Berkshire Hathaway 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B

ERKSHIRE

H

ATHAWAY

INC.

2013

ANNUAL REPORT

Table of contents

-

Page 1

BERKSHIRE HATHAWAY INC. 2013 ANNUAL REPORT -

Page 2

... and NV Energy; Northern Powergrid; Kern River Gas Transmission Company and Northern Natural Gas; and MidAmerican Renewables. In addition, MidAmerican owns HomeServices of America, a real estate brokerage firm. Numerous business activities are conducted through Berkshire's manufacturing services... -

Page 3

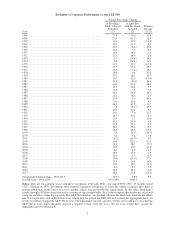

BERKSHIRE HATHAWAY INC. 2013 ANNUAL REPORT TABLE OF CONTENTS Business Activities ...Inside Front Cover Corporate Performance vs. the S&P 500 ...Chairman's Letter* ...Acquisition Criteria ...Management's Report on Internal Control Over Financial Reporting ...Selected Financial Data for the Past Five... -

Page 4

..., 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market rather than at the lower of cost or market, which was previously the requirement. In this table, Berkshire's results through 1978 have been restated to conform... -

Page 5

... of NV Energy and a major interest in H. J. Heinz. Both companies fit us well and will be prospering a century from now. With the Heinz purchase, moreover, we created a partnership template that may be used by Berkshire in future acquisitions of size. Here, we teamed up with investors at 3G Capital... -

Page 6

... large investments in renewable energy. NV Energy will not be MidAmerican's last major acquisition. Å MidAmerican is one of our "Powerhouse Five" - a collection of large non-insurance businesses that, in aggregate, had a record $10.8 billion of pre-tax earnings in 2013, up $758 million from 2012... -

Page 7

... one person at our Omaha home office. (Don't panic: The headquarters gang still fits comfortably on one floor.) Berkshire increased its ownership interest last year in each of its "Big Four" investments - American Express, Coca-Cola, IBM and Wells Fargo. We purchased additional shares of Wells Fargo... -

Page 8

... discount from intrinsic value; and (5) making an occasional large acquisition. We will also try to maximize results for you by rarely, if ever, issuing Berkshire shares. Those building blocks rest on a rock-solid foundation. A century hence, BNSF and MidAmerican Energy will still be playing major... -

Page 9

... individual policies and claims come and go, the amount of float an insurer holds usually remains fairly stable in relation to premium volume. Consequently, as our business grows, so does our float. And how we have grown, as the following table shows: Year 1970 1980 1990 2000 2010 2013 Float (in... -

Page 10

... its book value Berkshire's attractive insurance economics exist only because we have some terrific managers running disciplined operations that possess strong, hard-to-replicate business models. Let me tell you about the major units. First by float size is the Berkshire Hathaway Reinsurance Group... -

Page 11

...widely respected in the insurance world. Peter has assembled a spectacular team that is already writing a substantial amount of business with many Fortune 500 companies and with smaller operations as well. BHSI will be a major asset for Berkshire, one that will generate volume in the billions within... -

Page 12

... these companies and their managers. Underwriting Profit Yearend Float (in millions) 2013 2012 2013 2012 $1,294 283 1,127 385 $3,089 $ 304 355 680 286 $1,625 $37,231 20,013 12,566 7,430 $77,240 $34,821 20,128 11,578 6,598 $73,125 Insurance Operations BH Reinsurance ...General Re ...GEICO ...Other... -

Page 13

... their combined financial statistics in our GAAP balance sheet and income statement. A key characteristic of both companies is their huge investment in very long-lived, regulated assets, with these partially funded by large amounts of long-term debt that is not guaranteed by Berkshire. Our credit is... -

Page 14

... for any railroad. And, we will spend considerably more in 2014. Like Noah, who foresaw early on the need for dependable transportation, we know it's our job to plan ahead. Leading our two capital-intensive companies are Greg Abel, at MidAmerican, and the team of Matt Rose and Carl Ice at BNSF. The... -

