Berkshire Hathaway 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

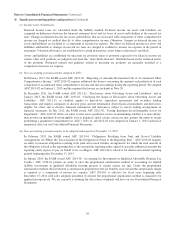

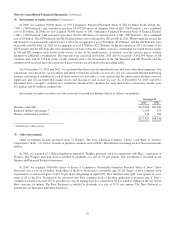

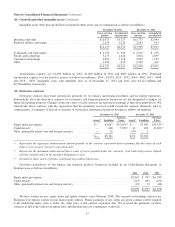

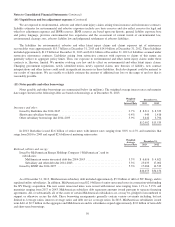

(5) Other investments (Continued)

In 2011, we acquired 50,000 shares of 6% Cumulative Perpetual Preferred Stock of BAC (“BAC Preferred”) and warrants

to purchase 700,000,000 shares of common stock of BAC (“BAC Warrants”) for a combined cost of $5 billion. The BAC

Preferred is redeemable at any time by BAC at a price of $105,000 per share ($5.25 billion in aggregate). The BAC Warrants

expire in 2021 and are exercisable for an additional aggregate cost of $5 billion ($7.142857/share). The BAC Preferred and

BAC Warrants are included in our Insurance and Other businesses (80%) and our Finance and Financial Products businesses

(20%).

Our other investments are classified as available-for-sale and are carried at fair value. In the aggregate, the cost of these

investments was approximately $10.0 billion and the fair value was approximately $17.9 billion and $15.1 billion at

December 31, 2013 and 2012, respectively.

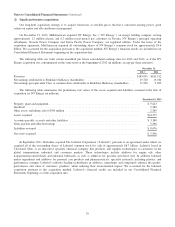

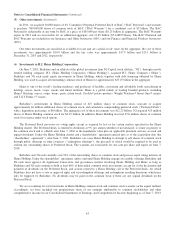

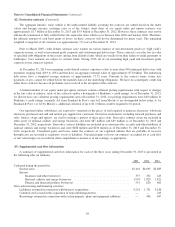

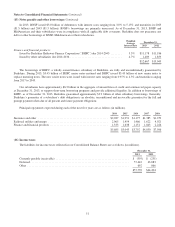

(6) Investments in H.J. Heinz Holding Corporation

On June 7, 2013, Berkshire and an affiliate of the global investment firm 3G Capital (such affiliate, “3G”), through a newly

formed holding company, H.J. Heinz Holding Corporation (“Heinz Holding”), acquired H.J. Heinz Company (“Heinz”).

Berkshire and 3G each made equity investments in Heinz Holding, which, together with debt financing obtained by Heinz

Holding, was used to acquire all outstanding common stock of Heinz for approximately $23.25 billion in the aggregate.

Heinz is one of the world’s leading marketers and producers of healthy, convenient and affordable foods specializing in

ketchup, sauces, meals, soups, snacks and infant nutrition. Heinz is a global family of leading branded products, including

Heinz®Ketchup, sauces, soups, beans, pasta, infant foods, Ore-Ida®potato products, Weight Watchers®Smart Ones®entrées

and T.G.I. Friday’s®snacks.

Berkshire’s investments in Heinz Holding consist of 425 million shares of common stock, warrants to acquire

approximately 46 million additional shares of common stock, and cumulative compounding preferred stock (“Preferred Stock”)

with a liquidation preference of $8 billion. The aggregate cost of these investments was $12.25 billion. 3G acquired 425 million

shares of Heinz Holding common stock for $4.25 billion. In addition, Heinz Holding reserved 39.6 million shares of common

stock for issuance under stock options.

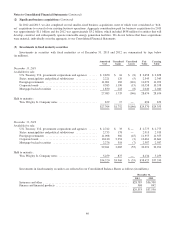

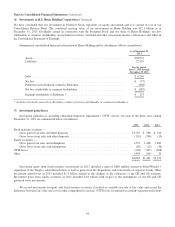

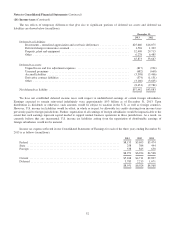

The Preferred Stock possesses no voting rights except as required by law or for certain matters specified in the Heinz

Holding charter. The Preferred Stock is entitled to dividends at 9% per annum whether or not declared, is senior in priority to

the common stock and is callable after June 7, 2016 at the liquidation value plus an applicable premium and any accrued and

unpaid dividends. Under the Heinz Holding charter and a shareholders’ agreement entered into as of the acquisition date (the

“shareholders’ agreement”), after June 7, 2021, Berkshire can cause Heinz Holding to attempt to sell shares of common stock

through public offerings or other issuances (“redemption offerings”), the proceeds of which would be required to be used to

redeem any outstanding shares of Preferred Stock. The warrants are exercisable for one cent per share and expire on June 7,

2018.

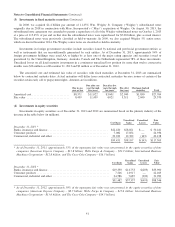

Berkshire and 3G each currently own 50% of the outstanding shares of common stock and possess equal voting interests in

Heinz Holding. Under the shareholders’ agreement, unless and until Heinz Holding engages in a public offering, Berkshire and

3G each must approve all significant transactions and governance matters involving Heinz Holding and Heinz so long as

Berkshire and 3G each continue to hold at least 66% of their initial common stock investments, except for (i) the declaration and

payment of dividends on the Preferred Stock, and actions related to a Heinz Holding call of the Preferred Stock, for which

Berkshire does not have a vote or approval right, and (ii) redemption offerings and redemptions resulting therefrom, which may

only be triggered by Berkshire. No dividends may be paid on the common stock if there are any unpaid dividends on the

Preferred Stock.

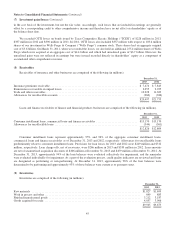

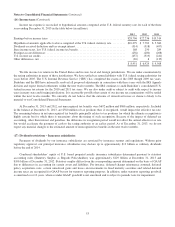

We are accounting for our investments in Heinz Holding common stock and common stock warrants on the equity method.

Accordingly, we have included our proportionate share of net earnings attributable to common stockholders and other

comprehensive income in our Consolidated Statements of Earnings and Comprehensive Income beginning as of June 7, 2013.

43