Aflac 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Municipalities and Mortgage- and Asset-Backed

Securities

At December 31, 2009, 74% of securities in the

municipalities sector and 39% of securities in the mortgage-

and asset-backed securities sector in an unrealized loss

position were investment grade, compared with 53% and

100%, respectively, at the end of 2008. We have determined

that the majority of the unrealized losses on the investments

in these sectors were caused by widening credit spreads.

However, we have determined that the ability of the issuers

to service our investments has not been compromised.

Unrealized gains or losses related to prevailing interest

rate environments are impacted by the remaining time

to maturity of an investment. Assuming no credit-related

factors develop, as investments near maturity the unrealized

gains or losses can be expected to diminish.

Collateralized Debt Obligation (CDO) Investments

As of December 31, 2009, 12% of our CDO investments

in an unrealized loss position was investment grade,

compared with 100% at the end of 2008. We have

determined that these unrealized losses were primarily

the result of widening credit spreads. The widening credit

spreads in the CDO sector have been fueled by continued

deterioration of the creditworthiness of the CDS reference

credit entities underlying the CDO contracts and an

overall contraction of market liquidity (demand) for CDO

investments in all capital markets. As more fully described

in our discussion regarding our investment in variable

interest entities below, we only invested in the senior

tranches of CDO structures. The subordinated tranches

of our CDOs absorb the majority of the risk of loss, if any,

arising from the CDS contracts underlying our CDOs. As a

part of our credit analysis process, we obtain CDS default

and default recovery probability statistics from published

market sources. We use these default and default recovery

statistics to project the number of defaults our CDOs can

withstand before our CDO investment would be impaired.

In addition to our review of default and default recovery

statistics, we also assess the credit quality of the collateral

underlying our CDOs.

Based on these reviews, we determined that the declines in

value of certain of our CDO investments below their carrying

value were considered to be other than temporary and

wrote down our investment in these CDOs to their estimated

fair value through a charge to earnings in the rst and third

quarters of 2009.

Our credit analyses of the CDO issues we own indicate that

the remaining number of defaults that can be sustained

in our CDOs, other than those disclosed in the preceding

paragraph, is sufcient to withstand any expected credit

deterioration without impairing the value of our investments.

In addition, the credit quality of the collateral underlying

these CDOs remains investment grade.

Bank and Financial Institution Investments

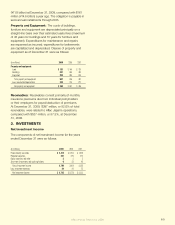

The following table shows the composition of our

investments in an unrealized loss position in the bank and

nancial institution sector by xed-maturity securities and

perpetual securities. The table reects those securities in

that sector that were in an unrealized loss position as a

percentage of our total investment portfolio in an unrealized

loss position and their respective unrealized losses as a

percentage of total unrealized losses at December 31.

2009 2008

Percentage of Percentage of Percentage of Percentage of

Total Investments in Total Total Investments in Total

an Unrealized Loss Unrealized an Unrealized Loss Unrealized

Position Losses Position Losses

Fixed maturities 33% 44% 41% 40%

Perpetual securities:

Upper Tier II 5 5 9 8

Tier I 4 10 6 12

Total perpetual securities 9 15 15 20

Total 42% 59% 56% 60%

The valuation and pricing pressures from certain structured

investment securities throughout 2008 and in the rst half

of 2009, more notably the bank and nancial institution

sector’s exposure to the well-publicized structured

investment vehicles (SIVs), coupled with their exposure to

the continued weakness in the housing sector in the UK,

Europe and the United States, led to signicant write-downs

of asset values and capital pressure. In the second half of

2009, the valuation of credit securities improved. To reduce

capital pressure, banks and other nancial institutions have

sought to enhance their capital positions through exchanges

and tender offers. In addition, national governments in

these regions have provided support in various forms,

ranging from guarantees on new and existing debt to

signicant injections of capital. Should capital markets

deteriorate, more of these banks and nancial institutions

may need various forms of government support. While it

does not appear to be a preferred solution, some troubled

banks and nancial institutions may be nationalized. Few

nationalizations have occurred to date, and the governments

have generally stood behind the classes of investments that

we own.

As of December 31, 2009, 75% of our investments in the

bank and nancial institution sector in an unrealized loss

position was investment grade, compared with 96% at

We’ve got you under our wing.

70