Page 15

... of rebranding their franchisees as Berkshire Hathaway HomeServices. If you haven't yet, many of you will soon be seeing our name on "for sale" signs. Manufacturing, Service and Retailing Operations "See that store," Warren says, pointing at Nebraska Furniture Mart. "That's a really good business... -

Page 16

...my job of capital allocation. I was not misled: I simply was wrong in my evaluation of the economic dynamics of the company or the industry in which it operated. Fortunately, my blunders usually involved relatively small acquisitions. Our large buys have generally worked out well and, in a few cases... -

Page 17

I can't resist, however, giving you an update on Nebraska Furniture Mart's expansion into Texas. I'm not covering this event because of its economic importance to Berkshire - it takes more than a new store to move the needle on Berkshire's $225 billion equity base. But I've now worked 30 years with ... -

Page 18

...backing their plans through purchases of equipment that enlarge their rental potential. Here's the pre-tax earnings recap for this sector: 2013 Berkadia ...Clayton ...CORT ...XTRA ...Net financial income* ...$ 80 416 40 125 324 $985 * Excludes capital gains or losses Investments "Our stock portfolio... -

Page 19

... buyout of electric utility assets in Texas. The equity owners put up $8 billion and borrowed a massive amount in addition. About $2 billion of the debt was purchased by Berkshire, pursuant to a decision I made without consulting with Charlie. That was a big mistake. Unless natural gas prices soar... -

Page 20

...that purchased the parcel. Fred was an experienced, high-grade real estate investor who, with his family, would manage the property. And manage it they did. As old leases expired, earnings tripled. Annual distributions now exceed 35% of our original equity investment. Moreover, our original mortgage... -

Page 21

...earth was going to swallow up the incredible productive assets and unlimited human ingenuity existing in America When Charlie and I buy stocks - which we think of as small portions of businesses - our analysis is very similar to that which we use in buying entire businesses. We first have to decide... -

Page 22

... pension funds, institutions or individuals - who employ high-fee managers And now back to Ben Graham. I learned most of the thoughts in this investment discussion from Ben's book The Intelligent Investor, which I bought in 1949. My financial life changed with that purchase. Before reading Ben... -

Page 23

... mystery company was GEICO. If Ben had not recognized the special qualities of GEICO when it was still in its infancy, my future and Berkshire's would have been far different. The 1949 edition of the book also recommended a railroad stock that was then selling for $17 and earning about $10 per share... -

Page 24

... if you had planned to rent a car in Omaha. Spend the savings with us. At Nebraska Furniture Mart, located on a 77-acre site on 72nd Street between Dodge and Pacific, we will again be having "Berkshire Weekend" discount pricing. Last year in the week surrounding the meeting, the store did $40... -

Page 25

... it Berkshire-related and include no more than two questions in any e-mail you send them. (In your e-mail, let the journalist know if you would like your name mentioned if your question is selected.) We will also have a panel of three analysts who follow Berkshire. This year the insurance specialist... -

Page 26

... files a 23,000-page Federal income tax return as well as state and foreign returns, responds to countless shareholder and media inquiries, gets out the annual report, prepares for the country's largest annual meeting, coordinates the Board's activities - and the list goes on and on. They handle all... -

Page 27

...their cocker spaniels. A line from a country song expresses our feeling about new ventures, turnarounds, or auction-like sales: "When the phone don't ring, you'll know it's me." MANAGEMENT'S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING Management of Berkshire Hathaway Inc. is responsible for... -

Page 28

BERKSHIRE HATHAWAY INC. and Subsidiaries Selected Financial Data for the Past Five Years (dollars in millions except per-share data) 2013 2012 2011 2010 2009 Revenues: Insurance premiums earned ...$ 36,684 $ 34,545 $ 32,075 $ Sales and service revenues ...94,806 83,268 72,803 Revenues of railroad, ... -

Page 29

... ACCOUNTING FIRM To the Board of Directors and Shareholders of Berkshire Hathaway Inc. Omaha, Nebraska We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc. and subsidiaries (the "Company") as of December 31, 2013 and 2012, and the related consolidated statements... -

