Berkshire Hathaway 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Property and casualty losses (Continued)

BHRG (Continued)

Other reinsurance reserves (approximately $11.9 billion as of December 31, 2013) consisted of a variety of traditional

property and casualty coverages written primarily under excess-of-loss and quota-share treaties. Liabilities as of December 31,

2013, included approximately $4.0 billion related to the 20% quota-share contract with Swiss Re, which is now in run-off.

Reinsurance reserve amounts are generally based upon loss estimates reported by ceding companies and IBNR reserves that are

primarily a function of reported losses from ceding companies and anticipated loss ratios established on a portfolio basis,

supplemented by management’s judgment of the impact of major catastrophe events as they become known. Anticipated loss

ratios are based upon management’s judgment considering the type of business covered, analysis of each ceding company’s loss

history and evaluation of that portion of the underlying contracts underwritten by each ceding company, which are in turn ceded

to BHRG. A range of reserve amounts as a result of changes in underlying assumptions is not prepared.

Derivative contract liabilities

Our Consolidated Balance Sheets include significant derivative contract liabilities that are measured at fair value. Our most

significant derivative contract exposures relate to equity index put option contracts written between 2004 and 2008. These

contracts were entered into in over-the-counter markets. Certain elements of the terms and conditions of these contracts are not

standard and we are not required to post collateral under most of these contracts. Furthermore, there is no source of independent

data available to us showing trading volume and actual prices of completed transactions. As a result, the values of these

liabilities are based on valuation models that we believe would be used by market participants. Such models or other valuation

techniques use inputs that are observable in the marketplace, while others are unobservable. Unobservable inputs require us to

make certain projections and assumptions about the information that would be used by market participants in establishing

prices. We believe that the fair values produced for long-duration options is inherently subjective. The values of contracts in an

actual exchange are affected by market conditions and perceptions of the buyers and sellers. Actual values in an exchange may

differ significantly from the values produced by any mathematical model.

We determine the estimated fair value of equity index put option contracts using a Black-Scholes based option valuation

model. Inputs to the model include the current index value, strike price, interest rate, dividend rate and contract expiration date.

The weighted average interest and dividend rates used as of December 31, 2013 were 2.5% and 3.6%, respectively, and were

approximately 2.1% and 3.3%, respectively, as of December 31, 2012. The interest rates as of December 31, 2013 and 2012

were approximately 64 basis points and 95 basis points (on a weighted average basis), respectively, over benchmark interest

rates and represented our estimate of our nonperformance risk. We believe that the most significant economic risks under these

contracts relate to changes in the index value component and, to a lesser degree, the foreign currency component.

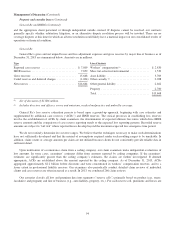

The Black-Scholes based model also incorporates volatility estimates that measure potential price changes over time. Our

contracts have an average remaining maturity of about 7 years. The weighted average volatility used as of December 31, 2013

was approximately 20.7%, compared to 20.9% as of December 31, 2012. The weighted average volatilities are based on the

volatility input for each equity index put option contract weighted by the notional value of each equity index put option contract

as compared to the aggregate notional value of all equity index put option contracts. The volatility input for each equity index

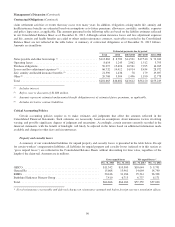

put option contract reflects our expectation of future price volatility. The impact on fair value as of December 31, 2013

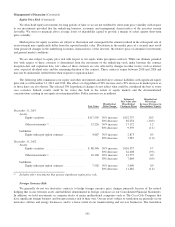

($4.7 billion) from changes in the volatility assumption is summarized in the table that follows. Dollars are in millions.

Hypothetical change in volatility (percentage points) Hypothetical fair value

Increase 2 percentage points .............................................................. $5,067

Increase 4 percentage points .............................................................. 5,479

Decrease 2 percentage points .............................................................. 4,284

Decrease 4 percentage points .............................................................. 3,923

For several years, we also have had exposures relating to a number of credit default contracts written involving corporate

and state/municipality issuers. During 2013, all credit default contracts involving corporate issuers expired and at December 31,

2013, our remaining exposures relate to state/municipality exposures which begin to expire in 2019. The fair values of our state/

98