Aflac 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unpaid policy claims include those claims that have been

incurred and are in the process of payment as well as an

estimate of those claims that have been incurred but have

not yet been reported to us. We compute unpaid policy

claims on a non-discounted basis using statistical analyses

of historical claims payments, adjusted for current trends

and changed conditions. We update the assumptions

underlying the estimate of unpaid policy claims regularly and

incorporate our historical experience as well as other data

that provides information regarding our outstanding liability.

Our insurance products provide xed-benet amounts per

occurrence that are not subject to medical-cost ination.

Furthermore, our business is widely dispersed in both the

United States and Japan. This geographic dispersion and

the nature of our benet structure mitigate the risk of a

signicant unexpected increase in claims payments due

to epidemics and events of a catastrophic nature. Claims

incurred under Aac’s policies are generally reported and

paid in a relatively short time frame. The unpaid claims

liability is sensitive to morbidity assumptions, in particular,

severity and frequency of claims. Severity is the ultimate

size of a claim, and frequency is the number of claims

incurred. Our claims experience is primarily related to the

demographics of our policyholders.

As a part of our established nancial reporting and

accounting practices and controls, we perform actuarial

reviews of our policyholder liabilities on an ongoing basis

and reect the results of those reviews in our results of

operations and nancial condition as required by GAAP.

In computing the estimate of unpaid policy claims, we

consider many factors, including the benets and amounts

available under the policy; the volume and demographics

of the policies exposed to claims; and internal business

practices, such as incurred date assignment and current

claim administrative practices. We monitor these conditions

closely and make adjustments to the liability as actual

experience emerges. Claim levels are generally stable from

period to period; however, uctuations in claim levels may

occur. In calculating the unpaid policy claim liability, we

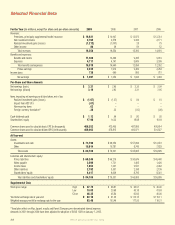

do not calculate a range of estimates. The table at the top

of the page shows the expected sensitivity of the unpaid

policy claims liability as of December 31, 2009, to changes

in severity and frequency of claims. For the years 2007

through 2009, our assumptions changed on average by

approximately 1% in total, and we believe that a variation

in assumptions in a range of plus or minus 1% in total is

reasonably likely to occur.

The table below reects the growth of future policy benets

liability for the years ended December 31.

The growth of the future policy benets liability in dollars

has been primarily due to the aging of our in-force block of

business and the addition of new business in Japan. This

growth in dollars was offset in 2009 by the weakening of the

yen against the U.S. dollar, however it was enhanced by the

strengthening of the yen against the U.S. dollar in 2008 and

20 07.

Income Taxes

Income tax provisions are generally based on pretax

earnings reported for nancial statement purposes, which

differ from those amounts used in preparing our income

tax returns. Deferred income taxes are recognized for

temporary differences between the nancial reporting

basis and income tax basis of assets and liabilities, based

on enacted tax laws and statutory tax rates applicable to

the periods in which we expect the temporary differences

to reverse. The evaluation of a tax position in accordance

with GAAP is a two-step process. Under the rst step, the

enterprise determines whether it is more likely than not that

a tax position will be sustained upon examination by taxing

Sensitivity of Unpaid Policy

Claims Liability

(In millions) Total Severity

Decrease Decrease Increase Increase

Total Frequency by 2% by 1% Unchanged by 1% by 2%

Increase by 2% $ – $ 22 $ 44 $ 66 $ 88

Increase by 1% (21) – 22 44 66

Unchanged (43) (22) – 22 44

Decrease by 1% (64) (43) (22) – 22

Decrease by 2% (85) (64) (43) (21) –

Future Policy Benets

(In millions of dollars and billions of yen) 2009 2008

2007

Aflac U.S. $ 5,779 $ 5,442 $ 4,958

Growth rate 6.2% 9.8% 12.9%

Aflac Japan $ 55,720 $ 53,866 $ 40,715

Growth rate 3.4% 32.3% 11.7%

Consolidated $ 61,501 $ 59,310 $ 45,675

Growth rate 3.7% 29.9% 11.8%

Yen/dollar exchange rate (end of period) 92.10 91.03 114.15

Aflac Japan ¥ 5,132 ¥ 4,903 ¥ 4,648

Growth rate 4.7% 5.5% 7.1%

Aflac Annual Report for 2009 27