Page 30

... 31, 2013 2012 ASSETS Insurance and Other: Cash and cash equivalents ...Investments: Fixed maturity securities ...Equity securities ...Other ...Investments in H.J. Heinz Holding Corporation ...Receivables ...Inventories ...Property, plant and equipment ...Goodwill ...Other ...Railroad, Utilities and... -

Page 31

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (dollars in millions except per-share amounts) Year Ended December 31, 2013 2012 2011 Revenues: Insurance and Other: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income... -

Page 32

... service cost and actuarial gains/losses of defined benefit pension plans ...Applicable income taxes ...Other, net ...Other comprehensive income, net ...Comprehensive income ...Comprehensive income attributable to noncontrolling interests ...Comprehensive income attributable to Berkshire Hathaway... -

Page 33

... ...Sales and redemptions of equity securities ...Purchases of loans and finance receivables ...Collections of loans and finance receivables ...Acquisitions of businesses, net of cash acquired ...Purchases of property, plant and equipment ...Other ...Net cash flows from investing activities... -

Page 34

... FINANCIAL STATEMENTS December 31, 2013 (1) Significant accounting policies and practices (a) Nature of operations and basis of consolidation Berkshire Hathaway Inc. ("Berkshire") is a holding company owning subsidiaries engaged in a number of diverse business activities, including insurance... -

Page 35

... origination and commitment costs paid or fees received, which together with acquisition premiums or discounts, are deferred and amortized as yield adjustments over the life of the loan. Loans and finance receivables include loan securitizations issued when we have the power to direct and the right... -

Page 36

..., 2013 and 2012, respectively. (i) Property, plant and equipment Additions to property, plant and equipment are recorded at cost and consist of major additions, improvements and betterments. With respect to constructed assets, all construction related material, direct labor and contract services as... -

Page 37

... rate is applied to the gross investment in a particular class of property, despite differences in the service life or salvage value of individual property units within the same class. When our regulated utilities or railroad retires or sells a component of the assets accounted for using group... -

Page 38

... of workers' compensation claims assumed under certain reinsurance contracts are discounted based upon an annual discount rate of 4.5% for claims arising prior to January 1, 2003 and 1% for claims arising thereafter, consistent with discount rates used under insurance statutory accounting principles... -

Page 39

... of capitalized insurance policy acquisition costs generally reflects anticipation of investment income. The unamortized balances are included in other assets and were $1,601 million and $1,682 million at December 31, 2013 and 2012, respectively. (p) Regulated utilities and energy businesses... -

Page 40

... to pay on behalf of its co-obligors. ASU 2013-04 is effective for interim and annual reporting periods beginning after December 15, 2013. In January 2014, the FASB issued ASU 2014-01 "Accounting for Investments in Qualified Affordable Housing Tax Credits." ASU 2014-01 permits an entity to elect the... -

Page 41

...per equivalent Class A common share attributable to Berkshire Hathaway shareholders ...11,998 9,090 The following table summarizes the preliminary fair values of the assets acquired and liabilities assumed at the date of acquisition for NV Energy (in millions). December 19, 2013 Property, plant and... -

Page 42

... securities Investments in securities with fixed maturities as of December 31, 2013 and 2012 are summarized by type below (in millions). Amortized Cost Unrealized Gains Unrealized Losses Fair Value Carrying Value December 31, 2013 Available for sale: U.S. Treasury, U.S. government corporations and... -

Page 43

...Consolidated Financial Statements (Continued) (3) Investments in fixed maturity securities (Continued) In 2008, we acquired $4.4 billion par amount of 11.45% Wm. Wrigley Jr. Company ("Wrigley") subordinated notes originally due in 2018 in conjunction with Mars, Incorporated's ("Mars") acquisition of... -

Page 44

... to Consolidated Financial Statements (Continued) (4) Investments in equity securities (Continued) In 2008, we acquired 50,000 shares of 10% Cumulative Perpetual Preferred Stock of The Goldman Sachs Group, Inc. ("GS") ("GS Preferred") and warrants to purchase 43,478,260 shares of common stock of GS... -

