annually and when events or

changes in circumstances indicate that it is more likely than not that the asset is impaired.

(k) Revenue recognition

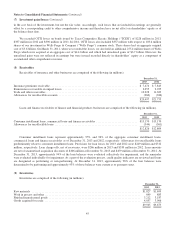

Insurance premiums for prospective property/casualty and health insurance and reinsurance are earned over the loss

exposure or coverage period, in proportion to the level of protection provided. In most cases, premiums are recognized

as revenues ratably over the term of the contract with unearned premiums computed on a monthly or daily pro-rata

basis. Premiums for retroactive property/casualty reinsurance policies are earned at the inception of the contracts, as all

of the underlying loss events covered by these policies occurred in the past. Premiums for life reinsurance and annuity

contracts are earned when due. Premiums earned are stated net of amounts ceded to reinsurers. For contracts containing

experience rating provisions, premiums are based upon estimated loss experience under the contracts.

Sales revenues derive from the sales of manufactured products and goods acquired for resale. Revenues from sales are

recognized upon passage of title to the customer, which generally coincides with customer pickup, product delivery or

acceptance, depending on terms of the sales arrangement.

Service revenues are recognized as the services are performed. Services provided pursuant to a contract are either

recognized over the contract period or upon completion of the elements specified in the contract depending on the

35