Aflac 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Investments in Qualied Special

Purpose Entities and Variable

Interest Entities

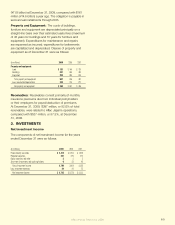

2009 2008

Amortized Fair Amortized Fair

(In millions) Cost Value Cost Value

QSPEs:

Total QSPEs $ 4,405* $ 4,089 $ 4,458* $ 4,372

VIEs:

Consolidated:

Total VIEs consolidated $ 1,809 $ 1,522 $ 1,842 $ 1,392

Not consolidated:

CDOs 498 464 908 433

Other 727 689 517 499

Total VIEs not consolidated 1,225 1,153 1,425 932

Total VIEs $ 3,034** $ 2,675 $ 3,267** $ 2,324

* Total QSPEs represent 6.1% of total debt and perpetual securities in 2009 and 6.4% in 2008.

** Total VIEs represent 4.2% of total debt and perpetual securities in 2009 and 4.7% in 2008.

QSPEs

We have no equity interests in any of the QSPEs in which

we invest, nor do we have control over these entities.

Therefore, our loss exposure is limited to the cost of our

investment. See Note 1 for a discussion of changes in

accounting for our QSPEs under the provisions of amended

FASB guidance, effective for us on January 1, 2010.

VIEs

Under accounting guidance in effect on December 31,

2009, we evaluate our involvement with VIEs at inception

to determine our benecial interests in the VIE and,

accordingly, our beneciary status. As a condition to our

involvement or investment in a VIE, we enter into certain

protective rights and covenants that preclude changes in the

structure of the VIE that would alter the creditworthiness of

our investment or our benecial interest in the VIE. We would

re-evaluate our beneciary status should a reconsideration

event occur. According to GAAP, reconsideration events

include changes to a VIE’s design or structure, contractual

arrangements, and/or its equity at risk. Due to the static

nature of these VIEs and our protective rights entered into

as a condition of investing in the VIEs, there are few, if any,

scenarios that would constitute a reconsideration event in

our VIEs. To date, we have not had any reconsideration

events in any of our VIEs. If we determine that we own less

than 50% of the variable interest created by a VIE, we are

not considered to be a primary beneciary of the VIE and

therefore are not required to consolidate the VIE.

Our involvement with all of the VIEs in which we have an

interest is passive in nature, and we are not the arranger of

these entities. Except as relates to our review and evaluation

of the structure of these VIEs in the normal course of our

investment decision-making process, we have not been

involved in establishing these entities. We have not been

nor are we required to purchase the securities issued in the

future by any of these VIEs.

Our ownership interest in the VIEs is limited to holding the

obligations issued by them. All of the VIEs in which we invest

are static with respect to funding and have no ongoing

forms of funding after the initial funding date. We have no

direct or contingent obligations to fund the limited activities

of these VIEs, nor do we have any direct or indirect nancial

guarantees related to the limited activities of these VIEs.

We have not provided any assistance or any other type of

nancing support to any of the VIEs we invest in, nor do

we have any intention to do so in the future. The weighted-

average lives of our notes are very similar to the underlying

collateral held by these VIEs where applicable.

Our risk of loss related to our interests in any of our VIEs

is limited to our investment in the debt securities issued

by them.

VIEs – Consolidated

We are substantively the only investor in the consolidated

VIEs listed in the table above. As the sole investor in these

VIEs, we absorb or participate in greater than 50%, if not

all, of the variability created by these VIEs and are therefore

considered to be the primary beneciary of the VIEs that

we consolidate. The activities of these VIEs are limited to

holding debt securities and utilizing the cash ows from the

debt securities to service our investments therein. The terms

of the debt securities held by these VIEs mirror the terms of

the notes held by Aac. Our loss exposure to these VIEs is

limited to the cost of our investment.

VIEs – Not Consolidated

We also have interests in VIEs that we are not required to

consolidate as reected in the above table. Included in the

VIEs that we do not consolidate are CDOs issued through

VIEs originated by third parties. These VIEs combine highly

rated underlying assets as collateral for the CDOs with

CDSs to produce an investment security that consists of

multiple asset tranches with varying levels of subordination

within the VIE.

The underlying collateral assets and funding of these VIEs

are generally static in nature. These VIEs are limited to

holding the underlying collateral and CDS contracts on

specic corporate entities and utilizing the cash ows from

the collateral and CDS contracts to service our investment

therein. The underlying collateral and the reference

corporate entities covered by the CDS contracts are all

investment grade at the time of issuance. These VIEs do not

rely on outside or ongoing sources of funding to support

We’ve got you under our wing.

72