Page 45

...Company ("Heinz"). Berkshire and 3G each made equity investments in Heinz Holding, which, together with debt financing obtained by Heinz Holding, was used to acquire all outstanding common stock of Heinz for approximately $23.25 billion in the aggregate. Heinz is one of the world's leading marketers... -

Page 46

... Holding Corporation (Continued) We have concluded that our investment in Preferred Stock represents an equity investment and it is carried at cost in our Consolidated Balance Sheet. The combined carrying value of our investments in Heinz Holding was $12.1 billion as of December 31, 2013. Dividends... -

Page 47

...Electric Holdings ("TCEH") of $228 million in 2013, $337 million in 2012 and $390 million in 2011. In 2011, OTTI losses also included $337 million with respect to 103.6 million shares of our investment in Wells Fargo & Company ("Wells Fargo") common stock. These shares had an aggregate original cost... -

Page 48

...interstate pipeline assets are the regulated assets of public utility and natural gas pipeline subsidiaries. Utility and energy net property, plant and equipment at December 31, 2013 included approximately $9.6 billion attributable to NV Energy, which was acquired on December 19, 2013. (11) Goodwill... -

Page 49

... 2013 2012 2011 Equity index put options ...Credit default ...Other, principally interest rate and foreign currency ... $2,843 $ 997 (213) 894 (22) 72 $2,608 $1,963 $(1,787) (251) (66) $(2,104) We have written no new equity index put option contracts since February 2008. The currently outstanding... -

Page 50

... forward purchases and sales, futures, swaps and options, are used to manage a portion of these price risks. Derivative contract assets are included in other assets of railroad, utilities and energy businesses and were $87 million and $49 million as of December 31, 2013 and December 31, 2012... -

Page 51

...related to reinsurance assumed business, excluding retroactive reinsurance, were attributable to generally lower than expected reported losses from ceding companies with respect to both property and casualty coverages. Individual underlying claim counts and average amounts per claim are not utilized... -

Page 52

... that range from 2016 to 2043 and repaid $2.6 billion of maturing senior notes. Weighted Average Interest Rate December 31, 2013 2012 Railroad, utilities and energy: Issued by MidAmerican Energy Holdings Company ("MidAmerican") and its subsidiaries: MidAmerican senior unsecured debt due 2014-2043... -

Page 53

... applicable debt covenants. Berkshire does not guarantee any debt or other borrowings of BNSF, MidAmerican or their subsidiaries. Weighted Average Interest Rate December 31, 2013 2012 Finance and financial products: Issued by Berkshire Hathaway Finance Corporation ("BHFC") due 2014-2043 ...Issued... -

Page 54

...significant portions of deferred tax assets and deferred tax liabilities are shown below (in millions). December 31, 2013 2012 Deferred tax liabilities: Investments - unrealized appreciation and cost basis differences ...Deferred charges reinsurance assumed ...Property, plant and equipment ...Other... -

Page 55

... months. We currently do not believe that the outcome of unresolved issues or claims is likely to be material to our Consolidated Financial Statements. At December 31, 2013 and 2012, net unrecognized tax benefits were $692 million and $866 million, respectively. Included in the balance at December... -

Page 56

... Investment in Heinz Holding Preferred Stock ...7,710 7,971 - Other investments ...17,951 17,951 - Loans and finance receivables ...12,826 12,002 - Derivative contract assets (1) ...87 87 3 Derivative contract liabilities: Railroad, utilities and energy (1) ...Finance and financial products: Equity... -

Page 57

... means. Pricing evaluations generally reflect discounted expected future cash flows, which incorporate yield curves for instruments with similar characteristics, such as credit ratings, estimated durations and yields for other instruments of the issuer or entities in the same industry sector. Level... -

Page 58

... Option pricing model 648 Discounted cash flow Volatility Credit spreads 9% 21% 124 basis points Other investments currently consist of investments that were acquired in a few relatively large private placement transactions and include preferred stocks and common stock warrants. These investments... -

