Berkshire Hathaway 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BERKSHIRE HATHAWAY INC.

and Subsidiaries

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

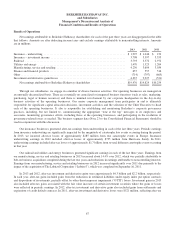

Results of Operations

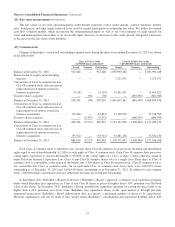

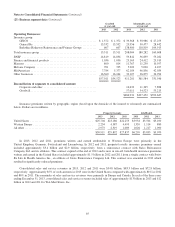

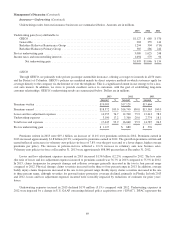

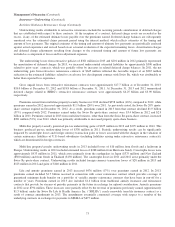

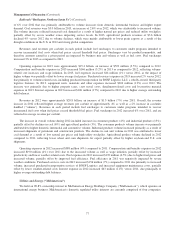

Net earnings attributable to Berkshire Hathaway shareholders for each of the past three years are disaggregated in the table

that follows. Amounts are after deducting income taxes and exclude earnings attributable to noncontrolling interests. Amounts

are in millions.

2013 2012 2011

Insurance – underwriting ......................................................... $ 1,995 $ 1,046 $ 154

Insurance – investment income .................................................... 3,708 3,397 3,555

Railroad ...................................................................... 3,793 3,372 2,972

Utilities and energy ............................................................. 1,470 1,323 1,204

Manufacturing, service and retailing ................................................ 4,230 3,699 3,039

Finance and financial products ..................................................... 657 557 516

Other ......................................................................... (714) (797) (665)

Investment and derivative gains/losses .............................................. 4,337 2,227 (521)

Net earnings attributable to Berkshire Hathaway shareholders ........................ $19,476 $14,824 $10,254

Through our subsidiaries, we engage in a number of diverse business activities. Our operating businesses are managed on

an unusually decentralized basis. There are essentially no centralized or integrated business functions (such as sales, marketing,

purchasing, legal or human resources) and there is minimal involvement by our corporate headquarters in the day-to-day

business activities of the operating businesses. Our senior corporate management team participates in and is ultimately

responsible for significant capital allocation decisions, investment activities and the selection of the Chief Executive to head

each of the operating businesses. It also is responsible for establishing and monitoring Berkshire’s corporate governance

practices, including, but not limited to, communicating the appropriate “tone at the top” messages to its employees and

associates, monitoring governance efforts, including those at the operating businesses, and participating in the resolution of

governance-related issues as needed. The business segment data (Note 23 to the Consolidated Financial Statements) should be

read in conjunction with this discussion.

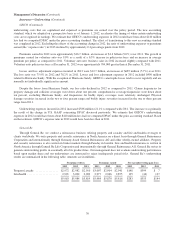

Our insurance businesses generated after-tax earnings from underwriting in each of the last three years. Periodic earnings

from insurance underwriting are significantly impacted by the magnitude of catastrophe loss events occurring during the period.

In 2013, we incurred after-tax losses of approximately $285 million from two catastrophe events in Europe. Insurance

underwriting earnings in 2012 included after-tax losses of approximately $725 million from Hurricane Sandy. In 2011,

underwriting earnings included after-tax losses of approximately $1.7 billion from several different catastrophe events occurring

in that year.

Our railroad and utilities and energy businesses generated significant earnings in each of the last three years. Earnings from

our manufacturing, service and retailing businesses in 2013 increased about 14.4% over 2012, which was partially attributable to

bolt-on business acquisitions completed during the last two years and reductions in earnings attributable to noncontrolling interests.

Earnings from our manufacturing, service and retailing businesses in 2012 increased significantly over 2011 due primarily to the

impact of the acquisition of The Lubrizol Corporation (“Lubrizol”), which was completed on September 16, 2011.

In 2013 and 2012, after-tax investment and derivative gains were approximately $4.3 billion and $2.2 billion, respectively.

In each year, after-tax gains included gains from the reductions in estimated liabilities under equity index put option contracts

and dispositions of investments, partially offset by other-than-temporary impairment (“OTTI”) losses. Investment gains in 2013

also included after-tax gains associated with the fair value increases of certain investment securities where the gains or losses

were reflected in periodic earnings. In 2012, after-tax investment and derivative gains also included gains from settlements and

expirations of credit default contracts. In 2011, after-tax investment and derivative losses were $521 million, reflecting after-tax

67