Berkshire Hathaway 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2013

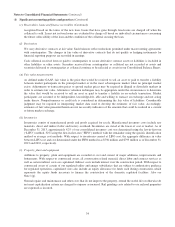

(1) Significant accounting policies and practices

(a) Nature of operations and basis of consolidation

Berkshire Hathaway Inc. (“Berkshire”) is a holding company owning subsidiaries engaged in a number of diverse

business activities, including insurance and reinsurance, freight rail transportation, utilities and energy, finance,

manufacturing, service and retailing. In these notes the terms “us,” “we,” or “our” refer to Berkshire and its

consolidated subsidiaries. Further information regarding our reportable business segments is contained in Note 23.

Significant business acquisitions completed over the past three years are discussed in Note 2.

The accompanying Consolidated Financial Statements include the accounts of Berkshire consolidated with the

accounts of all subsidiaries and affiliates in which we hold a controlling financial interest as of the financial statement

date. Normally a controlling financial interest reflects ownership of a majority of the voting interests. We consolidate a

variable interest entity (“VIE”) when we possess both the power to direct the activities of the VIE that most

significantly impact its economic performance and we are either obligated to absorb the losses that could potentially be

significant to the VIE or we hold the right to receive benefits from the VIE that could potentially be significant to the

VIE.

Intercompany accounts and transactions have been eliminated. In prior years, we presented certain relatively large

private placement investments as other investments in the Consolidated Balance Sheets and Statements of Cash Flows

and Notes to the Consolidated Financial Statements. At December 31, 2013, we included these investments as

components of investments in fixed maturity or equity securities. Prior year presentations were reclassified to conform

with the current year presentation.

(b) Use of estimates in preparation of financial statements

The preparation of our Consolidated Financial Statements in conformity with accounting principles generally accepted

in the United States (“GAAP”) requires us to make estimates and assumptions that affect the reported amounts of

assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during

the period. In particular, estimates of unpaid losses and loss adjustment expenses and related recoverables under

reinsurance for property and casualty insurance are subject to considerable estimation error due to the inherent

uncertainty in projecting ultimate claim amounts. In addition, estimates and assumptions associated with the

amortization of deferred charges reinsurance assumed, determinations of fair values of certain financial instruments

and evaluations of goodwill for impairment require considerable judgment. Actual results may differ from the

estimates used in preparing our Consolidated Financial Statements.

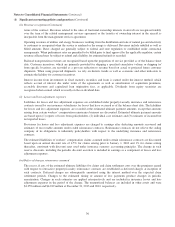

(c) Cash and cash equivalents

Cash equivalents consist of funds invested in U.S. Treasury Bills, money market accounts, demand deposits and other

investments with a maturity of three months or less when purchased.

(d) Investments

We determine the appropriate classification of investments in fixed maturity and equity securities at the acquisition

date and re-evaluate the classification at each balance sheet date. Held-to-maturity investments are carried at amortized

cost, reflecting the ability and intent to hold the securities to maturity. Trading investments are securities acquired with

the intent to sell in the near term and are carried at fair value. All other securities are classified as available-for-sale and

are carried at fair value with net unrealized gains or losses reported as a component of accumulated other

comprehensive income. Substantially all of our investments in equity and fixed maturity securities are classified as

available-for-sale.

We utilize the equity method to account for investments when we possess the ability to exercise significant influence,

but not control, over the operating and financial policies of the investee. The ability to exercise significant influence is

32