Berkshire Hathaway 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(21) Pension plans (Continued)

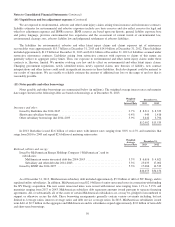

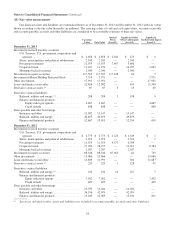

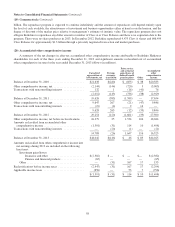

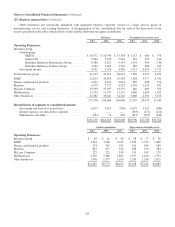

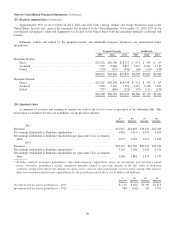

The net funded status is recognized in the Consolidated Balance Sheets as follows (in millions).

December 31,

2013 2012

Accounts payable, accruals and other liabilities .................................................. $1,287 $3,441

Losses and loss adjustment expenses .......................................................... 309 256

Other assets .............................................................................. (975) (60)

$ 621 $3,637

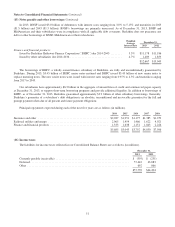

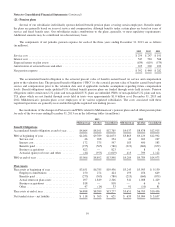

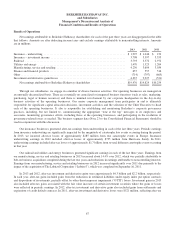

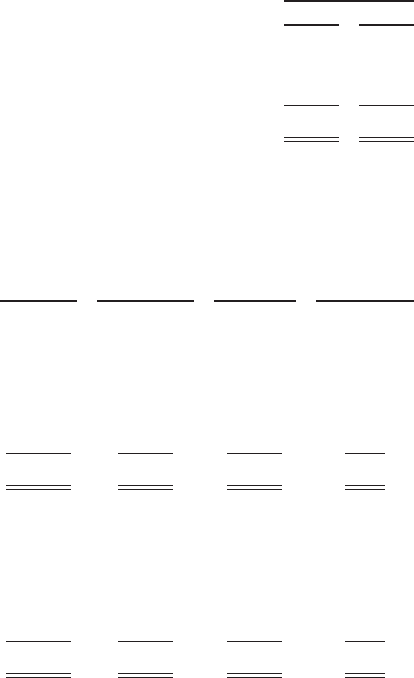

Fair value measurements of Plan assets as of December 31, 2013 and 2012 follow (in millions).

Total

Fair Value

Quoted Prices

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

December 31, 2013

Cash and equivalents ...................................... $ 595 $ 355 $ 240 $—

Equity securities .......................................... 7,844 7,684 160 —

Government obligations .................................... 891 607 284 —

Other fixed maturity securities ............................... 901 81 820 —

Investment funds and other ................................. 3,046 577 2,156 313

$13,277 $9,304 $3,660 $313

December 31, 2012

Cash and equivalents ...................................... $ 900 $ 345 $ 555 $—

Equity securities .......................................... 5,444 5,211 233 —

Government obligations .................................... 899 529 370 —

Other fixed maturity securities ............................... 790 92 698 —

Investment funds and other ................................. 2,403 419 1,652 332

$10,436 $6,596 $3,508 $332

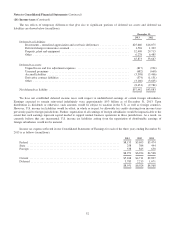

Refer to Note 18 for a discussion of the three levels in the hierarchy of fair values. Plan assets measured at fair value with

significant unobservable inputs (Level 3) for the years ending December 31, 2013 and 2012 consisted primarily of real estate

and limited partnership interests. Plan assets are generally invested with the long-term objective of earning amounts sufficient to

cover expected benefit obligations, while assuming a prudent level of risk. Allocations may change as a result of changing

market conditions and investment opportunities. The expected rates of return on Plan assets reflect subjective assessments of

expected invested asset returns over a period of several years. Generally, past investment returns are not given significant

consideration when establishing assumptions for expected long-term rates of returns on Plan assets. Actual experience will

differ from the assumed rates.

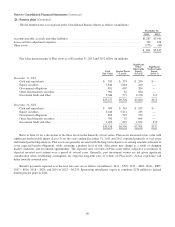

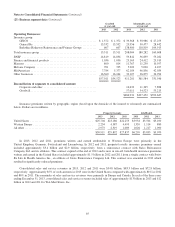

Benefits payments expected over the next ten years are as follows (in millions): 2014 – $787; 2015 – $802; 2016 – $805;

2017 – $816; 2018 – $823; and 2019 to 2023 – $4,253. Sponsoring subsidiaries expect to contribute $276 million to defined

benefit pension plans in 2014.

60