Berkshire Hathaway 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

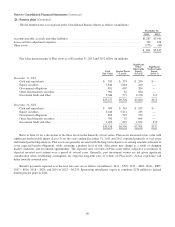

(22) Contingencies and Commitments (Continued)

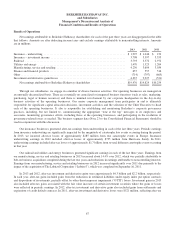

We have owned a controlling interest in Marmon Holdings, Inc. (“Marmon”) since 2008 when we acquired 63.6% of its

outstanding shares of common stock. In 2010, we acquired 16.6% of its outstanding common stock for approximately $1.5

billion and in 2012, we acquired an additional 9.8% of its outstanding common stock for aggregate consideration of

approximately $1.4 billion. In 2013, we acquired an additional 9.7% of its outstanding common stock for aggregate

consideration of approximately $1.47 billion of which $1.2 billion is payable in March 2014. As of December 31, 2013, we own

substantially all of Marmon outstanding common stock. On April 29, 2013, we acquired the remaining noncontrolling interests

of IMC International Metalworking Companies B.V., the parent company of Iscar, for consideration of $2.05 billion. Berkshire

now owns 100% of IMC International Metalworking Companies B.V. Each of these transactions was accounted for as an

acquisition of noncontrolling interests. The differences between the consideration paid or payable and the carrying amounts of

these noncontrolling interests were recorded as reductions in Berkshire’s shareholders’ equity and aggregated approximately

$1.8 billion in 2013 and $700 million in 2012.

Pursuant to the terms of shareholder agreements with noncontrolling shareholders in our other less than wholly-owned

subsidiaries, we may be obligated to acquire their equity ownership interests. If we had acquired all outstanding noncontrolling

interests as of December 31, 2013, we estimate the cost would have been approximately $3.1 billion. However, the timing and

the amount of any such future payments that might be required are contingent on future actions of the noncontrolling owners.

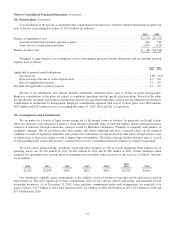

On October 16, 2013, Marmon announced it entered into an agreement to acquire the beverage dispensing and

merchandising operations of British engineering company, IMI plc for approximately $1.1 billion. The acquisition closed in

January 2014.

On December 30, 2013, we entered into an agreement with Phillips 66 (“PSX”) whereby we would exchange up to the

20,668,118 shares of PSX common stock that we owned on that date for 100% of the outstanding common stock of PSX’s flow

improver business, Phillips Specialty Products Inc. (“PSPI”). Per the agreement, the exact number of shares of PSX common

stock to be exchanged was to be determined based upon the volume weighted average price of PSX common stock on the

closing date. On February 25, 2014, the closing occurred and we exchanged 17,422,615 shares of PSX common stock for the

outstanding common stock of PSPI. At the time of the closing, the assets of PSPI included approximately $450 million of cash

and cash equivalents.

Berkshire has a 50% interest in a joint venture, Berkadia Commercial Mortgage (“Berkadia”), with Leucadia National

Corporation (“Leucadia”) having the other 50% interest. Berkadia is a servicer of commercial real estate loans in the U.S.,

performing primary, master and special servicing functions for U.S. government agency programs, commercial mortgage-

backed securities transactions, banks, insurance companies and other financial institutions. A significant source of funding for

Berkadia’s operations is through the issuance of commercial paper. Repayment of the commercial paper is supported by a $2.5

billion surety policy issued by a Berkshire insurance subsidiary. Leucadia has agreed to indemnify Berkshire for one-half of any

losses incurred under the policy. As of December 31, 2013, the aggregate amount of Berkadia commercial paper outstanding

was $2.47 billion.

62