Berkshire Hathaway 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

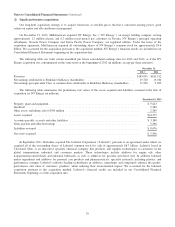

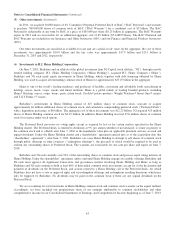

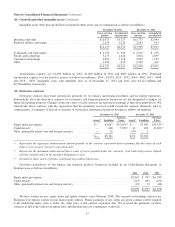

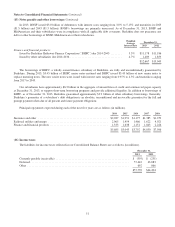

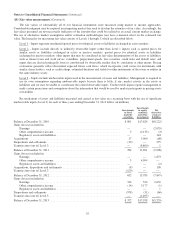

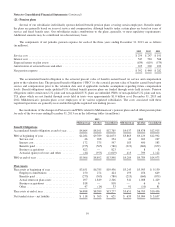

(14) Unpaid losses and loss adjustment expenses

The liabilities for unpaid losses and loss adjustment expenses are based upon estimates of the ultimate claim costs

associated with property and casualty claim occurrences as of the balance sheet dates including estimates for incurred but not

reported (“IBNR”) claims. Considerable judgment is required to evaluate claims and establish estimated claim liabilities. A

reconciliation of the changes in liabilities for unpaid losses and loss adjustment expenses of our property/casualty insurance

subsidiaries for each of the three years ending December 31, 2013 is as follows (in millions).

2013 2012 2011

Unpaid losses and loss adjustment expenses:

Gross liabilities at beginning of year .......................................... $64,160 $ 63,819 $ 60,075

Ceded losses and deferred charges at beginning of year ........................... (6,944) (7,092) (6,545)

Net balance at beginning of year ............................................. 57,216 56,727 53,530

Incurred losses recorded during the year:

Current accident year ...................................................... 23,027 22,239 23,031

Prior accident years ....................................................... (1,752) (2,126) (2,202)

Total incurred losses ...................................................... 21,275 20,113 20,829

Payments during the year with respect to:

Current accident year ...................................................... (10,154) (9,667) (9,269)

Prior accident years ....................................................... (10,978) (10,628) (8,854)

Total payments ........................................................... (21,132) (20,295) (18,123)

Unpaid losses and loss adjustment expenses:

Net balance at end of year .................................................. 57,359 56,545 56,236

Ceded losses and deferred charges at end of year ................................ 7,414 6,944 7,092

Foreign currency translation adjustment ....................................... 93 186 (100)

Business acquisitions ...................................................... — 485 591

Gross liabilities at end of year ............................................... $64,866 $ 64,160 $ 63,819

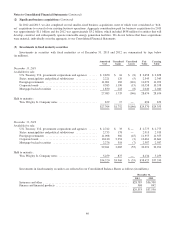

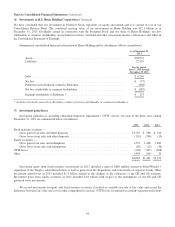

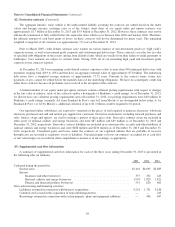

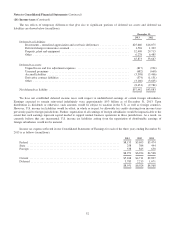

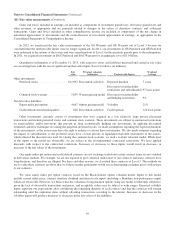

Incurred losses recorded during the current year but attributable to a prior accident year (“prior accident years”) reflect the

amount of estimation error charged or credited to earnings in each calendar year with respect to the liabilities established as of

the beginning of that year. Incurred losses shown in the preceding table include the impact of deferred charge assets established

in connection with retroactive reinsurance contracts and discounting of certain assumed workers’ compensation liabilities.

Deferred charge and loss discount balances represent time value discounting of the related ultimate estimated claim liabilities.

Before the effects of deferred charges and loss discounting, we reduced the beginning of the year net losses and loss

adjustment expenses liability by $1,938 million in 2013, $2,507 million in 2012 and $2,780 million in 2011. In each of the

years, the reduction primarily derived from reinsurance assumed business and from private passenger auto and medical

malpractice coverages. The reductions in liabilities related to reinsurance assumed business, excluding retroactive reinsurance,

were attributable to generally lower than expected reported losses from ceding companies with respect to both property and

casualty coverages. Individual underlying claim counts and average amounts per claim are not utilized by our reinsurance

assumed businesses because clients do not consistently provide reliable data in sufficient detail. In 2013, we increased liabilities

under retroactive reinsurance contracts by approximately $300 million primarily due to net increases in asbestos and

environmental liabilities. In 2011, we recorded a $1.1 billion reduction in retroactive reinsurance liabilities primarily due to

lower than expected losses under one contract. The reductions in private passenger auto liabilities reflected lower than

previously anticipated bodily injury and personal injury protection severities. The reductions in medical malpractice liabilities

reflected lower than originally anticipated claims frequencies and severities. Accident year loss estimates are regularly adjusted

to consider emerging loss development patterns of prior years’ losses, whether favorable or unfavorable.

Incurred losses for prior accident years also include charges associated with the changes in deferred charge balances related

to retroactive reinsurance contracts incepting prior to the beginning of the year and net discounts recorded on liabilities for

certain workers’ compensation claims. The aggregate charges included in prior accident years’ incurred losses were $186

million in 2013, $381 million in 2012 and $578 million in 2011. Net discounted workers’ compensation liabilities at

December 31, 2013 and 2012 were $2,066 million and $2,155 million, respectively, reflecting net discounts of $1,866 million

and $1,990 million, respectively.

49