Aflac 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

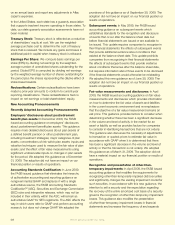

of a VIE; eliminates the exemption for the consolidation

of QSPEs; establishes conditions for reporting a transfer

of a portion of a nancial asset as a sale; modies the

nancial asset derecognition criteria; and requires additional

disclosures. This accounting guidance is effective for

scal years beginning after November 15, 2009, and early

application is prohibited.

As a result of implementing this new accounting guidance

on January 1, 2010, we will be required to consolidate

certain of the former QSPEs and VIEs with which we are

currently involved. We do not believe there are any VIEs that

we will be required to deconsolidate on January 1, 2010.

As of December 31, 2009, we had benecial interests in

QSPEs with a total amortized cost of $4.4 billion, which

we will begin consolidating effective January 1, 2010. Our

benecial interests in the former QSPEs are structured as

debt investments, which we have classied as available

for sale. We are the only benecial interest holder in the

QSPEs and our risk of loss over the life of these investments

is limited to the amount of our original investment. These

investments are primarily structured as reverse dual-

currency investments whereby the principal payments are

denominated in yen and the periodic coupon payments

are denominated in dollars. The underlying assets of

each QSPE includes a debt or hybrid instrument and a

derivative transaction (swap) that swaps all or a portion of

the cash ows from the debt/hybrid instrument into yen, the

functional currency of Aac Japan. The QSPE operates in

accordance with a set of governing documents and all of

the critical activities are entirely predened.

We also have interests in VIEs with a total amortized cost

of $3.0 billion, of which $496 million we will be required to

consolidate as a result of this new accounting guidance.

Many of these VIEs that we will begin consolidating are

structured as collateralized debt obligations (CDOs) that

combine highly rated underlying assets as collateral with a

credit default swap (CDS) linked to a portfolio of reference

assets. These structures produce an investment security

that consists of multiple asset tranches with varying levels of

subordination within the VIE. We currently own only senior

CDO tranches within these VIEs. The underlying collateral

assets and funding of these VIEs are generally static in

nature, and these VIEs are limited to holding the underlying

collateral and CDS contracts and utilizing the cash ows

from the collateral and CDS contracts.

Upon the initial consolidation of the VIEs and QSPEs on

January 1, 2010, the assets, liabilities, and noncontrolling

interests of the VIEs and QSPEs will be recorded at their

carrying values, which is the amounts at which the assets,

liabilities, and noncontrolling interests would have been

carried in the consolidated nancial statements when we

rst met the conditions to be the primary beneciary. For

any of the former QSPEs and VIEs that are required to

be consolidated, we also considered whether any of the

derivatives in these structures qualify on January 1, 2010, as

a cash ow hedge of the changes in cash ows attributable

to foreign currency and/or interest rate risk. Certain of the

swaps may not qualify for hedge accounting since the swap

has a fair value on January 1, 2010. Other swaps may not

qualify for hedge accounting since they increase, rather than

reduce, cash ow risk.

The estimated impact of consolidating these VIEs and

former QSPEs as of January 1, 2010, includes three

components. The rst component is the valuation

differences associated with the underlying securities

and derivatives included in the former QSPE structures.

Prior to the consolidation of these QSPEs, we utilized a

pricing model to value our benecial interests and did not

separately consider the fair value of the individual assets

included within the structure. The cumulative impact of

these valuation adjustments will be recorded in other

comprehensive income or retained earnings depending

on whether the valuation adjustment is associated with

the underlying debt securities and whether the derivative

qualies as a cash ow hedge.

Another portion of the impact of consolidation is related to

the currency translation adjustments that were previously

recognized for our benecial interests in the VIEs and

QSPEs that were yen-denominated. Since some of the

underlying assets in the VIEs and QSPEs are dollar-

denominated, the previously recognized currency translation

adjustment will be reversed and any amortization/accretion

of discount/premium recognized as a cumulative impact

through retained earnings.

The nal portion relates to the fair value of CDSs included

in the CDOs that had been designated as held to maturity.

Under U.S. GAAP, these credit default swaps will be

recorded at fair value as a cumulative effect adjustment

through retained earnings. The CDSs are not eligible for

hedge accounting.

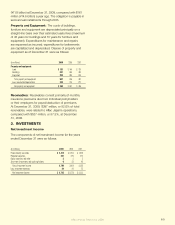

The following table summarizes the estimated after-tax

consolidation impact:

(In millions) Total Shareholders’ Equity

Cumulative valuation adjustments $ 157*

Currency translation adjustments (295)

Credit default swaps (73)

Total $ (211)

* Includes $54 in realized gains which represents the effective portion of derivatives that qualify for and are designated

as cash flow hedges on January 1, 2010

We’ve got you under our wing.

60