Berkshire Hathaway 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

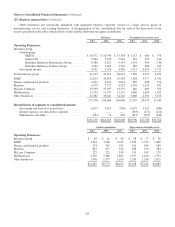

(23) Business segment data (Continued)

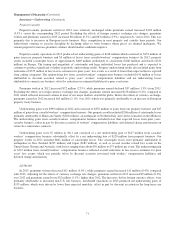

Approximately 96% of our revenues in 2013, 2012 and 2011 from railroad, utilities and energy businesses were in the

United States. In each year, most of the remainder was attributed to the United Kingdom. At December 31, 2013, 92% of our

consolidated net property, plant and equipment was located in the United States with the remainder primarily in Europe and

Canada.

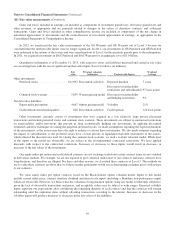

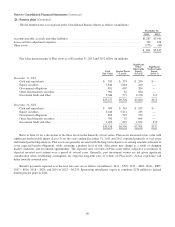

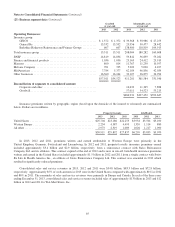

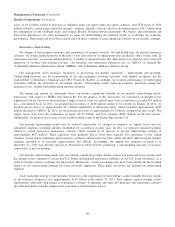

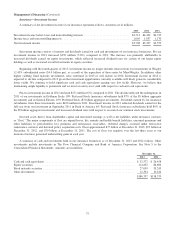

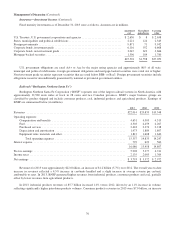

Premiums written and earned by the property/casualty and life/health insurance businesses are summarized below

(in millions).

Property/Casualty Life/Health

2013 2012 2011 2013 2012 2011

Premiums Written:

Direct .............................................. $24,292 $20,796 $18,512 $ 931 $ 554 $ 67

Assumed ........................................... 7,339 9,668 9,867 5,437 5,391 5,133

Ceded .............................................. (720) (572) (542) (69) (110) (130)

$30,911 $29,892 $27,837 $6,299 $5,835 $5,070

Premiums Earned:

Direct .............................................. $23,267 $20,204 $18,038 $ 931 $ 554 $ 67

Assumed ........................................... 7,928 9,142 9,523 5,425 5,356 5,099

Ceded .............................................. (797) (600) (522) (70) (111) (130)

$30,398 $28,746 $27,039 $6,286 $5,799 $5,036

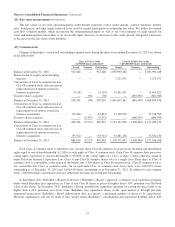

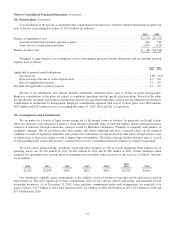

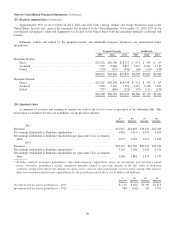

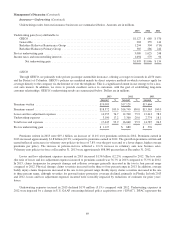

(24) Quarterly data

A summary of revenues and earnings by quarter for each of the last two years is presented in the following table. This

information is unaudited. Dollars are in millions, except per share amounts.

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter

2013

Revenues ............................................................. $43,867 $44,693 $46,541 $47,049

Net earnings attributable to Berkshire shareholders * .......................... 4,892 4,541 5,053 4,990

Net earnings attributable to Berkshire shareholders per equivalent Class A common

share .............................................................. 2,977 2,763 3,074 3,035

2012

Revenues ............................................................. $38,147 $38,546 $41,050 $44,720

Net earnings attributable to Berkshire shareholders * .......................... 3,245 3,108 3,920 4,551

Net earnings attributable to Berkshire shareholders per equivalent Class A common

share .............................................................. 1,966 1,882 2,373 2,757

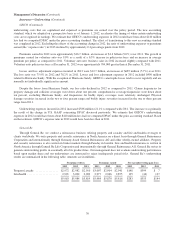

*Includes realized investment gains/losses, other-than-temporary impairment losses on investments and derivative gains/

losses. Derivative gains/losses include significant amounts related to non-cash changes in the fair value of long-term

contracts arising from short-term changes in equity prices, interest rates and foreign currency rates, among other factors.

After-tax investment and derivative gains/losses for the periods presented above are as follows (in millions):

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter

Investment and derivative gains/losses – 2013 .................................. $1,110 $ 622 $1,391 $1,214

Investment and derivative gains/losses – 2012 .................................. 580 (612) 521 1,738

66