Page 59

... the voting rights of a Class A share. Unless otherwise required under Delaware General Corporation Law, Class A and Class B common shares vote as a single class. Each share of Class A common stock is convertible, at the option of the holder, into 1,500 shares of Class B common stock. Class B common... -

Page 60

... of discount of the market price relative to management's estimate of intrinsic value. The repurchase program does not obligate Berkshire to repurchase any dollar amount or number of Class A or Class B shares and there is no expiration date to the program. There were no share purchases in 2013. In... -

Page 61

... actuarial present value of benefits earned based upon service and compensation prior to the valuation date and, if applicable, includes assumptions regarding future compensation levels. Benefit obligations under qualified U.S. defined benefit pension plans are funded through assets held in trusts... -

Page 62

... December 31, 2013 and 2012 consisted primarily of real estate and limited partnership interests. Plan assets are generally invested with the long-term objective of earning amounts sufficient to cover expected benefit obligations, while assuming a prudent level of risk. Allocations may change as... -

Page 63

... average interest rate assumptions used in determining projected benefit obligations and net periodic pension expense were as follows. 2013 2012 Applicable to pension benefit obligations: Discount rate ...Expected long-term rate of return on plan assets ...Rate of compensation increase ...Discount... -

Page 64

... Corporation ("Leucadia") having the other 50% interest. Berkadia is a servicer of commercial real estate loans in the U.S., performing primary, master and special servicing functions for U.S. government agency programs, commercial mortgagebacked securities transactions, banks, insurance companies... -

Page 65

... multiple lines of property and casualty insurance policies for primarily commercial accounts Operates one of the largest railroad systems in North America Proprietary investing, manufactured housing and related consumer financing, transportation equipment leasing and furniture leasing An... -

Page 66

...Revenues 2012 2011 Earnings before income taxes 2013 2012 2011 Operating Businesses: Insurance group: Underwriting: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Group ...Investment income ...Total insurance group ...BNSF ...Finance and financial products... -

Page 67

... year-end 2013 2012 Identifiable assets at year-end 2012 2013 2011 Operating Businesses: Insurance group: GEICO ...General Re ...Berkshire Hathaway Reinsurance and Primary Groups ...Total insurance group ...BNSF ...Finance and financial products ...Marmon ...McLane Company ...MidAmerican ...Other... -

Page 68

... Derivative gains/losses include significant amounts related to non-cash changes in the fair value of long-term contracts arising from short-term changes in equity prices, interest rates and foreign currency rates, among other factors. After-tax investment and derivative gains/losses for the periods... -

Page 69

.... 2013 2012 2011 Insurance - underwriting ...Insurance - investment income ...Railroad ...Utilities and energy ...Manufacturing, service and retailing ...Finance and financial products ...Other ...Investment and derivative gains/losses ...Net earnings attributable to Berkshire Hathaway shareholders... -

Page 70

... under our equity index put option contracts and OTTI losses of $590 million related to certain equity and fixed maturity securities, partially offset by after-tax investment gains of $1.2 billion from the redemptions of our Goldman Sachs and General Electric Preferred Stock investments. We believe... -

Page 71

... from our insurance businesses are summarized below. Amounts are in millions. 2013 2012 2011 Underwriting gain (loss) attributable to: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Group ...Pre-tax underwriting gain ...Income taxes and noncontrolling... -

Page 72

... is written in North America through General Re Life Corporation and internationally through General Reinsurance AG. General Re strives to generate underwriting profits in essentially all of its product lines. Our management does not evaluate underwriting performance based upon market share and our... -

Page 73

... events, which was partially offset by discount accretion associated with workers' compensation liabilities and deferred charge amortization. Life/health In 2013, premiums written decreased $11 million (0.4%), while premiums earned increased $11 million (0.4%) compared with 2012. Adjusting for the... -

Page 74

..., and related claims are generally expected to be paid over long periods of time. Premiums and limits of indemnification are often very large in amount. Coverages are generally subject to policy limits. Premiums earned in 2013, 2012 and 2011 were attributed to a relatively small number of contracts... -

