Aflac 2009 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Message From Management 2

2009 presented every industry across the globe with the

most formidable economic challenge this generation has ever

experienced. Balance sheet strength and capital adequacy

quickly emerged as a primary focus for investors. Aac’s ability to

generate capital through operations allowed us to maintain strong

capital levels on a regulatory basis. Despite the economic turmoil,

Aac generated combined sales of more than $2.8 billion of total

new annualized premium in the United States and Japan.

A Conversation With Dan Amos 6

Chairman and CEO Dan Amos shares his thoughts on Aac’s

nancial strength, corporate citizenship, the economy, and future

opportunities for Aac.

Aflac Japan 8

Aac Japan continued its status as the number one insurance

company in terms of individual policies in force and surpassed

an important milestone: 20 million individual policies in force.

In addition to favorable nancial performance, we successfully

introduced new products and reached consumers through

advertising that created a marketing phenomenon and advanced

opportunities for sales through the recently opened bank channel.

Move over, Wright brothers! More than 100 years after this

well-known and daring brotherly duo made history with

their rst ight, a different set of wings is making history and

changing lives. But this time, the wings belong to the rather

boisterous, ercely protective, and quite loyal Aac Duck,

whose outstretched wings signify what Aac means when

we say, “We’ve Got You Under Our Wing.” These wings

provide protection, just as we promise. We protect our

policyholders from the nancial storm that’s created when

a medical health event strikes and bills pile up. We

empower our customers to concentrate on getting better

while we focus on quickly paying cash benets.

Aac is different from major medical insurance; it’s

insurance for daily living. Major medical pays doctors and

hospitals. In contrast, Aac pays cash benets directly

to policyholders to help with daily expenditures and the

many out-of-pocket expenses resulting from a serious

illness or injury – like a mortgage, car payment, groceries,

utilities, and child care. The benets are predetermined

based on medical events, and are paid regardless of any

other insurance. Aac claims are easy to le and they’re

processed quickly – usually within four days. Through a

broad range of products, we offer an affordable extra layer

of nancial protection to help provide security at a time

when families need it most. We mean what we say, and

we say what we mean. “We’ve Got You Under Our Wing.”

We’ve Got You Under Our Wing®

Table of Contents

Aflac U.S. 16

Despite a tough economic environment, Aac U.S. forged ahead

with a strong product line and a growing sales force. Aac U.S.

also leveraged a major competitive strength – its brand – to

connect with consumers and better convey how Aac can help

protect their nancial futures.

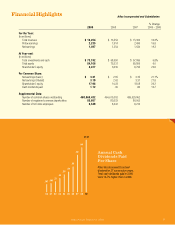

Selected Financial Data 22

This section includes summary statements of earnings and

balance sheets, stock price ranges, and exchange rates for the

past 11 years.

Management’s Discussion and Analysis 24

This section provides an analysis of Aac’s overall nancial

condition, and reviews the company’s nancial and operational

performance in Japan and the United States.

Consolidated Financial Statements 50

This section contains the consolidated nancial statements of

Aac Incorporated and its subsidiaries.

Notes to the Consolidated Financial Statements 54

This section provides additional information about the

company’s consolidated nancial statements and accounting

policies.

Board of Directors and Management 92

Biographical information about the company’s leaders

As of February 26, 2010, Aac was rated AA- by Standard

& Poor’s, Aa2 (Excellent) by Moody’s, A+ (Superior) by A.M.

Best for nancial strength, and AA- by R&I for insurance

claims-paying ability. For 55 years, Aac products have

given policyholders cash benets for daily living so they can

focus on recovery instead of the nancial stress brought

about by a serious health event. Aac is the number one

provider of guaranteed-renewable insurance in the United

States and the number one insurance company in terms

of individual insurance policies in force in Japan, protecting

more than 50 million people worldwide. Aac has been

recognized by Ethisphere magazine as one of the World’s

Most Ethical Companies for three consecutive years and

has also been named by the Reputation Institute as the

Most Reputable Company in the Global Insurance Industry

for two consecutive years. In 2010 Fortune magazine

named Aac one of the 100 Best Companies to Work For

in America for the twelfth consecutive year. In 2009 Fortune

magazine also ranked Aac number one on its global list

of the Most Admired Companies in the Life and Health

Insurance category. Aac was also named by Forbes

magazine as America’s Best-Managed Company in the

Insurance category. Aac Incorporated is a Fortune 500

company listed on the New York Stock Exchange under

the symbol AFL.