Aflac 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of statutory capital and surplus as of the previous year-end.

Dividends declared by Aac during 2010 in excess of $1.4

billion would require such approval. Dividends declared by

Aac during 2009 were $464 million.

A portion of Aac Japan earnings, as determined on a

Japanese regulatory accounting basis, can be repatriated

each year to Aac U.S. after complying with solvency margin

provisions and satisfying various conditions imposed by

Japanese regulatory authorities for protecting policyholders.

Prot repatriations to the United States can uctuate due to

changes in the amounts of Japanese regulatory earnings.

Among other items, factors affecting regulatory earnings

include Japanese regulatory accounting practices and

uctuations in currency translation of Aac Japan’s dollar-

denominated investments and related investment income

into yen. Prots repatriated by Aac Japan to Aac U.S.

were as follows for the years ended December 31:

In Dollars In Yen

(In millions of dollars and billions of yen) 2009 2008 2007 2009 2008 2007

Profit repatriation $ 230 $ 598 $ 567 ¥ 20.0 ¥ 64.1 ¥ 67.8

12. BENEFIT PLANS

Our basic employee dened-benet pension plans cover

substantially all of our full-time employees in the United

States and Japan.

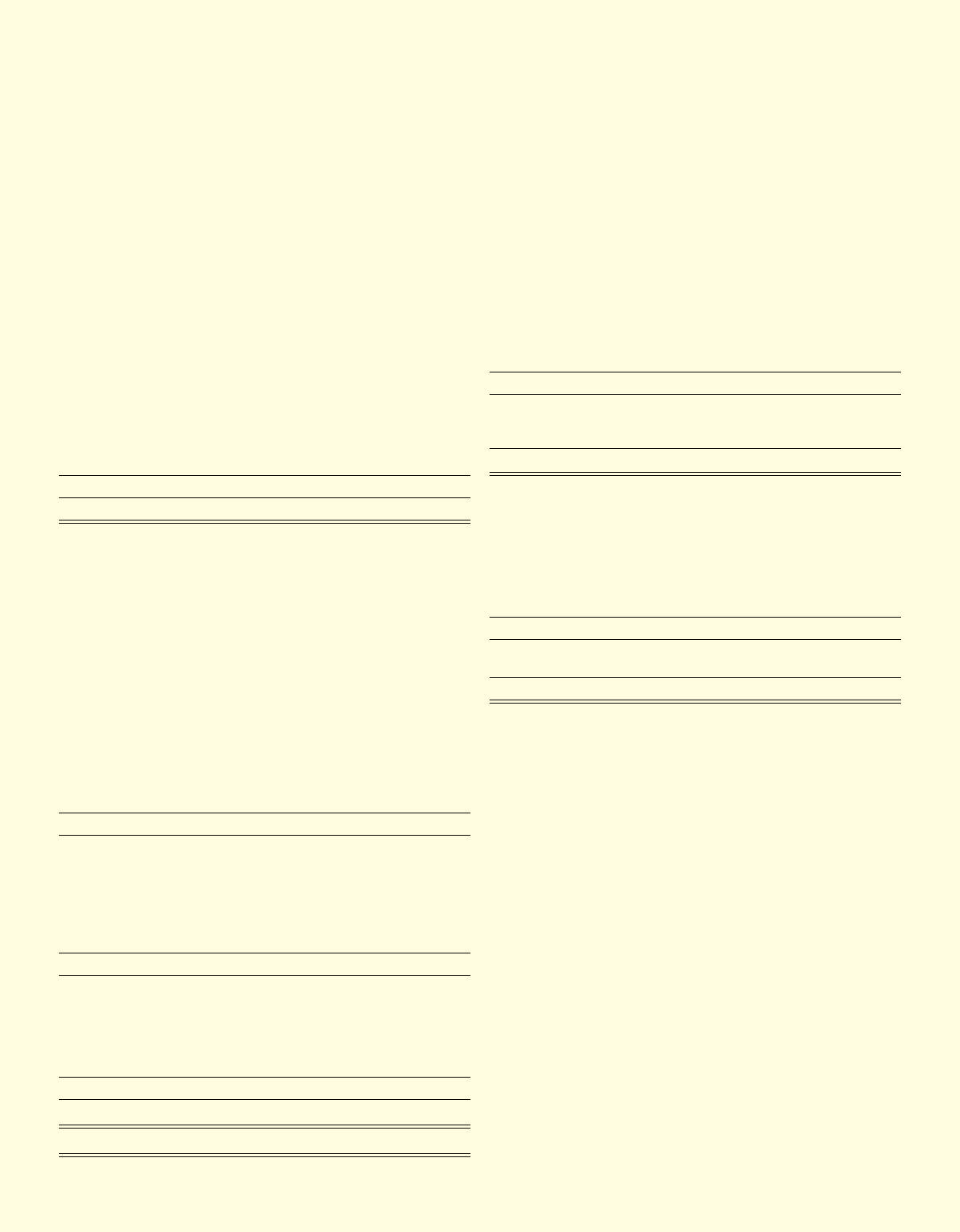

Reconciliations of the funded status of the basic employee

dened-benet pension plans with amounts recognized in

the consolidated balance sheets as of December 31 were

as follows:

2009 2008

(In millions) Japan U.S. Japan U.S.

Projected benefit obligation:

Benefit obligation, beginning of year $ 169 $ 201 $ 125 $ 186

Service cost 13 10 11 10

Interest cost 4 12 3 11

Actuarial loss (gain) – 16 (1) (2)

Benefits paid (3) (4) (2) (4)

Effect of foreign exchange rate changes (2) – 33 –

Benefit obligation, end of year 181 235 169 201

Plan assets:

Fair value of plan assets, beginning of year 94 128 79 150

Actual return on plan assets 8 35 (16) (48)

Employer contribution 17 10 14 30

Benefits paid (4) (4) (2) (4)

Effect of foreign exchange rate changes (1) – 19 –

