Berkshire Hathaway 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(2) Significant business acquisitions

Our long-held acquisition strategy is to acquire businesses at sensible prices that have consistent earning power, good

returns on equity and able and honest management.

On December 19, 2013, MidAmerican acquired NV Energy, Inc. (“NV Energy”), an energy holding company serving

approximately 1.2 million electric and 0.2 million retail natural gas customers in Nevada. NV Energy’s principal operating

subsidiaries, Nevada Power Company and Sierra Pacific Power Company, are regulated utilities. Under the terms of the

acquisition agreement, MidAmerican acquired all outstanding shares of NV Energy’s common stock for approximately $5.6

billion. We accounted for the acquisition pursuant to the acquisition method. NV Energy’s financial results are included in our

Consolidated Financial Statements beginning on the acquisition date.

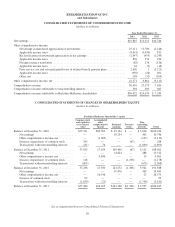

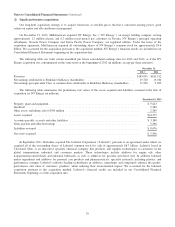

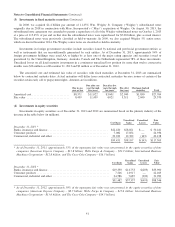

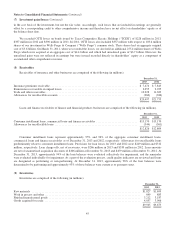

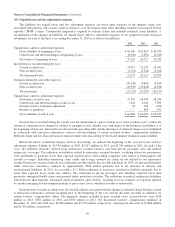

The following table sets forth certain unaudited pro forma consolidated earnings data for 2013 and 2012, as if the NV

Energy acquisition was consummated on the same terms at the beginning of 2012 (in millions, except per share amounts).

December 31,

2013 2012

Revenues ............................................................................ $185,095 $165,312

Net earnings attributable to Berkshire Hathaway shareholders .................................. 19,720 15,010

Net earnings per equivalent Class A common share attributable to Berkshire Hathaway shareholders . . . 11,998 9,090

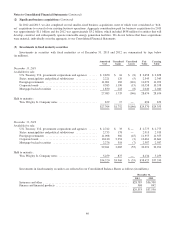

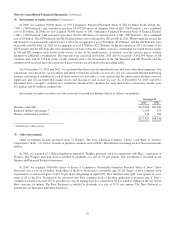

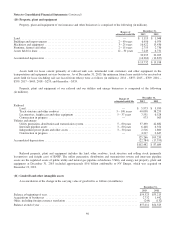

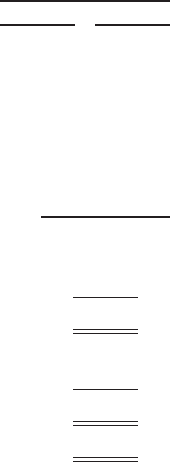

The following table summarizes the preliminary fair values of the assets acquired and liabilities assumed at the date of

acquisition for NV Energy (in millions).

December 19, 2013

Property, plant and equipment ................................................................ $ 9,623

Goodwill ................................................................................ 2,280

Other assets, including cash of $304 million .................................................... 2,369

Assets acquired ........................................................................... $14,272

Accounts payable, accruals and other liabilities .................................................. $ 3,380

Notes payable and other borrowings ........................................................... 5,296

Liabilities assumed ........................................................................ $ 8,676

Net assets acquired ........................................................................ $ 5,596

In September 2011, Berkshire acquired The Lubrizol Corporation (“Lubrizol”) pursuant to an agreement under which we

acquired all of the outstanding shares of Lubrizol common stock for cash of approximately $8.7 billion. Lubrizol, based in

Cleveland, Ohio, is an innovative specialty chemical company that produces and supplies technologies to customers in the

global transportation, industrial and consumer markets. These technologies include additives for engine oils, other

transportation-related fluids and industrial lubricants, as well as additives for gasoline and diesel fuel. In addition, Lubrizol

makes ingredients and additives for personal care products and pharmaceuticals; specialty materials, including plastics; and

performance coatings. Lubrizol’s industry-leading technologies in additives, ingredients and compounds enhance the quality,

performance and value of customers’ products, while reducing their environmental impact. We accounted for the Lubrizol

acquisition pursuant to the acquisition method. Lubrizol’s financial results are included in our Consolidated Financial

Statements beginning as of the acquisition date.

39