Berkshire Hathaway 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ron Peltier continues to build HomeServices, MidAmerican’s real estate brokerage subsidiary. Last year

his operation made four acquisitions, the most significant being Fox & Roach, a Philadelphia-based company that

is the largest single-market realtor in the country.

HomeServices now has 22,114 agents (listed by geography on page 112), up 38% from 2012.

HomeServices also owns 67% of the Prudential and Real Living franchise operations, which are in the process of

rebranding their franchisees as Berkshire Hathaway HomeServices. If you haven’t yet, many of you will soon be

seeing our name on “for sale” signs.

Manufacturing, Service and Retailing Operations

“See that store,” Warren says, pointing at Nebraska Furniture Mart. “That’s a really good business.”

“Why don’t you buy it?” I said.

“It’s privately held,” Warren said.

“Oh,” I said.

“I might buy it anyway,” Warren said. “Someday.”

—Supermoney by Adam Smith (1972)

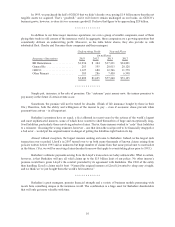

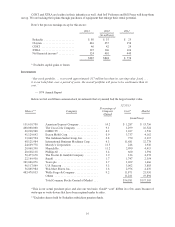

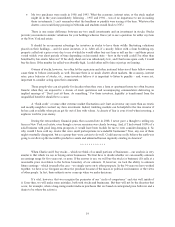

Our activities in this part of Berkshire cover the waterfront. Let’s look, though, at a summary balance

sheet and earnings statement for the entire group.

Balance Sheet 12/31/13 (in millions)

Assets Liabilities and Equity

Cash and equivalents ................... $ 6,625 Notes payable .................... $ 1,615

Accounts and notes receivable ............ 7,749 Other current liabilities ............. 8,965

Inventory ............................. 9,945 Total current liabilities ............. 10,580

Other current assets ..................... 716

Total current assets ..................... 25,035

Deferred taxes .................... 5,184

Goodwill and other intangibles ............ 25,617 Term debt and other liabilities ....... 4,405

Fixed assets ........................... 19,389 Non-controlling interests ............ 456

Other assets ........................... 4,274 Berkshire equity .................. 53,690

$74,315 $74,315

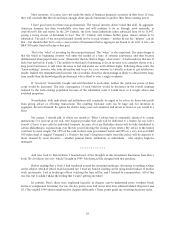

Earnings Statement (in millions)

2013 2012 2011

Revenues ........................................................ $95,291 $83,255 $72,406

Operating expenses ................................................ 88,414 76,978 67,239

Interest expense ................................................... 135 146 130

Pre-tax earnings ................................................... 6,742 6,131 5,037

Income taxes and non-controlling interests .............................. 2,512 2,432 1,998

Net earnings ...................................................... $ 4,230 $ 3,699 $ 3,039

Our income and expense data conforming to Generally Accepted Accounting Principles (“GAAP”) is on

page 29. In contrast, the operating expense figures above are non-GAAP and exclude some purchase-accounting

items (primarily the amortization of certain intangible assets). We present the data in this manner because Charlie

and I believe the adjusted numbers more accurately reflect the true economic expenses and profits of the businesses

aggregated in the table than do GAAP figures.

13