Berkshire Hathaway 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our confidence is justified both by our past experience and by the knowledge that society will forever

need massive investments in both transportation and energy. It is in the self-interest of governments to treat capital

providers in a manner that will ensure the continued flow of funds to essential projects. It is meanwhile in our self-

interest to conduct our operations in a way that earns the approval of our regulators and the people they represent.

Tangible proof of our dedication to that duty was delivered last year in a poll of customer satisfaction

covering 52 holding companies and their 101 operating electric utilities. Our MidAmerican group ranked number

one, with 95.3% of respondents giving us a “very satisfied” vote and not a single customer rating us “dissatisfied.”

The bottom score in the survey, incidentally, was a dismal 34.5%.

All three of our companies were ranked far lower by this measure before they were acquired by

MidAmerican. The extraordinary customer satisfaction we have achieved is of great importance as we expand:

Regulators in states we hope to enter are glad to see us, knowing we will be responsible operators.

Our railroad has been diligent as well in anticipating the needs of its customers. Whatever you may have

heard about our country’s crumbling infrastructure in no way applies to BNSF or railroads generally. America’s rail

system has never been in better shape, a consequence of huge investments by the industry. We are not, however,

resting: BNSF spent $4 billion on the railroad in 2013, double its depreciation charge and a single-year record for

any railroad. And, we will spend considerably more in 2014. Like Noah, who foresaw early on the need for

dependable transportation, we know it’s our job to plan ahead.

Leading our two capital-intensive companies are Greg Abel, at MidAmerican, and the team of Matt Rose

and Carl Ice at BNSF. The three are extraordinary managers who have my gratitude and deserve yours as well.

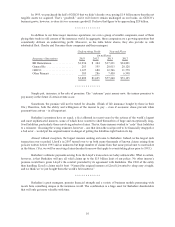

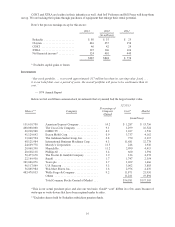

Here are the key figures for their businesses:

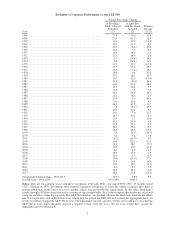

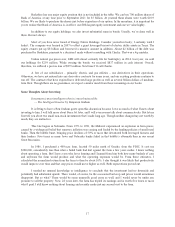

MidAmerican (89.8% owned) Earnings (in millions)

2013 2012 2011

U.K. utilities ........................................................ $ 362 $ 429 $ 469

Iowa utility ......................................................... 230 236 279

Western utilities ..................................................... 982 737 771

Pipelines ........................................................... 385 383 388

HomeServices ....................................................... 139 82 39

Other (net) ......................................................... 4 91 36

Operating earnings before corporate interest and taxes ....................... 2,102 1,958 1,982

Interest ............................................................ 296 314 336

Income taxes ........................................................ 170 172 315

Net earnings ........................................................ $ 1,636 $ 1,472 $ 1,331

Earnings applicable to Berkshire ........................................ $ 1,470 $ 1,323 $ 1,204

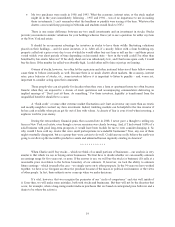

BNSF Earnings (in millions)

2013 2012 2011

Revenues .......................................................... $22,014 $20,835 $19,548

Operating expenses .................................................. 15,357 14,835 14,247

Operating earnings before interest and taxes ............................... 6,657 6,000 5,301

Interest (net) ........................................................ 729 623 560

Income taxes ........................................................ 2,135 2,005 1,769

Net earnings ........................................................ $ 3,793 $ 3,372 $ 2,972

12