Page 75

...for upfront consideration. Annuity premiums in 2012 were $794 million. These increases were partially offset by the reversal of premiums previously earned (approximately $1.3 billion) under the Swiss Re Life & Health America Inc. ("SRLHA") yearly renewable term life insurance contract as a result of... -

Page 76

... and general liability coverages; U.S. Investment Corporation, whose subsidiaries underwrite specialty insurance coverages; a group of companies referred to internally as "Berkshire Hathaway Homestate Companies," providers of commercial multi-line insurance, including workers' compensation; Central... -

Page 77

...2012 reflected dividends earned for the full year from our investment in September 2011 in Bank of America 6% Preferred Stock (insurance subsidiaries hold 80% of the $5 billion aggregate investment) and increased dividend rates with respect to several of our common stock investments. Invested assets... -

Page 78

...'s major business groups are classified by product shipped and include consumer products, coal, industrial products and agricultural products. Earnings of BNSF are summarized below (in millions). 2013 2012 2011 Revenues ...Operating expenses: Compensation and benefits ...Fuel ...Purchased services... -

Page 79

... In 2013, fuel expenses increased $44 million (1%) versus 2012, as the impact of higher volume was partially offset by lower average fuel prices. Purchased services expenses in 2013 increased 2% versus 2012, due primarily to volume-related costs, including purchased transportation for BNSF Logistics... -

Page 80

... of NV Energy since December 19, 2013 are included in other. Amounts are in millions. 2013 Revenues 2012 2011 2013 Earnings 2012 2011 PacifiCorp ...MidAmerican Energy Company ...Natural gas pipelines ...Northern Powergrid ...Real estate brokerage ...Other ...Earnings before corporate interest... -

Page 81

... retail volumes and increases in recoveries through adjustment clauses as a result of a higher average per-unit cost of gas sold. Nonregulated and other operating revenues in 2013 declined $67 million in comparison with 2012 due primarily to lower electricity volumes and prices. MEC's EBIT in 2013... -

Page 82

...NV Energy acquisition costs and customer refunds, more than offset the increase in earnings from the new solar and wind-powered electricity generation projects. Corporate interest includes interest on the unsecured debt issued by MidAmerican Energy Holding Company. Corporate interest expense in 2014... -

Page 83

... 2011. The increase in pre-tax earnings in 2012 reflected the growth in market share and higher margins in the Distribution Services sector, partially offset by the revenue declines in the Electrical & Plumbing Products sector. Natural Resources' revenues were $2.6 billion in 2012, an increase of 10... -

Page 84

... of the aforementioned bolt-on acquisitions, higher rail fleet utilization and lease rates and Middle East projects, as well cost savings relating to restructuring actions taken in 2011 in the Engineered Wire & Cable sector. Retail Technologies' revenues were $2.2 billion in 2012, an increase of... -

Page 85

... stores that offer prepared dairy treats and food; the Buffalo News; the BH Media Group ("BH Media"), which includes the Omaha WorldHerald, as well as 29 other daily newspapers and numerous other publications; and businesses that provide management and other services to insurance companies. Revenues... -

Page 86

... jewelry businesses (Borsheims, Helzberg and Ben Bridge), See's Candies; Pampered Chef, a direct seller of high quality kitchen tools; and Oriental Trading Company ("OTC"), a direct retailer of party supplies, school supplies and toys and novelties, which we acquired on November 27, 2012. Revenues... -

Page 87

...increased lease revenues and earnings of XTRA, which benefitted from increases in working units and average rental rates, relatively stable operating expenses and a foreign currency related gain in 2013. Pre-tax earnings of CORT and XTRA in 2012 were $148 million, a decline of $7 million (5%) versus... -

Page 88

...billion in 2012 and were primarily attributable to sales of equity securities. Investment gains in 2011 included aggregate pre-tax gains of $1.8 billion from the redemptions of our Goldman Sachs and General Electric preferred stock investments. In each of the three years ending December 31, 2013, we... -

Page 89

... credit default and equity index put option contracts. Periodic changes in the fair values of these contracts are reflected in earnings and can be significant, reflecting the volatility of underlying credit and equity markets. In 2013, our equity index put option contracts generated a pre-tax gain... -

