Berkshire Hathaway 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

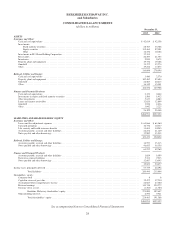

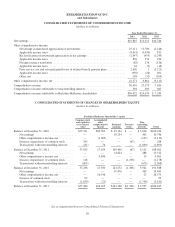

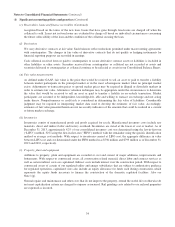

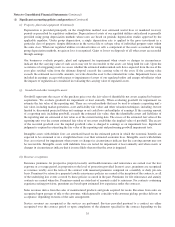

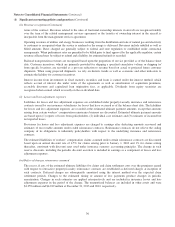

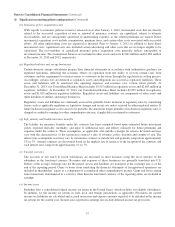

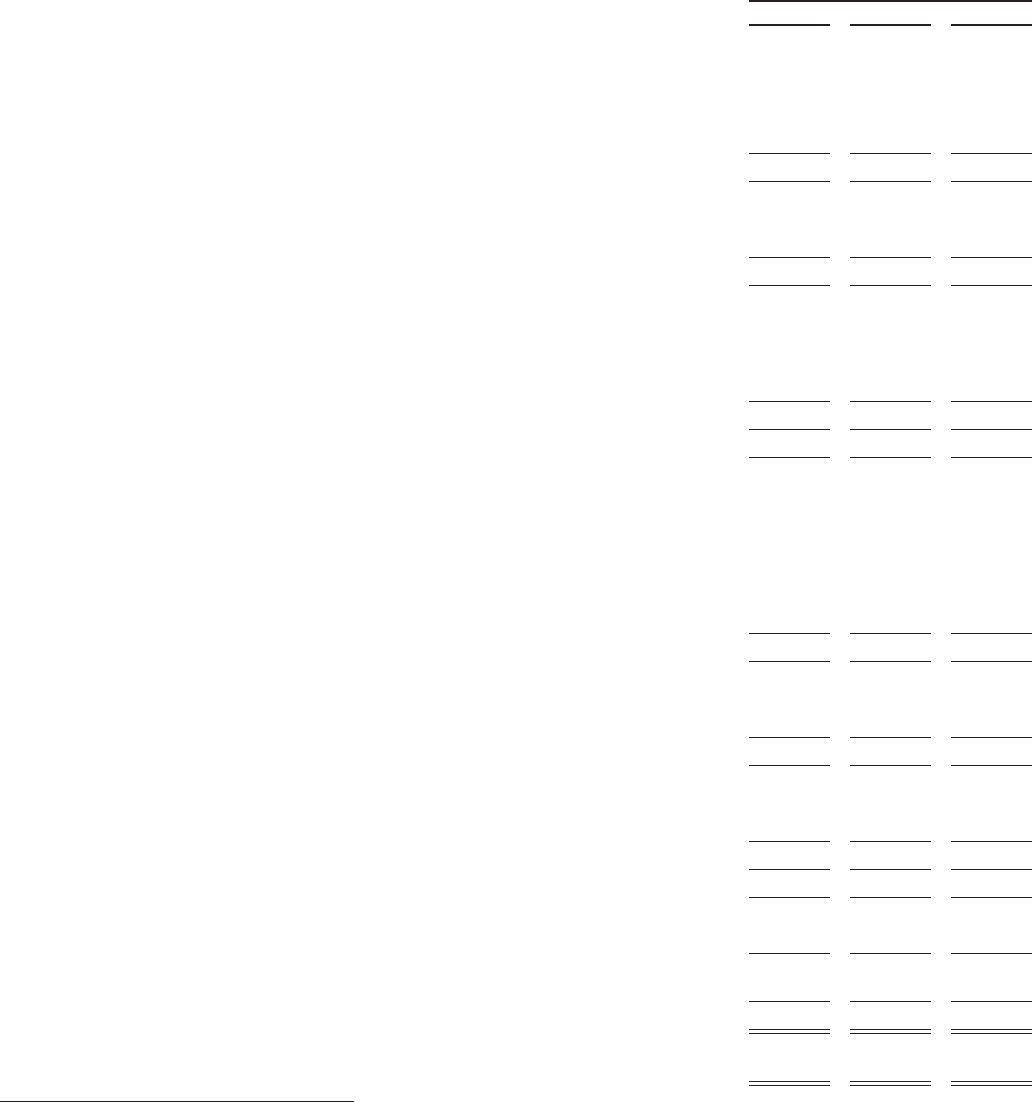

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED STATEMENTS OF EARNINGS

(dollars in millions except per-share amounts)

Year Ended December 31,

2013 2012 2011

Revenues:

Insurance and Other:

Insurance premiums earned ...................................................... $ 36,684 $ 34,545 $ 32,075

Sales and service revenues ....................................................... 94,806 83,268 72,803

Interest, dividend and other investment income ....................................... 4,939 4,534 4,792

Investment gains/losses .......................................................... 3,881 990 1,065

140,310 123,337 110,735

Railroad, Utilities and Energy:

Operating revenues ............................................................. 34,649 32,383 30,721

Other ........................................................................ 108 199 118

34,757 32,582 30,839

Finance and Financial Products:

Interest, dividend and other investment income ....................................... 1,469 1,572 1,618

Investment gains/losses .......................................................... 184 472 209

Derivative gains/losses .......................................................... 2,608 1,963 (2,104)

Other ........................................................................ 2,822 2,537 2,391

7,083 6,544 2,114

182,150 162,463 143,688

Costs and expenses:

Insurance and Other:

Insurance losses and loss adjustment expenses ....................................... 21,275 20,113 20,829

Life, annuity and health insurance benefits .......................................... 5,072 5,114 4,879

Insurance underwriting expenses .................................................. 7,248 7,693 6,119

