Aflac 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

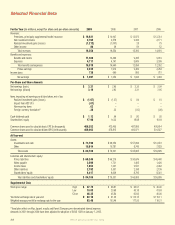

Total Policies Annualized Total New Licensed

and Certificates Premiums Annualized Sales

In Force* In Force** Premiums** Associates

2009 11,688 $4,956 $1,453 75,315

2008 11,437 4,789 1,551 74,390

2007 11,116 4,510 1,558 71,258

2006 10,519 4,101 1,423 68,394

2005 9,884 3,711 1,259 63,008

2004 9,341 3,374 1,186 58,992

2003 8,805 3,043 1,128 57,493

2002 8,077 2,674 1,070 53,149

2001 7,031 2,238 919 43,188

2000 6,119 1,861 712 37,509

*In thousands **In millions

Aflac U.S.

Sales Results

Reflecting a challenging

economy, Aflac U.S. total

new annualized premium

sales declined 6.4% in

2009, although annualized

premiums in force increased

3.5% for the year.

Aflac U.S.: Strong Wings

Navigate Financial Storm

We entered 2009 facing continued

deterioration in the U.S. economy,

and as a result, we expected the sales

environment to be challenging. Clearly, the

deep recession in 2009 impacted product

demand for most business sectors.

Aac’s U.S. business was not immune.

Total new annualized premium sales

for Aac U.S. were $1.5 billion in 2009,

or 6.4% lower than in 2008. However,

despite the decline in sales, we continued

to produce both top- and bottom-line

growth. Some highlights for 2009 follow:

• Premium income increased 4.0%

to $4.4 billion, up from $4.3 billion

in 2008.

• Total revenues were up 3.5% to

$5.0 billion, increasing from $4.8

billion in 2008.

• Pretax operating earnings rose 4.1%

to $776 million, compared with $745

million in 2008.

Aflac Products: Proactive Coverage

in a Reactive Environment

We knew it was important to maintain

our focus on the fundamental aspects of

our business model in 2009. While we

understood why demand for our products

was lower in this recessionary period, we

remained convinced that the need for our

products is just as strong, if not stronger,

during an economic downturn. That’s

because the nancial stress that often

accompanies a major health event

is magnied when nances are tight.

Understanding the economic situation

that consumers faced, we adapted two

of our most popular products to create

Essentials Accident coverage, which we

launched in April 2009, and Essentials

Maximum Difference

®

cancer coverage,

which was introduced in August 2009.

These basic policies respond to household

budget constraints by providing a basic

level of coverage for their respective lines

of business.

As we look ahead to product offerings

in 2010, we will be introducing

a revised life insurance portfolio

that will allow consumers various

customizable life insurance options to

t individual budgets. As always, we

are also continually working on other

product initiatives designed to reach

consumers and offer protection to take

them under Aac’s strong wing.

Aflac’s Sales Force:

Turning Challenges

Into Opportunities

The weaker U.S. labor market

presented an opportunity to enhance

our recruiting efforts as fewer salaried

positions became available. To that

end, we recruited more than 28,400

new sales associates in 2009, an

increase of 10.6% over 2008. At

year-end 2009, Aac U.S. was

represented by more than 75,300

licensed sales associates, a 1.2%

increase over 2008.

Aflac Annual Report for 2009 17