Aflac 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORWARD-LOOKING INFORMATION

The Private Securities Litigation Reform Act of 1995

provides a “safe harbor” to encourage companies to provide

prospective information, so long as those informational

statements are identied as forward-looking and are

accompanied by meaningful cautionary statements

identifying important factors that could cause actual results

to differ materially from those included in the forward-

looking statements. We desire to take advantage of these

provisions. This report contains cautionary statements

identifying important factors that could cause actual

results to differ materially from those projected herein,

and in any other statements made by Company ofcials

in communications with the nancial community and

contained in documents led with the Securities and

Exchange Commission (SEC). Forward-looking statements

are not based on historical information and relate to

future operations, strategies, nancial results or other

developments. Furthermore, forward-looking information is

subject to numerous assumptions, risks and uncertainties.

In particular, statements containing words such as “expect,”

“anticipate,” “believe,” “goal,” “objective,” “may,” “should,”

“estimate,” “intends,” “projects,” “will,” “assumes,” “potential,”

“target” or similar words as well as specic projections of

future results, generally qualify as forward-looking. Aac

undertakes no obligation to update such forward-looking

statements.

We caution readers that the following factors, in addition

to other factors mentioned from time to time, could cause

actual results to differ materially from those contemplated by

the forward-looking statements:

• difcult conditions in global capital markets and the

economy

• governmental actions for the purpose of stabilizing the

nancial markets

• defaults and downgrades in certain securities in our

investment portfolio

• impairment of nancial institutions

• credit and other risks associated with Aac’s investment

in perpetual securities

• differing judgments applied to investment valuations

• subjective determinations of amount of impairments

taken on our investments

• limited availability of acceptable yen-denominated

investments

• concentration of our investments in any particular sector

• concentration of business in Japan

• ongoing changes in our industry

• exposure to signicant nancial and capital markets risk

• uctuations in foreign currency exchange rates

• signicant changes in investment yield rates

• deviations in actual experience from pricing and reserving

assumptions

• subsidiaries’ ability to pay dividends to the Parent

Company

• changes in law or regulation by governmental authorities

• ability to attract and retain qualied sales associates and

employees

• decreases in our nancial strength or debt ratings

• ability to continue to develop and implement

improvements in information technology systems

• changes in U.S. and/or Japanese accounting standards

• failure to comply with restrictions on patient privacy and

information security

• level and outcome of litigation

• ability to effectively manage key executive succession

• catastrophic events

• failure of internal controls or corporate governance

policies and procedures

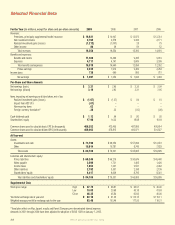

MD&A OVERVIEW

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (MD&A) is intended

to inform the reader about matters affecting the nancial

condition and results of operations of Aac Incorporated and

its subsidiaries for the three-year period ended December

31, 2009. As a result, the following discussion should be

read in conjunction with the related consolidated nancial

statements and notes. This MD&A is divided into the

following sections:

• Our Business

• 2009 Performance Highlights

• Critical Accounting Estimates

• Results of Operations, consolidated and by segment

• Analysis of Financial Condition, including discussion of

market risks of nancial instruments

• Capital Resources and Liquidity, including discussion of

availability of capital and the sources and uses of cash

OUR BUSINESS

Aac Incorporated (the Parent Company) and its subsidiaries

(collectively, the Company) primarily sell supplemental

health and life insurance in the United States and Japan.

The Company’s insurance business is marketed and

administered through American Family Life Assurance

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

We’ve got you under our wing.

24