Page 90

.... The acquisition was funded with existing cash balances. Berkshire's Board of Directors has authorized Berkshire to repurchase its Class A and Class B common shares at prices no higher than a 20% premium over the book value of the shares. Berkshire may repurchase shares at management's discretion... -

Page 91

...acquisition of goods or services in the future, such as minimum rentals under operating leases, that are not currently reflected in the financial statements. Such obligations will be reflected in future periods as the goods are delivered or services provided. Amounts due as of the balance sheet date... -

Page 92

... Balance Sheets without discounting for time value, regardless of the length of the claim-tail. Amounts are in millions. Gross unpaid losses Dec. 31, 2013 Dec. 31, 2012 Net unpaid losses * Dec. 31, 2013 Dec. 31, 2012 GEICO ...General Re ...BHRG ...Berkshire Hathaway Primary Group ...Total... -

Page 93

... as of December 31, 2013 were $11.3 billion, which included $8.0 billion of reported average, case and case development reserves and $3.3 billion of IBNR reserves. GEICO predominantly writes private passenger auto insurance. Auto insurance claims generally have a relatively short claim-tail. The key... -

Page 94

...paid within a relatively short time after being reported. Average reserve amounts are driven by the estimated average severity per claim and the number of new claims opened. Our claims adjusters generally establish individual liability claim case loss and loss adjustment expense reserve estimates as... -

Page 95

... from primary insurance. Under contracts where periodic premium and claims reports are required from ceding companies, such reports are generally required at quarterly intervals which in the U.S. range from 30 to 90 days after the end of the accounting period. Outside the U.S., reinsurance... -

Page 96

... 7,859 Workers' compensation (1) ...Mass tort-asbestos/environmental ... $ 2,830 1,539 3,769 2,288 2,462 2,780 $15,668 15,668 Auto liability ...(1,004) Other casualty (2) ...$14,664 Other general liability ...Property ...Total ... (1) (2) Net of discounts of $1,866 million. Includes directors and... -

Page 97

... a test of the adequacy of prior year-end IBNR reserves and forms the basis for possibly changing IBNR reserve assumptions during the course of the year. In 2013, our reported claims for prior years' workers' compensation losses were less than expected by $238 million. However, further analysis of... -

Page 98

... paid were $72 million in 2013. In 2013, ultimate loss estimates for asbestos and environmental claims were increased by $30 million. In addition to the previously described methodologies, we consider "survival ratios" based on average net claim payments in recent years versus net unpaid losses as... -

Page 99

... indemnified or contracts that indemnify all losses paid by the counterparty after the policy effective date. We paid retroactive reinsurance losses and loss adjustment expenses of approximately $1.3 billion in 2013. The classification "reported case reserves" has no practical analytical value with... -

Page 100

... value of equity index put option contracts using a Black-Scholes based option valuation model. Inputs to the model include the current index value, strike price, interest rate, dividend rate and contract expiration date. The weighted average interest and dividend rates used as of December 31, 2013... -

Page 101

... market trade involving identical (or sufficiently similar) risks and contract terms as our equity index put option or credit default contracts could differ significantly from the fair values used in the financial statements. We do not operate as a derivatives dealer and currently do not utilize... -

Page 102

... Value December 31, 2013 Assets: Investments in fixed maturity securities ...Other investments (1) ...Loans and finance receivables ...Liabilities: Notes payable and other borrowings: Insurance and other ...Railroad, utilities and energy ...Finance and financial products ...Equity index put option... -

Page 103

...average levels of shareholder capital to provide a margin of safety against short-term price volatility. Market prices for equity securities are subject to fluctuation and consequently the amount realized in the subsequent sale of an investment may significantly differ from the reported market value... -

Page 104

... MidAmerican uses derivative instruments, including forwards, futures, options, swaps and other agreements, to effectively secure future supply or sell future production generally at fixed prices. The settled cost of these contracts is generally recovered from customers in regulated rates. Financial... -

Page 105

... meaningless for us except to the extent they offer us an opportunity to increase our ownership at an attractive price. 2. In line with Berkshire's owner-orientation, most of our directors have a major portion of their net worth invested in the company. We eat our own cooking. Charlie's family has... -

