Aflac 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Message from

Management

Daniel P. Amos

Chairman and CEO

Aac: Spreading Our Wings to Protect

50 Million People and Counting

A year ago, we were happy to see 2008

come to its tumultuous close, although it

became quickly apparent that signicant

challenges around the globe would

follow. Sure enough, 2009 presented the

world with the greatest economic hurdle

this generation has ever experienced.

For the insurance industry in general,

and Aac specically, balance sheet

strength and capital adequacy quickly

emerged as a primary focus. While

the investment community scrutinized

investment portfolios, we were doing

the same. We spent countless hours

analyzing our investments to determine if

they continued to be appropriate for our

portfolio. We also continually assessed

the capital levels of our insurance

operations to ensure that we had

adequate capital resources to fulll all

our obligations and retain the condence

of our policyholders and shareholders.

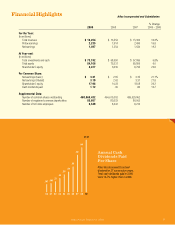

2009 Financial Results – Resilience,

Strength, and Growth

In the end, we concluded that our

investment approach was indeed the

most prudent course for our business.

We also had condence in our

company’s expected capital generation.

In addition, we made a $500 million

capital contribution from the parent

company to our principal insurance

subsidiary. As a result, our regulatory

capital levels remained strong. At the

end of 2009, our risk-based capital ratio

was a strong 479%, which exceeded

our internal target of 375% for the year.

Our risk-based capital ratio increased

from year-end 2008, despite realized

investment losses and increased capital

requirements resulting from credit rating

downgrades in our portfolio. As a result

of the steady growth of our insurance

operations and the capital contribution,

our regulatory capital level was 25.1%

higher at year-end 2009, compared

with year-end 2008. I believe our

strong capital base demonstrates the

resilience of our business model, which

is ultimately a reection of the need for

our products.

Our capital position enabled us to

maintain dividend payments at a time

when many companies have either cut

or eliminated their dividends. In fact,

Aac’s cash dividend payments in 2009

were 16.7% higher than in 2008. We

are very proud that we have increased

cash dividends for 27 consecutive years,

and we would certainly like to extend

that track record. However, we believe

it is most prudent for us to continue to

closely monitor global nancial markets

and our capital strength before we

commit to further increasing the dividend

in 2010 or to deploy capital for other

purposes, such as share repurchase.

Despite an intense focus on the

balance sheet, we never lost sight

of growing our business. Combined,

we generated more than $2.8 billion

of new annualized premium in the

United States and Japan in 2009. Total

revenues rose 10.3% to $18.3 billion,

reecting solid growth in premium

income and net investment income,

as well as the benet of the stronger

yen/dollar exchange rate for the

year. Importantly, we again achieved

the primary nancial objective we

use internally to assess the growth

of our business. We measure our

performance using the growth of net

earnings per diluted share, excluding

items that are inherently uncontrollable

We’ve got you under our wing.

2