Berkshire Hathaway 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Berkshire is the financing partner. In that role, we purchased $8 billion of Heinz preferred stock that

carries a 9% coupon but also possesses other features that should increase the preferred’s annual return to

12% or so. Berkshire and 3G each purchased half of the Heinz common stock for $4.25 billion.

Though the Heinz acquisition has some similarities to a “private equity” transaction, there is a crucial

difference: Berkshire never intends to sell a share of the company. What we would like, rather, is to buy

more, and that could happen: Certain 3G investors may sell some or all of their shares in the future, and

we might increase our ownership at such times. Berkshire and 3G could also decide at some point that it

would be mutually beneficial if we were to exchange some of our preferred for common shares (at an

equity valuation appropriate to the time).

Our partnership took control of Heinz in June, and operating results so far are encouraging. Only minor

earnings from Heinz, however, are reflected in those we report for Berkshire this year: One-time charges

incurred in the purchase and subsequent restructuring of operations totaled $1.3 billion. Earnings in 2014

will be substantial.

With Heinz, Berkshire now owns 8

1

⁄

2

companies that, were they stand-alone businesses, would be in the

Fortune 500. Only 491

1

⁄

2

to go.

NV Energy, purchased for $5.6 billion by MidAmerican Energy, our utility subsidiary, supplies electricity

to about 88% of Nevada’s population. This acquisition fits nicely into our existing electric-utility

operation and offers many possibilities for large investments in renewable energy. NV Energy will not be

MidAmerican’s last major acquisition.

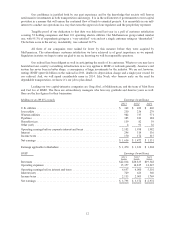

ŠMidAmerican is one of our “Powerhouse Five” – a collection of large non-insurance businesses that, in

aggregate, had a record $10.8 billion of pre-tax earnings in 2013, up $758 million from 2012. The other

companies in this sainted group are BNSF, Iscar, Lubrizol and Marmon.

Of the five, only MidAmerican, then earning $393 million pre-tax, was owned by Berkshire nine years

ago. Subsequently, we purchased another three of the five on an all-cash basis. In acquiring the fifth,

BNSF, we paid about 70% of the cost in cash, and, for the remainder, issued shares that increased the

number outstanding by 6.1%. In other words, the $10.4 billion gain in annual earnings delivered Berkshire

by the five companies over the nine-year span has been accompanied by only minor dilution. That satisfies

our goal of not simply growing, but rather increasing per-share results.

If the U.S. economy continues to improve in 2014, we can expect earnings of our Powerhouse Five to

improve also – perhaps by $1 billion or so pre-tax.

ŠOur many dozens of smaller non-insurance businesses earned $4.7 billion pre-tax last year, up from $3.9

billion in 2012. Here, too, we expect further gains in 2014.

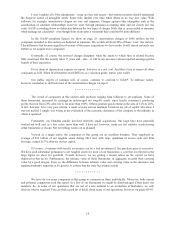

ŠBerkshire’s extensive insurance operation again operated at an underwriting profit in 2013 – that makes 11

years in a row – and increased its float. During that 11-year stretch, our float – money that doesn’t belong

to us but that we can invest for Berkshire’s benefit – has grown from $41 billion to $77 billion.

Concurrently, our underwriting profit has aggregated $22 billion pre-tax, including $3 billion realized in

2013. And all of this all began with our 1967 purchase of National Indemnity for $8.6 million.

We now own a wide variety of exceptional insurance operations. Best known is GEICO, the car insurer

Berkshire acquired in full at yearend 1995 (having for many years prior owned a partial interest). GEICO

in 1996 ranked number seven among U.S. auto insurers. Now, GEICO is number two, having recently

passed Allstate. The reasons for this amazing growth are simple: low prices and reliable service. You can

do yourself a favor by calling 1-800-847-7536 or checking Geico.com to see if you, too, can cut your

insurance costs. Buy some of Berkshire’s other products with the savings.

4