Berkshire Hathaway 2013 Annual Report Download - page 11

Download and view the complete annual report

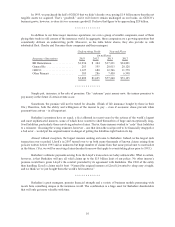

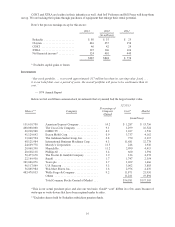

Please find page 11 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.One venture materialized last June when he formed Berkshire Hathaway Specialty Insurance (“BHSI”).

This initiative took us into commercial insurance, where we were instantly accepted by both major insurance

brokers and corporate risk managers throughout America. These professionals recognize that no other insurer can

match the financial strength of Berkshire, which guarantees that legitimate claims arising many years in the future

will be paid promptly and fully.

BHSI is led by Peter Eastwood, an experienced underwriter who is widely respected in the insurance

world. Peter has assembled a spectacular team that is already writing a substantial amount of business with many

Fortune 500 companies and with smaller operations as well. BHSI will be a major asset for Berkshire, one that will

generate volume in the billions within a few years. Give Peter a Berkshire greeting when you see him at the annual

meeting.

************

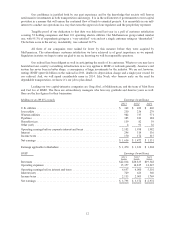

We have another reinsurance powerhouse in General Re, managed by Tad Montross.

At bottom, a sound insurance operation needs to adhere to four disciplines. It must (1) understand all

exposures that might cause a policy to incur losses; (2) conservatively assess the likelihood of any exposure

actually causing a loss and the probable cost if it does; (3) set a premium that, on average, will deliver a profit after

both prospective loss costs and operating expenses are covered; and (4) be willing to walk away if the appropriate

premium can’t be obtained.

Many insurers pass the first three tests and flunk the fourth. They simply can’t turn their back on business

that is being eagerly written by their competitors. That old line, “The other guy is doing it, so we must as well,”

spells trouble in any business, but in none more so than insurance.

Tad has observed all four of the insurance commandments, and it shows in his results. General Re’s huge

float has been better than cost-free under his leadership, and we expect that, on average, to continue. We are

particularly enthusiastic about General Re’s international life reinsurance business, which has grown consistently

and profitably since we acquired the company in 1998.

It can be remembered that soon after we purchased General Re, the company was beset by problems that

caused commentators – and me as well, briefly – to believe I had made a huge mistake. That day is long gone.

General Re is now a gem.

************

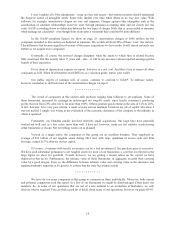

Finally, there is GEICO, the insurer on which I cut my teeth 63 years ago. GEICO is managed by Tony

Nicely, who joined the company at 18 and completed 52 years of service in 2013. Tony became CEO in 1993, and

since then the company has been flying.

When I was first introduced to GEICO in January 1951, I was blown away by the huge cost advantage the

company enjoyed compared to the expenses borne by the giants of the industry. That operational efficiency continues

today and is an all-important asset. No one likes to buy auto insurance. But almost everyone likes to drive. The

insurance needed is a major expenditure for most families. Savings matter to them – and only a low-cost operation can

deliver these.

GEICO’s cost advantage is the factor that has enabled the company to gobble up market share year after

year. Its low costs create a moat – an enduring one – that competitors are unable to cross. Meanwhile, our little

gecko continues to tell Americans how GEICO can save them important money. With our latest reduction in

operating costs, his story has become even more compelling.

9