Berkshire Hathaway 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Manufacturing, Service and Retailing (Continued)

Other manufacturing (Continued)

chemical manufacturer that we acquired on September 16, 2011, IMC International Metalworking Companies (“Iscar”), an

industry leader in the metal cutting tools business with operations worldwide, Forest River, a leading manufacturer of leisure

vehicles and CTB, a manufacturer of equipment and systems for the livestock and agricultural industries.

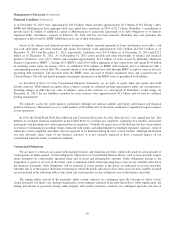

Other manufacturing revenues in 2013 increased $2.3 billion (8.7%) to $29.1 billion. Forest River generated revenues of

$3.3 billion in 2013, a 24% increase over 2012. The increase reflected a 17% volume increase and higher average sales prices,

attributable to price and product mix changes. Revenues in 2013 from our building products businesses increased 8% to about

$9.6 billion. These businesses benefitted from the generally improved residential and commercial construction markets. Apparel

revenues in 2013 increased 3.5% to about $4.3 billion. Our other businesses in this group produced revenues in 2013 of $11.9

billion in the aggregate, an increase of about 8% over 2012. Most of the increase in revenues of these other businesses was

attributable to bolt-on acquisitions during the last two years.

Pre-tax earnings of our other manufacturing businesses in 2013 were $3.6 billion, an increase of $289 million

(8.7%) versus 2012. Increased earnings were generated by Forest River (32%), building products businesses (13%) and apparel

businesses (25%) compared to 2012. Pre-tax earnings of Iscar and Lubrizol were roughly unchanged from 2012. In addition,

bolt-on acquisitions during the last two years contributed to the overall increased earnings.

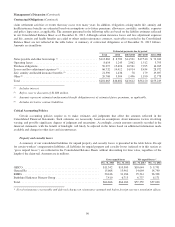

Revenues of our other manufacturing businesses in 2012 were approximately $26.8 billion, an increase of approximately

$5.6 billion (26%) over 2011. Excluding Lubrizol, revenues in 2012 grew 6% over 2011. Revenues of Forest River increased

27%, which was attributable to increased volume and average sales prices. Revenues from building products and apparel

businesses increased 4% and 5%, respectively, as compared with 2011. However, revenues of Iscar and CTB (before the impact

of bolt-on acquisitions) declined compared to 2011 as a result of weakness in demand, particularly in non-U.S. markets.

Pre-tax earnings of our other manufacturing businesses were approximately $3.3 billion in 2012, an increase of $922

million (38%) over earnings in 2011. Excluding the impact of Lubrizol, earnings of our other manufacturing businesses in 2012

increased 6% compared to 2011. The increase was primarily attributable to increased earnings from building products, apparel

and Forest River, partially offset by lower earnings from Iscar, CTB and Scott Fetzer. In 2012, our Shaw carpet and flooring

business benefited from the impact of price increases at the end of 2011 and the beginning of 2012, as well as from relatively

stable raw material costs, which resulted in higher margins. Our apparel businesses benefitted from past pricing actions and

stabilizing raw material costs. On the other hand, our other businesses that manufacture products that are primarily for

commercial and industrial customers, particularly those with significant business in overseas markets, such as CTB and Iscar,

were negatively impacted in 2012 by slowing economic conditions in certain of those markets.

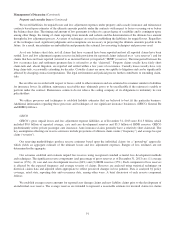

Other service

Our other service businesses include NetJets, the world’s leading provider of fractional ownership programs for general

aviation aircraft and FlightSafety, a provider of high technology training to operators of aircraft. Among the other businesses

included in this group are: TTI, a leading electronic components distributor; Business Wire, a leading distributor of corporate

news, multimedia and regulatory filings; Dairy Queen, which licenses and services a system of over 6,300 stores that offer

prepared dairy treats and food; the Buffalo News; the BH Media Group (“BH Media”), which includes the Omaha World-

Herald, as well as 29 other daily newspapers and numerous other publications; and businesses that provide management and

other services to insurance companies.

Revenues of our other service businesses in 2013 were $9.0 billion, an increase of $821 million (10%) over revenues in

2012. In 2013, revenues of NetJets increased $288 million (7.5%), driven by higher sales of fractional aircraft shares, while

TTI’s revenues increased $255 million (11%) over 2012. Revenues of BH Media increased $207 million (66%), attributable to

the impact of business acquisitions during the last two years. Pre-tax earnings of $1.1 billion in 2013 increased $130 million

83