Berkshire Hathaway 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

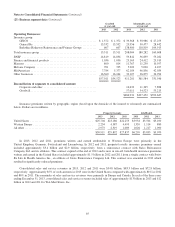

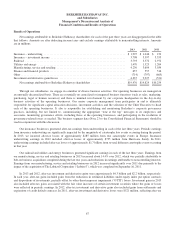

Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

Life/health (Continued)

Premiums written in 2012 increased $93 million (3.2%) and earned premiums increased $91 million (3.2%) from 2011.

Excluding the effects of foreign currency exchange rate changes, premiums written and earned in 2012 increased $239 million

(8.2%) and $236 million (8.2%), respectively, compared to 2011. The increases in premiums written and earned were primarily

attributed to increased writings in non-U.S. life business. The underwriting results for 2012 were negatively impacted by a

premium deficiency reserve that was established on the run off of the U.S. long-term care book of business as well as greater

than expected claims frequency and duration in the individual and group disability business in Australia. Underwriting results

for 2011 included losses of $15 million attributable to the earthquake in Japan, offset by lower than expected mortality in the

life business.

Berkshire Hathaway Reinsurance Group

Through BHRG, we underwrite excess-of-loss reinsurance and quota-share coverages on property and casualty risks for

insurers and reinsurers worldwide. BHRG’s business includes catastrophe excess-of-loss reinsurance and excess primary

insurance and facultative reinsurance for large or otherwise unusual property risks referred to as individual risk. BHRG also

writes retroactive reinsurance, which provides indemnification of losses and loss adjustment expenses with respect to past loss

events. Multi-line property/casualty refers to various coverages written on both a quota-share and excess basis and includes a

20% quota-share contract with Swiss Reinsurance Company Ltd. (“Swiss Re”) covering substantially all of Swiss Re’s property/

casualty risks incepting between January 1, 2008 and December 31, 2012. The Swiss Re quota-share contract is now in run-off.

BHRG’s underwriting activities also include life reinsurance and traditional annuity businesses. BHRG’s underwriting results

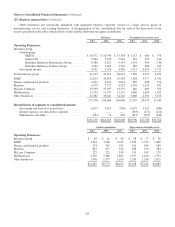

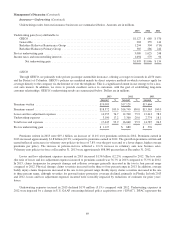

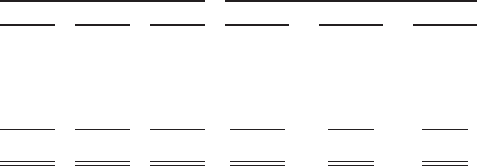

are summarized in the table below. Amounts are in millions.

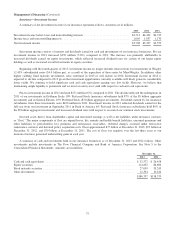

Premiums earned Pre-tax underwriting gain/loss

2013 2012 2011 2013 2012 2011

Catastrophe and individual risk ............................ $ 801 $ 816 $ 751 $ 581 $400 $(321)

Retroactive reinsurance .................................. 328 717 2,011 (321) (201) 645

Other multi-line property/casualty .......................... 4,348 5,306 4,224 655 295 (338)

Life and annuity ........................................ 3,309 2,833 2,161 379 (190) (700)

$8,786 $9,672 $9,147 $1,294 $ 304 $(714)

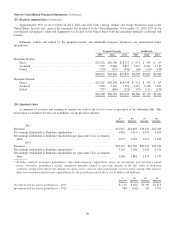

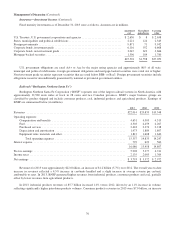

Catastrophe and individual risk premiums written were $807 million in 2013, $785 million in 2012, and $720 million in

2011. The level of business written in a given period will vary significantly depending on changes in market conditions and

management’s assessment of the adequacy of premium rates. We have constrained the volume of business written in recent

years. However, we have the capacity and desire to write substantially more business when appropriate pricing can be obtained.

Periodic underwriting results of our catastrophe and individual risk business are subject to extraordinary volatility,

depending on the timing and magnitude of significant catastrophe losses. In 2013, we incurred losses of $20 million from floods

in Europe, while in 2012 we incurred losses of $96 million in connection with Hurricane Sandy. In 2011, we incurred losses of

approximately $800 million attributable to the earthquakes in Japan ($700 million) and New Zealand ($100 million).

Retroactive reinsurance policies provide indemnification of unpaid losses and loss adjustment expenses with respect to past

loss events, and related claims are generally expected to be paid over long periods of time. Premiums and limits of

indemnification are often very large in amount. Coverages are generally subject to policy limits. Premiums earned in 2013, 2012

and 2011 were attributed to a relatively small number of contracts. Premiums earned under retroactive reinsurance contracts in

2011 included approximately $1.7 billion from a reinsurance contract with Eaglestone Reinsurance Company, a subsidiary of

American International Group, Inc. (“AIG”). Under the contract, we agreed to reinsure the bulk of AIG’s U.S. asbestos

liabilities. The agreement provides for a maximum limit of indemnification of $3.5 billion.

72