Cost of sales and services ........................................................ 77,053 67,536 59,839

Selling, general and administrative expenses ......................................... 11,917 10,503 8,670

Interest expense ................................................................ 426 397 308

122,991 111,356 100,644

Railroad, Utilities and Energy:

Cost of sales and operating expenses ............................................... 25,157 23,816 22,736

Interest expense ................................................................ 1,865 1,745 1,703

27,022 25,561 24,439

Finance and Financial Products:

Interest expense ................................................................ 510 602 653

Other ........................................................................ 2,831 2,708 2,638

3,341 3,310 3,291

153,354 140,227 128,374

Earnings before income taxes ....................................................... 28,796 22,236 15,314

Income tax expense ............................................................. 8,951 6,924 4,568

Net earnings ...................................................................... 19,845 15,312 10,746

Less: Earnings attributable to noncontrolling interests .................................. 369 488 492

Net earnings attributable to Berkshire Hathaway shareholders ........................... $ 19,476 $ 14,824 $ 10,254

Average common shares outstanding * ............................................. 1,643,613 1,651,294 1,649,891

Net earnings per share attributable to Berkshire Hathaway shareholders * ................. $ 11,850 $ 8,977 $ 6,215

* Average shares outstanding include average Class A common shares and average Class B common shares determined on an equivalent

Class A common stock basis. Net earnings per common share attributable to Berkshire Hathaway shown above represents net earnings per

equivalent Class A common share. Net earnings per Class B common share is equal to one-fifteen-hundredth (1/1,500) of such amount or

$7.90 per share for 2013, $5.98 per share for 2012 and $4.14 per share for 2011.

See accompanying Notes to Consolidated Financial Statements

29