Aflac 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

When we combine honesty with caring service,

Strong Aflac Brand + Fun

Advertising = Marketing

Phenomenon

One ip through Japanese television

channels or a walk down a metropolitan

Japanese city street is all it takes to

conrm that product advertising for all

industries is everywhere and perhaps,

overwhelming. To cut through the

advertising clutter, Aac Japan leveraged

its brand with a new twist on the popular

Aac Duck that consumers have ocked

to over the last six years. To support the

promotion of our newly revised EVER

product in 2009, the Aac Duck donned

a cat costume in its latest commercials

to become a unique new character – a

maneki neko duck. The literal translation

of maneki neko is “beckoning cat.” With

its paw raised to beckon good luck, it is a

familiar icon throughout Asia.

To complement the commercials and

enhance the reception by consumers,

we created a truck with the maneki neko

duck character on board that traveled

from city to city throughout Japan. At

one location in central Tokyo, more than

20,000 people showed up to see and

touch the beckoning cat duck, hoping it

would bring them good luck. Events like

that have occurred across Japan, and

the jingle in the television commercial

has become the number one cell phone

download in Japan. On Aac Japan’s

Web site, fans can even customize the

commercial jingle to send an original

song to their friends and family. And from

August through the end of the year more

than 390,000 consumers have created

their own maneki neko jingle. From the

introduction of the maneki neko duck

in August through the end of 2009,

Aac Japan distributed more than 1.5

million miniature stuffed maneki neko

toy ducks. The success of the maneki

neko duck campaign has surpassed our

expectations and has become nothing

short of an advertising phenomenon.

More important, it drew great attention

to our new EVER product, resulting in

strong medical policy sales for the last ve

months of 2009.

Technology Enhances

Administrative Efficiency

Technology has long been the essence

of what is perhaps Aac Japan’s most

signicant competitive strength –

administrative efciency. Our maintenance

expenses per policy in force remain lower

than every other life insurance company

operating in Japan, allowing us to give

consumers quality products at affordable

prices while compensating our sales

force with competitive commissions.

Throughout the years, we have

undertaken many initiatives to improve

our efciency, including the development

and promotion of Aac Japan’s electronic

enrollment software and our net billing

system. We will continue to prioritize and

rene our efforts to operate efciently

and put our resources into making

affordable products. We believe that

the Aac Contact Center plays a critical

role in establishing and maintaining

strong relationships with our customers,

agencies and banks. We believe it is

important to operate efciently while

providing high-quality service.

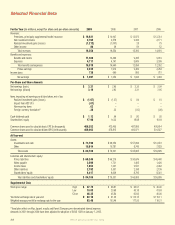

Disciplined Investment

Process Yields Consistent

Results

Insurance company investment portfolios

were the subject of intense investor

scrutiny in 2009, and Aac’s portfolio

was no exception. However, throughout

the year, we remained focused on an

investment approach that we believed

was most prudent for our policyholders

and shareholders – purchasing

investment assets that best match

the liabilities of our insurance policies.

We continue to believe that approach

is the best course, and our insurance

product needs will continue to drive the

investment process. At the same time,

we will continue to emphasize liquidity,

safety, and quality when purchasing

investments to help mitigate risk. Some

Aac Japan investment highlights for

2009 follow:

• Investments and cash increased

4.0% to $64.2 billion at the end of

2009. In yen, investments and cash

were up 5.2%.

• Net investment income increased

10.3% to $2.3 billion. In yen, net

investment income was down .1%.

• The average yield on new

investments was 3.03% in 2009,

compared with 3.43% in 2008.

Despite global credit downgrades from

rating agencies, Aac Japan’s overall

credit quality remained high. At the end of

2009, 93.4% of Aac Japan’s debt and

perpetual securities were rated investment

grade on an amortized cost basis.

We’ve got you under our wing.

14