Berkshire Hathaway 2013 Annual Report Download - page 76

Download and view the complete annual report

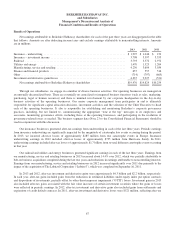

Please find page 76 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

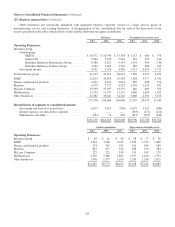

Insurance—Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

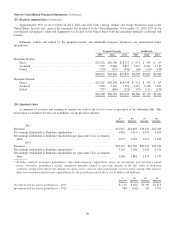

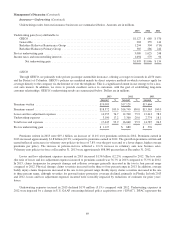

The life and annuity business produced pre-tax underwriting gains of $379 million in 2013. The underwriting gains in 2013

included a one-time pre-tax gain of $255 million attributable to the aforementioned amendments to the SRLHA contract as the

reversal of premiums earned was more than offset by the reversal of life benefits incurred. The one-time underwriting gain

related to the SRLHA contract partially offset the significant underwriting losses incurred under that contract over the previous

three years. Underwriting results in 2013 also included pre-tax gains of approximately $250 million related to the variable

annuity guarantee business written in 2013. The gains were primarily attributable to the impact of rising equity markets which

lowered estimates of liabilities for guaranteed minimum benefits. The annuity business normally generates periodic

underwriting losses as a result of the periodic accretion of discounted annuity liabilities. Periodic underwriting results are also

impacted by adjustments for mortality experience and changes in foreign currency exchange rates applicable to certain of the

contracts. Annuity business produced net underwriting losses of $178 million in 2013.

The life and annuity business generated pre-tax underwriting losses of $190 million in 2012 and $700 million in 2011.

Annuity business produced net underwriting losses of $159 million in 2012 and $118 million in 2011. In 2011, we also recorded

a pre-tax underwriting loss of $642 million with respect to the SRLHA contract. Mortality rates under that contract persistently

exceeded the assumptions we made at the inception of the contract. During the fourth quarter of 2011, after considerable

internal actuarial analysis, our management concluded that future mortality rates are expected to be greater than our original

assumptions. As a result, we increased our estimated liabilities for future policyholder benefits to reflect the new assumptions.

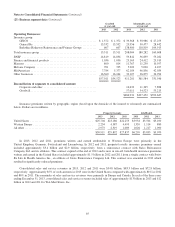

Berkshire Hathaway Primary Group

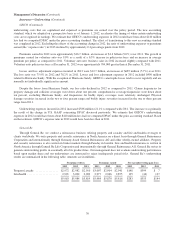

The Berkshire Hathaway Primary Group (“BH Primary”) consists of a wide variety of independently managed insurance

businesses. These businesses include: Medical Protective Company and Princeton Insurance Company (“Princeton,” acquired in

December 2011), providers of healthcare malpractice insurance coverages; National Indemnity Company’s primary group,

writers of commercial motor vehicle and general liability coverages; U.S. Investment Corporation, whose subsidiaries

underwrite specialty insurance coverages; a group of companies referred to internally as “Berkshire Hathaway Homestate

Companies,” providers of commercial multi-line insurance, including workers’ compensation; Central States Indemnity

Company, a provider of credit and disability insurance; Applied Underwriters, a provider of integrated workers’ compensation

solutions; and BoatU.S., a writer of insurance for owners of boats and small watercraft. In the fourth quarter of 2012, we

acquired GUARD Insurance Group (“GUARD”), a provider of workers’ compensation and complimentary commercial property

and casualty insurance coverage to small and mid-sized businesses. In the second quarter of 2013, we formed Berkshire

Hathaway Specialty Insurance which concentrates on providing large scale capacity solutions for commercial property and

casualty risks.

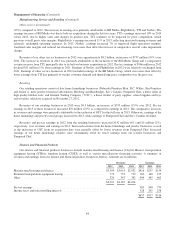

Premiums earned in 2013 by BH Primary aggregated $3,342 million, an increase of $1,079 million (48%) over 2012.

Premiums earned in 2012 by BH Primary were $2,263 million, an increase of $514 million (29%) over 2011. The comparative

increases in 2013 and 2012 reflected the impact of the GUARD acquisition in 2012 and Princeton at the end of 2011. In

addition, Berkshire Hathaway Homestate Companies’ premiums earned increased $301 million in 2013 and $188 million in

2012 compared to the corresponding prior years, due primarily to significantly higher workers’ compensation insurance volume.

BH Primary produced underwriting gains of $385 million in 2013, $286 million in 2012 and $242 million in 2011. The gains

reflected a generally favorable claim environment over the three years, which resulted in loss ratios of 60% in 2013, 58% in

2012 and 52% in 2011.

74