Berkshire Hathaway 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Utilities and Energy (“MidAmerican”) (Continued)

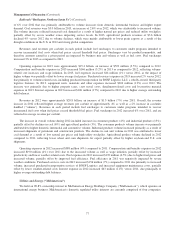

offset by the impact of one-time customer refunds issued by NV Energy and impairment losses associated with MidAmerican’s

interests in certain geothermal electricity generation projects. EBIT in 2013 from other activities declined $87 million compared

to 2012, as the impacts of the aforementioned losses associated with geothermal projects and NV Energy acquisition costs and

customer refunds, more than offset the increase in earnings from the new solar and wind-powered electricity generation

projects.

Corporate interest includes interest on the unsecured debt issued by MidAmerican Energy Holding Company. Corporate

interest expense in 2014 is expected to increase compared to recent years as a result of new borrowings in connection with the

NV Energy acquisition, including borrowings from certain Berkshire insurance subsidiaries.

MidAmerican’s consolidated income tax expense as percentages of pre-tax earnings were 7% in 2013, 9% in 2012 and

18% in 2011. In each year, MidAmerican’s utility subsidiaries generated significant production tax credits. In addition, pre-tax

earnings of Northern Powergrid are taxed at lower rates in the U.K. and each year also benefitted from reductions of deferred

income taxes as a result of lower enacted corporate income tax rates in the U.K.

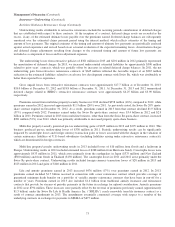

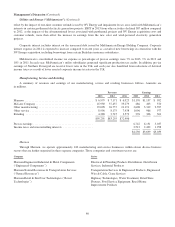

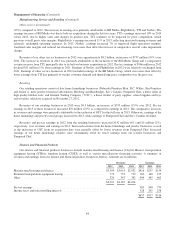

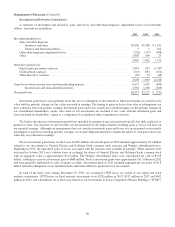

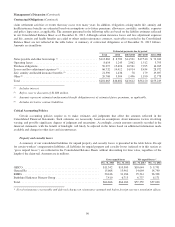

Manufacturing, Service and Retailing

A summary of revenues and earnings of our manufacturing, service and retailing businesses follows. Amounts are

in millions.

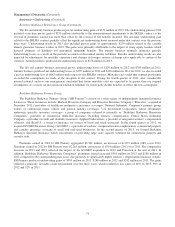

Revenues Earnings

2013 2012 2011 2013 2012 2011

Marmon ................................................ $ 6,979 $ 7,171 $ 6,925 $1,176 $1,137 $ 992

McLane Company ........................................ 45,930 37,437 33,279 486 403 370

Other manufacturing ...................................... 29,098 26,757 21,191 3,608 3,319 2,397

Other service ............................................ 8,996 8,175 7,438 1,096 966 977

Retailing ............................................... 4,288 3,715 3,573 376 306 301

$95,291 $83,255 $72,406

Pre-tax earnings .......................................... 6,742 6,131 5,037

Income taxes and noncontrolling interests ..................... 2,512 2,432 1,998

$4,230 $3,699 $3,039

Marmon

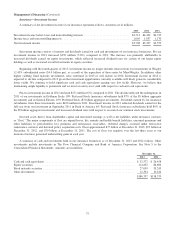

Through Marmon, we operate approximately 160 manufacturing and service businesses within eleven diverse business

sectors that are further organized in three separate companies. Those companies and constituent sectors are:

Company Sector

Marmon Engineered Industrial & Metal Components

(“Engineered Components”)

Electrical & Plumbing Products Distribution, Distribution

Services, Industrial Products

Marmon Natural Resources & Transportation Services

(“Natural Resources”)

Transportation Services & Engineered Products, Engineered

Wire & Cable, Crane Services

Marmon Retail & End User Technologies (“Retail

Technologies”)

Highway Technologies, Water Treatment, Retail Store

Fixtures, Food Service Equipment, Retail Home

Improvement Products

80