Berkshire Hathaway 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.I can’t resist, however, giving you an update on Nebraska Furniture Mart’s expansion into Texas. I’m not

covering this event because of its economic importance to Berkshire – it takes more than a new store to move the

needle on Berkshire’s $225 billion equity base. But I’ve now worked 30 years with the marvelous Blumkin family,

and I’m excited about the remarkable store – truly Texas-sized – it is building at The Colony, in the northern part of

the Dallas metropolitan area.

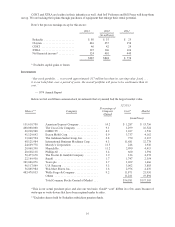

When the store is completed next year, NFM will have – under one roof, and on a 433-acre site – 1.8 million

square feet of retail and supporting warehouse space. View the project’s progress at www.nfm.com/texas. NFM

already owns the two highest-volume home furnishings stores in the country (in Omaha and Kansas City, Kansas),

each doing about $450 million annually. I predict the Texas store will blow these records away. If you live anywhere

near Dallas, come check us out.

I think back to August 30, 1983 – my birthday – when I went to see Mrs. B (Rose Blumkin), carrying a

1

1

⁄

4

-page purchase proposal for NFM that I had drafted. (It’s reproduced on pages 114 - 115.) Mrs. B accepted my

offer without changing a word, and we completed the deal without the involvement of investment bankers or

lawyers (an experience that can only be described as heavenly). Though the company’s financial statements were

unaudited, I had no worries. Mrs. B simply told me what was what, and her word was good enough for me.

Mrs. B was 89 at the time and worked until 103 – definitely my kind of woman. Take a look at NFM’s

financial statements from 1946 on pages 116 - 117. Everything NFM now owns comes from (a) that $72,264 of net

worth and $50 – no zeros omitted – of cash the company then possessed, and (b) the incredible talents of Mrs. B,

her son, Louie, and his sons Ron and Irv.

The punch line to this story is that Mrs. B never spent a day in school. Moreover, she emigrated from

Russia to America knowing not a word of English. But she loved her adopted country: At Mrs. B’s request, the

family always sang God Bless America at its gatherings.

Aspiring business managers should look hard at the plain, but rare, attributes that produced Mrs. B’s

incredible success. Students from 40 universities visit me every year, and I have them start the day with a visit to

NFM. If they absorb Mrs. B’s lessons, they need none from me.

Finance and Financial Products

“Clayton’s loan portfolio will likely grow to at least $5 billion in not too many years and, with sensible

credit standards in place, should deliver significant earnings.”

— 2003 Annual Report

This sector, our smallest, includes two rental companies, XTRA (trailers) and CORT (furniture), as well as

Clayton Homes, the country’s leading producer and financer of manufactured homes. Aside from these 100%-

owned subsidiaries, we also include in this category a collection of financial assets and our 50% interest in

Berkadia Commercial Mortgage.

Clayton is placed in this section because it owns and services 326,569 mortgages, totaling $13.6 billion. In

recent years, as manufactured home sales plummeted, a high percentage of Clayton’s earnings came from this

mortgage business.

In 2013, however, the sale of new homes began to pick up and earnings from both manufacturing and

retailing are again becoming significant. Clayton remains America’s number one homebuilder: Its 2013 output of

29,547 homes accounted for about 4.7% of all single-family residences built in the country. Kevin Clayton,

Clayton’s CEO, has done a magnificent job of guiding the company through the severe housing depression. Now,

his job – definitely more fun these days – includes the prospect of another earnings gain in 2014.

15