Berkshire Hathaway 2013 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

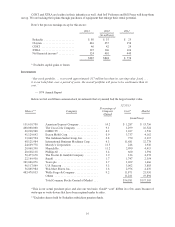

CORT and XTRA are leaders in their industries as well. And Jeff Pederson and Bill Franz will keep them

on top. We are backing their plans through purchases of equipment that enlarge their rental potential.

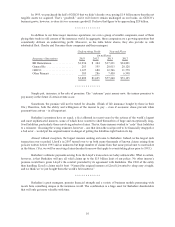

Here’s the pre-tax earnings recap for this sector:

2013 2012 2011

(in millions)

Berkadia ..................... $ 80 $ 35 $ 25

Clayton ...................... 416 255 154

CORT ....................... 40 42 29

XTRA ....................... 125 106 126

Net financial income* ........... 324 410 440

$985 $848 $ 774

* Excludes capital gains or losses

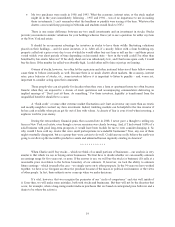

Investments

“Our stock portfolio . . . was worth approximately $17 million less than its carrying value [cost] . . .

it is our belief that, over a period of years, the overall portfolio will prove to be worth more than its

cost.”

— 1974 Annual Report

Below we list our fifteen common stock investments that at yearend had the largest market value.

12/31/13

Shares** Company

Percentage of

Company

Owned

Cost* Market

(in millions)

151,610,700 American Express Company ............. 14.2 $ 1,287 $ 13,756

400,000,000 The Coca-Cola Company ............... 9.1 1,299 16,524

22,238,900 DIRECTV ........................... 4.2 1,017 1,536

41,129,643 Exxon Mobil Corp. .................... 0.9 3,737 4,162

13,062,594 The Goldman Sachs Group, Inc. .......... 2.8 750 2,315

68,121,984 International Business Machines Corp. ..... 6.3 11,681 12,778

24,669,778 Moody’s Corporation .................. 11.5 248 1,936

20,060,390 Munich Re ........................... 11.2 2,990 4,415

20,668,118 Phillips 66 ........................... 3.4 660 1,594

52,477,678 The Procter & Gamble Company ......... 1.9 336 4,272

22,169,930 Sanofi .............................. 1.7 1,747 2,354

301,046,076 Tesco plc ............................ 3.7 1,699 1,666

96,117,069 U.S. Bancorp ......................... 5.3 3,002 3,883

56,805,984 Wal-Mart Stores, Inc. .................. 1.8 2,976 4,470

483,470,853 Wells Fargo & Company ................ 9.2 11,871 21,950

Others .............................. 11,281 19,894

Total Common Stocks Carried at Market . . . $56,581 $117,505

*This is our actual purchase price and also our tax basis; GAAP “cost” differs in a few cases because of

write-ups or write-downs that have been required under its rules.

**Excludes shares held by Berkshire subsidiary pension funds.

16