Berkshire Hathaway 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ŠWhile Charlie and I search for elephants, our many subsidiaries are regularly making bolt-on acquisitions.

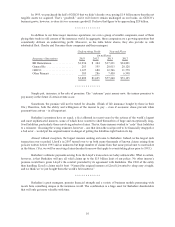

Last year, we contracted for 25 of these, scheduled to cost $3.1 billion in aggregate. These transactions

ranged from $1.9 million to $1.1 billion in size.

Charlie and I encourage these deals. They deploy capital in activities that fit with our existing businesses

and that will be managed by our corps of expert managers. The result is no more work for us and more

earnings for you. Many more of these bolt-on deals will be made in future years. In aggregate, they will be

meaningful.

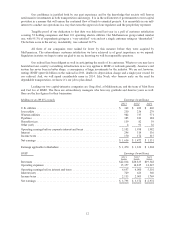

ŠLast year we invested $3.5 billion in the surest sort of bolt-on: the purchase of additional shares in two

wonderful businesses that we already controlled. In one case – Marmon – our purchases brought us to the

100% ownership we had signed up for in 2008. In the other instance – Iscar – the Wertheimer family

elected to exercise a put option it held, selling us the 20% of the business it retained when we bought

control in 2006.

These purchases added about $300 million pre-tax to our current earning power and also delivered us $800

million of cash. Meanwhile, the same nonsensical accounting rule that I described in last year’s letter

required that we enter these purchases on our books at $1.8 billion less than we paid, a process that

reduced Berkshire’s book value. (The charge was made to “capital in excess of par value”; figure that one

out.) This weird accounting, you should understand, instantly increased Berkshire’s excess of intrinsic

value over book value by the same $1.8 billion.

ŠOur subsidiaries spent a record $11 billion on plant and equipment during 2013, roughly twice our

depreciation charge. About 89% of that money was spent in the United States. Though we invest abroad as

well, the mother lode of opportunity resides in America.

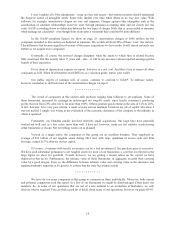

ŠIn a year in which most equity managers found it impossible to outperform the S&P 500, both Todd

Combs and Ted Weschler handily did so. Each now runs a portfolio exceeding $7 billion. They’ve earned

it.

I must again confess that their investments outperformed mine. (Charlie says I should add “by a lot.”) If

such humiliating comparisons continue, I’ll have no choice but to cease talking about them.

Todd and Ted have also created significant value for you in several matters unrelated to their portfolio

activities. Their contributions are just beginning: Both men have Berkshire blood in their veins.

ŠBerkshire’s yearend employment – counting Heinz – totaled a record 330,745, up 42,283 from last year.

The increase, I must admit, included one person at our Omaha home office. (Don’t panic: The

headquarters gang still fits comfortably on one floor.)

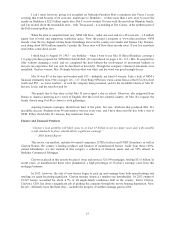

ŠBerkshire increased its ownership interest last year in each of its “Big Four” investments – American

Express, Coca-Cola, IBM and Wells Fargo. We purchased additional shares of Wells Fargo (increasing

our ownership to 9.2% versus 8.7% at yearend 2012) and IBM (6.3% versus 6.0%). Meanwhile, stock

repurchases at Coca-Cola and American Express raised our percentage ownership. Our equity in Coca-

Cola grew from 8.9% to 9.1% and our interest in American Express from 13.7% to 14.2%. And, if you

think tenths of a percent aren’t important, ponder this math: For the four companies in aggregate, each

increase of one-tenth of a percent in our share of their equity raises Berkshire’s share of their annual

earnings by $50 million.

5