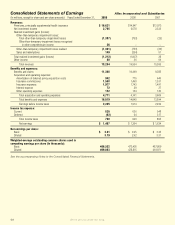

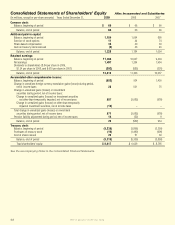

Aflac 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The following table presents a distribution of unrealized

losses on debt and perpetual securities by magnitude as of

December 31, 2009.

The following table presents the 10 largest unrealized loss

positions in our portfolio as of December 31, 2009.

Declines in fair value noted above resulted from changes in

interest rates and credit spreads, yen/dollar exchange rates,

and issuer credit status. However, we believe it would be

inappropriate to recognize impairment charges because we

believe the changes in fair value are temporary. See Note 3

of the Notes to the Consolidated Financial Statements for

discussion about the investments in the preceding table.

Investment Valuation and Cash

We estimate the fair values of our securities available for

sale on a monthly basis. We monitor the estimated fair

values obtained from our custodian and pricing brokers and

those derived from our discounted cash ow pricing model

for consistency from month to month, while considering

current market conditions. We also periodically discuss with

our custodian and pricing brokers the pricing techniques

they use to monitor the consistency of their approach and

periodically assess the appropriateness of the valuation level

assigned to the values obtained from them. See Note 4 of

the Notes to the Consolidated Financial Statements for the

fair value hierarchy classication of our securities available

for sale as of December 31, 2009.

Cash, cash equivalents and short-term investments totaled

$2.3 billion, or 3.2% of total investments and cash, as of

December 31, 2009, compared with $.9 billion, or 1.4%,

at December 31, 2008. For a discussion of the factors

causing the change in our cash balance, see the Operating

Activities, Investing Activities and Financing Activities

sections of this MD&A.

For additional information concerning our investments, see

Notes 3 and 4 of the Notes to the Consolidated Financial

Statements.

Deferred Policy Acquisition Costs

The following table presents deferred policy acquisition

costs by segment for the years ended December 31.

The increase in Aac Japan’s deferred policy acquisition

costs was primarily driven by total new annualized premium

sales. See Note 5 of the Notes to the Consolidated Financial

Statements for additional information on our deferred policy

acquisition costs.

Policy Liabilities

The following table presents policy liabilities by segment for

the years ending December 31.

Percentage Decline From Amortized Cost

Total Total Less than 20% 20% to 50% Greater than 50%

Amortized Unrealized Amortized Unrealized Amortized Unrealized Amortized Unrealized

(In millions) Cost Loss Cost Loss Cost Loss Cost Loss

Available-for-sale securities:

Investment-grade securities $ 20,160 $ 2,035 $ 17,289 $ 1,191 $ 2,871 $ 844 $ – $ –

Below-investment-grade securities 3,539 1,029 1,366 138 1,571 560 602 331

Held-to-maturity securities:

Investment-grade securities 16,466 1,393 15,517 1,040 623 173 326 180

Below-investment-grade securities 200 98 – – 200 98 – –

Total $ 40,365 $ 4,555 $ 34,172 $ 2,369 $ 5,265 $ 1,675 $ 928 $ 511

Credit Amortized Fair Unrealized

(In millions) Rating Cost Value Loss

Investcorp SA BB $ 452 $ 223 $ 229

SLM Corp. BBB 356 165 191

Banco Espirito Santo A 326 192 134

CSAV (Tollo Shipping Co. S.A.) B 261 135 126

UPM-Kymmene BB 337 224 113

Aiful Corporation CCC 175 74 101

Morgan Stanley Aces 2008-6* BB 200 102 98

Hella KG Hueck & Co. BB 238 148 90

UniCredit SpA

(includes HVB & Bank Austria) A 553 463 90

The Sultanate of Oman A 380 293 87

*Collateralized debt obligation

(In millions)

2009

2008 % Change

Aflac Japan $ 5,846 $ 5,644 3.6%*

Aflac U.S. 2,687 2,593 3.6

Total $ 8,533 $ 8,237 3.6%

*Aflac Japan’s deferred policy acquisition costs increased 4.8% in yen during the year ended December 31, 2009.

(In millions)

2009

2008 % Change

Aflac Japan $ 62,055 $ 59,466 4.4%

Aflac U.S. 7,187 6,750 6.5

Other 3 3 –

Total $ 69,245 $ 66,219 4.6%

*Aflac Japan’s policy liabilities increased 5.6% in yen during the year ended December 31, 2009.

We’ve got you under our wing.

44