Fair value of plan assets, end of year 114 169 94 128

Funded status $ (67) $ (66) $ (75) $ (73)

Accumulated benefit obligation $ 156 $ 181 $ 146 $ 151

At December 31, 2009, other liabilities included a liability

for both plans in the amount of $133 million, compared

with $148 million a year ago. In December 2008, we pre-

funded $10 million to the U.S. plan that we had originally

planned to contribute in 2009. We accelerated the timing of

this contribution to improve the funded status of the plan in

light of the effect that market volatility had on plan asset fair

values. We plan to make contributions of $18 million to the

Japanese plan and $20 million to the U.S. plan in 2010.

The following table summarizes the amounts included in

accumulated other comprehensive income as of

December 31.

2009 2008 2007

(In millions) Japan U.S. Japan U.S. Japan U.S.

Net actuarial loss $ 56 $ 92 $ 64 $ 102 $ 36 $ 47

Prior service cost (credit) (5) 1 (5) 1 (4) 1

Transition obligation 2 – 2 – 2 –

Total $ 53 $ 93 $ 61 $ 103 $ 34 $ 48

The following table summarizes the amounts recognized

in other comprehensive loss (income) for the years ended

December 31.

2009 2008 2007

(In millions) Japan U.S. Japan U.S. Japan U.S.

Net actuarial loss (gain) $ (5) $ (6) $ 17 $ 57 $ 2 $ (11)

Amortization of net actuarial loss (3) (4) (2) (2) (1) (4)

Total $ (8) $ (10) $ 15 $ 55 $ 1 $ (15)

No prior service costs or credits or transition obligations

arose during 2009, and the amounts of prior service costs

and credits and transition obligations amortized to expense

were immaterial for the years ended December 31, 2009,

2008 and 2007. Amortization of actuarial losses to expense

in 2010 is estimated to be $2 million for the Japanese plan

and $5 million for the U.S. plan, while the amortization of

prior service costs and credits and transition obligation are

expected to be negligible.

The components of retirement expense and actuarial

assumptions for the Japanese and U.S. pension plans for

the years ended December 31 appear in the table at the top

of the following page.

We’ve got you under our wing.

86