Berkshire Hathaway 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

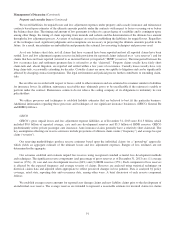

Investment and Derivative Gains/Losses (Continued)

bonds. In 2011, we also recognized aggregate OTTI losses of $506 million related to our investments in equity securities, a

portion of which related to certain components of our Wells Fargo common stock investments. The OTTI losses on equity

securities in 2011 averaged about 7.5% of the original cost of the impaired securities. In each case, the issuer had been

profitable in recent periods and in some cases highly profitable.

Although we have periodically recorded OTTI losses in earnings in each of the past three years, we continue to own certain

of these securities. In cases where the market values of these investments have increased since the dates the OTTI losses were

recorded in earnings, these increases are not reflected in earnings but are instead included in shareholders’ equity as a

component of accumulated other comprehensive income. When recorded, OTTI losses have no impact whatsoever on the asset

values otherwise recorded in our Consolidated Balance Sheets or on our consolidated shareholders’ equity. In addition, the

recognition of such losses in earnings rather than in accumulated other comprehensive income does not necessarily indicate that

sales are imminent or planned and sales ultimately may not occur for a number of years. Furthermore, the recognition of OTTI

losses does not necessarily indicate that the loss in value of the security is permanent or that the market price of the security will

not subsequently increase to and ultimately exceed our original cost.

As of December 31, 2013, consolidated gross unrealized losses on our investments in equity and fixed maturity securities

determined on an individual purchase lot basis were $289 million. We have concluded that as of December 31, 2013, such

losses were not other than temporary. We consider several factors in determining whether or not impairments are deemed to be

other than temporary, including the current and expected long-term business prospects and if applicable, the creditworthiness of

the issuer, our ability and intent to hold the investment until the price recovers and the length of time and relative magnitude of

the price decline.

Derivative gains/losses primarily represent the changes in fair value of our credit default and equity index put option

contracts. Periodic changes in the fair values of these contracts are reflected in earnings and can be significant, reflecting the

volatility of underlying credit and equity markets.

In 2013, our equity index put option contracts generated a pre-tax gain of $2.8 billion, which was due to changes in fair

values of the contracts as a result of overall higher equity index values, favorable currency movements and modestly higher

interest rate assumptions. Our ultimate payment obligations, if any, under our remaining equity index put option contracts will

be determined as of the contract expiration dates, which begin in 2018, and will be based on the intrinsic value as defined under

the contracts as of those dates. As of December 31, 2013, the intrinsic value of these contracts was approximately $1.7 billion

and our recorded liability at fair value was approximately $4.7 billion.

In 2012, we recorded pre-tax gains from our equity index put option contracts of approximately $1.0 billion. These gains

were due to increased index values, foreign currency exchange rate changes and valuation adjustments on a small number of

contracts where contractual settlements are determined differently than the standard determination of intrinsic value, partially

offset by lower interest rate assumptions. In 2011, we recorded pre-tax losses of approximately $1.8 billion on our equity index

put option contracts. The losses reflected declines ranging from about 5.5% to 17% with respect to three of the four equity

indexes covered under our contracts and lower interest rate assumptions.

Our credit default contracts generated pre-tax losses of $213 million in 2013, which was due to increases in estimated

liabilities of a municipality issuer contract that relates to more than 500 municipal debt issues. Our credit default contract

exposures associated with corporate issuers expired in December 2013. There were no losses paid in 2013. Our remaining credit

default derivative contract exposures are currently limited to the municipality issuer contract.

In 2012, we recognized pre-tax gains of $894 million on credit default contracts. Such gains were attributable to narrower

spreads and reduced time exposure, as well as from settlements related to the termination of certain contracts. We recorded pre-

tax losses of $251 million on our credit default contracts in 2011. The losses in 2011 were primarily related to our contracts

involving non-investment grade corporate issuers due to widening credit default spreads and loss events. In 2012 and 2011,

credit loss payments were $68 million and $86 million, respectively.

87