Page 106

... of their own shares, which means that they, and we, gain from the cheaper prices at which they can buy. Overall, Berkshire and its long-term shareholders benefit from a sinking stock market much as a regular purchaser of food benefits from declining food prices. So when the market plummets - as it... -

Page 107

...public stock offerings, but stock-for-debt swaps, stock options, and convertible securities as well. We will not sell small portions of your company - and that is what the issuance of shares amounts to - on a basis inconsistent with the value of the entire enterprise. When we sold the Class B shares... -

Page 108

... the best prospect of attracting long-term investors who seek to profit from the progress of the company rather than from the investment mistakes of their partners. We regularly compare the gain in Berkshire's per-share book value to the performance of the S&P 500. Over time, we hope to outpace... -

Page 109

... regularly report our per-share book value, an easily calculable number, though one of limited use. The limitations do not arise from our holdings of marketable securities, which are carried on our books at their current prices. Rather the inadequacies of book value have to do with the companies we... -

Page 110

...100 80 2008 2009 2010 2011 2012 2013 * ** Cumulative return for the Standard and Poor's indices based on reinvestment of dividends. It would be difficult to develop a peer group of companies similar to Berkshire. The Corporation owns subsidiaries engaged in a number of diverse business activities... -

Page 111

... annual gain in pre-tax, non-insurance earnings per share is 21.0%. During the same period, Berkshire's stock price increased at a rate of 22.1% annually. Over time, you can expect our stock price to move in rough tandem with Berkshire's investments and earnings. Market price and intrinsic value... -

Page 112

... holding at least 450,000 shares of Class A common stock and 1,170,000,000 shares of Class B common stock on behalf of beneficial-but-not-of-record owners. Price Range of Common Stock Berkshire's Class A and Class B common stock are listed for trading on the New York Stock Exchange, trading symbol... -

Page 113

... Company ...Metalogic Inspection Services (2) ...MidAmerican Energy (2) ...MidAmerican Energy Holdings (2) ...MidAmerican Renewables (2) ...MiTek Inc...Nebraska Furniture Mart ...NetJets ...Northern Natural Gas (2) ...Northern Powergrid Holdings (2) ...NV Energy (2) ...Oriental Trading ...PacifiCorp... -

Page 114

... New England Properties Berkshire Hathaway HomeServices Northwest Real Estate Alabama Alabama Arizona California California Connecticut Florida Georgia Georgia Illinois Illinois Iowa Iowa Kentucky Kentucky Maryland Minnesota Missouri Missouri Missouri Nebraska Nebraska Nebraska North Carolina North... -

Page 115

BERKSHIRE HATHAWAY INC. DAILY NEWSPAPERS Publication City Daily Circulation Sunday Alabama Enterprise Ledger Opelika Auburn News Dothan Eagle Florida Jackson County Floridan Iowa The Daily Nonpareil Nebraska York News-Times The North Platte Telegraph Kearney Hub Star-Herald The Grand Island ... -

Page 116

114 -

Page 117

115 -

Page 118

116 -

Page 119

117 -

Page 120

118 -

Page 121

119 -

Page 122

120 -

Page 123

121 -

Page 124

122 -

Page 125

123 -

Page 126

124 -

Page 127

125 -

Page 128

126 -

Page 129

127 -

Page 130

128 -

Page 131

129 -

Page 132

130 -

Page 133

131 -

Page 134

132 -

Page 135

133 -

Page 136

134 -

Page 137

135 -

Page 138

136 -

Page 139

..., Chairman of Allen and Company Incorporated, an investment banking firm. THOMAS S. MURPHY, Former Chairman of the Board and CEO of Capital Cities/ABC RONALD L. OLSON, Partner of the law firm of Munger, Tolles & Olson LLP WALTER SCOTT, JR., Chairman of Level 3 Communications, a successor to certain... -

Page 140

BERKSHIRE HATHAWAY INC. Executive Offices - 3555 Farnam Street, Omaha, Nebraska 68131