Aflac 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

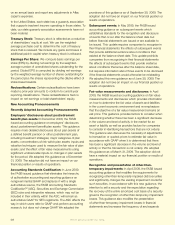

on an annual basis and report any adjustments in Aac

Japan’s expenses.

In the United States, each state has a guaranty association

that supports insolvent insurers operating in those states. To

date, our state guaranty association assessments have not

been material.

Treasury Stock: Treasury stock is reected as a reduction

of shareholders’ equity at cost. We use the weighted-

average purchase cost to determine the cost of treasury

stock that is reissued. We include any gains and losses in

additional paid-in capital when treasury stock is reissued.

Earnings Per Share: We compute basic earnings per

share (EPS) by dividing net earnings by the weighted-

average number of unrestricted shares outstanding for the

period. Diluted EPS is computed by dividing net earnings

by the weighted-average number of shares outstanding for

the period plus the shares representing the dilutive effect of

share-based awards.

Reclassications: Certain reclassications have been

made to prior-year amounts to conform to current-year

reporting classications. These reclassications had no

impact on net earnings or total shareholders’ equity.

New Accounting Pronouncements

Recently Adopted Accounting Pronouncements

Employers’ disclosures about postretirement

benet plan assets: In December 2008, the FASB

issued accounting guidance on employers’ disclosures

about postretirement benet plan assets. This guidance

requires more detailed disclosures about plan assets of

a dened benet pension or other postretirement plan,

including investment strategies; major categories of plan

assets; concentrations of risk within plan assets; inputs and

valuation techniques used to measure the fair value of plan

assets; and the effect of fair value measurements using

signicant unobservable inputs on changes in plan assets

for the period. We adopted this guidance as of December

31, 2009. The adoption did not have an impact on our

nancial position or results of operations.

Accounting Standards Codication: In June 2009,

the FASB issued guidance that eliminates the hierarchy

of authoritative accounting and reporting guidance on

nongovernmental GAAP and replaces it with a single

authoritative source, the FASB Accounting Standards

CodicationTM (ASC). Securities and Exchange Commission

(SEC) rules and interpretive releases, which may not be

included in their entirety within the ASC, will remain as

authoritative GAAP for SEC registrants. The ASC affects the

way in which users refer to GAAP and perform accounting

research, but does not change GAAP. We adopted the

provisions of this guidance as of September 30, 2009. The

adoption did not have an impact on our nancial position or

results of operations.

Subsequent events: In May 2009, the FASB issued

accounting guidance on subsequent events which

establishes standards for the recognition and disclosure

of events that occur after the balance sheet date but

before nancial statements are issued or are available to

be issued. This update requires companies to recognize in

their nancial statements the effects of subsequent events

that provide additional evidence about conditions that

existed at the balance sheet date. This update prohibits

companies from recognizing in their nancial statements

the effects of subsequent events that provide evidence

about conditions that arose after the balance sheet date,

but requires information about those events to be disclosed

if the nancial statements would otherwise be misleading.

We adopted this new guidance as of June 30, 2009. The

adoption did not have an impact on our nancial position or

results of operations.

Fair value measurements and disclosures: In April

2009, the FASB issued accounting guidance on fair value

measurements and disclosures which provides information

on how to determine the fair value of assets and liabilities

in the current economic environment and re-emphasizes

that the objective of a fair value measurement remains an

exit price. This guidance provides factors to consider when

determining whether there has been a signicant decrease

in the volume and level of activity in the market for an

asset or liability as well as provides factors for companies

to consider in identifying transactions that are not orderly.

This guidance also discusses the necessity of adjustments

to transaction or quoted prices to estimate fair value in

accordance with GAAP when it is determined that there

has been a signicant decrease in the volume and level of

activity or that the transaction is not orderly. We adopted

this guidance as of March 31, 2009. The adoption did not

have a material impact on our nancial position or results of

operations.

Recognition and presentation of other-than-

temporary impairments: In April 2009, the FASB issued

accounting guidance that modies the requirements for

recognizing other-than-temporarily impaired debt securities

and signicantly changes the existing impairment model for

such securities. In accordance with this new guidance, the

intention to sell a security and the expectation regarding

the recovery of the entire amortized cost basis of a security

governs the recognition of other-than-temporary impairment

losses. This guidance also modies the presentation

of other-than-temporary impairment losses in nancial

statements and increases the frequency of and expands

We’ve got you under our wing.

58