Berkshire Hathaway 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regulated, Capital-Intensive Businesses

“Though there are many regulatory restraints in the utility industry, it’s possible that we will make

additional commitments in the field. If we do, the amounts involved could be large.”

— 1999 Annual Report

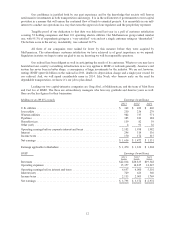

We have two major operations, BNSF and MidAmerican Energy, that share important characteristics

distinguishing them from our other businesses. Consequently, we assign them their own section in this letter and

split out their combined financial statistics in our GAAP balance sheet and income statement.

A key characteristic of both companies is their huge investment in very long-lived, regulated assets, with

these partially funded by large amounts of long-term debt that is not guaranteed by Berkshire. Our credit is in fact

not needed because each company has earning power that even under terrible economic conditions will far exceed

its interest requirements. Last year, for example, BNSF’s interest coverage was 9:1. (Our definition of coverage is

pre-tax earnings/interest, not EBITDA/interest, a commonly-used measure we view as seriously flawed.)

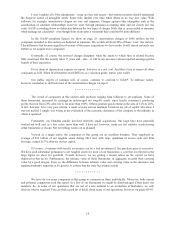

At MidAmerican, meanwhile, two factors ensure the company’s ability to service its debt under all

circumstances. The first is common to all utilities: recession-resistant earnings, which result from these companies

exclusively offering an essential service. The second is enjoyed by few other utilities: a great diversity of earnings

streams, which shield us from being seriously harmed by any single regulatory body. Now, with the acquisition of

NV Energy, MidAmerican’s earnings base has further broadened. This particular strength, supplemented by

Berkshire’s ownership, has enabled MidAmerican and its utility subsidiaries to significantly lower their cost of

debt. This advantage benefits both us and our customers.

Every day, our two subsidiaries power the American economy in major ways:

ŠBNSF carries about 15% (measured by ton-miles) of all inter-city freight, whether it is transported by

truck, rail, water, air, or pipeline. Indeed, we move more ton-miles of goods than anyone else, a fact

establishing BNSF as the most important artery in our economy’s circulatory system. Its hold on the

number-one position strengthened in 2013.

BNSF, like all railroads, also moves its cargo in an extraordinarily fuel-efficient and environmentally

friendly way, carrying a ton of freight about 500 miles on a single gallon of diesel fuel. Trucks taking on

the same job guzzle about four times as much fuel.

ŠMidAmerican’s utilities serve regulated retail customers in eleven states. No utility company stretches

further. In addition, we are the leader in renewables: From a standing start nine years ago, MidAmerican

now accounts for 7% of the country’s wind generation capacity, with more on the way. Our share in

solar – most of which is still in construction – is even larger.

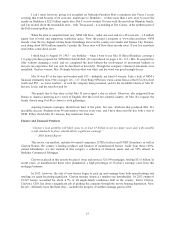

MidAmerican can make these investments because it retains all of its earnings. Here’s a little known fact:

Last year MidAmerican retained more dollars of earnings – by far – than any other American electric

utility. We and our regulators see this as an important advantage – one almost certain to exist five, ten and

twenty years from now.

When our current projects are completed, MidAmerican’s renewables portfolio will have cost $15 billion.

We relish making such commitments as long as they promise reasonable returns. And, on that front, we put a large

amount of trust in future regulation.

11