Aflac 2009 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

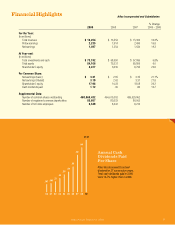

00 01 02 03 04 05 06 07 08 09

79.3

37.2 37.9

45.1

51.0

59.3 56.4

59.8

65.8

Japan U.S.

$84.1

Total Assets

(In billions)

Total assets surpassed

$84 billion in 2009 despite

a weaker yen/dollar

exchange rate at the

end of the year.

appropriate for the current economy.

We continued to recruit and train new

sales associates to expand our reach

in the market. We also enhanced our

product portfolio and distribution

through a strategic acquisition.

After spending a signicant amount of

time on market research, we acquired

Continental American Insurance

Company based in Columbia, South

Carolina, in 2009. We were specically

looking for the capability to expand

our product line to offer voluntary

insurance products on a group basis

that would complement the individually

underwritten products we’ve traditionally

offered. With Continental American, now

branded as Aac Group Insurance, we

have found the right t. We believe we

can leverage this new platform of group

products in the insurance broker market,

as well as with our existing sales force

to better penetrate the large payroll

account market.

I remain as excited as ever about the

future of Aac. I am also convinced

that the United States is a tremendous

and underpenetrated market for our

products, with literally tens of millions

of consumers who can benet from our

affordable insurance protection. Like

last year, we will remain cautious on

the outlook for new sales in the United

States until we see some stability

in the economy. But we continue to

believe we are well positioned within

our segment of the U.S. insurance

market to take advantage of the many

opportunities we see when economic

pressures subside.

Aac: Standing Strong,

Not Standing Still

In the brightest and bleakest of

economic times throughout our 55

years of operation, our focus on offering

relevant products through an extensive

sales force network has remained

constant. What has changed – and

actually strengthened over time – is

our resolve to leverage our competitive

strengths, while delivering on our

promise to help protect policyholders’

nancial health when they need

us most. I believe it’s that resolute

approach and discipline that creates

value for you, our shareholders.

As we think about 2010 and beyond,

we realize we will likely face a landscape

of challenges. But we continue to

believe that Aac will stand strong. And

I can promise you, we won’t stand still.

We are moved by the determination of

hundreds of thousands of dedicated

sales agents and employees, and

motivated by the one and only

Aac Duck to continue to spread

our message to new and existing

customers. This team has helped

secure a place under the Aac Duck’s

wing for 50 million people worldwide

who rely on us when they need help.

Some simply enjoy the peace of mind

knowing they have the protection Aac

can offer. Whatever the reason, with the

help of the Aac Duck, our wings offer

plenty of protection, and a special spot

for you and everyone with whom we

do business.

Daniel P. Amos

Chairman and

Chief Executive Ofcer

Aflac Annual Report for 2009 5