Aflac 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

investments in perpetual securities that are rated below

investment grade are evaluated for other-than-temporary

impairment using our equity impairment model. Our equity

impairment model focuses on the severity of a security’s

decline in fair value coupled with the length of time the fair

value of the security has been below amortized cost.

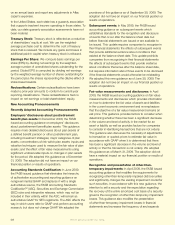

The following table details our pretax impairment losses by

investment category for the years ended December 31.

(In millions) 2009 2008 2007

Perpetual securities $ 729 $ 379 $ –

Corporate bonds 458 160 20

Collateralized debt obligations 148 213 –

Collateralized mortgage obligations 24 – 2

Equity securities 2 1 1

Total other-than-temporary impairments $ 1,361 $ 753 $ 23

As more fully discussed in the SEC Guidance section of

Note 1, we apply the debt security impairment model to our

perpetual securities provided there has been no evidence of

deterioration in credit of the issuer, such as a downgrade of

the rating of a perpetual security to below investment grade.

During 2009, the perpetual securities of seven issuers we

own were downgraded to below investment grade. As a

result of these downgrades, we were required to evaluate

these securities for other-than-temporary impairment using

the equity security impairment model rather than the debt

security impairment model. Use of the equity impairment

model limits the forecasted recovery period that can

be used in the impairment evaluation and, accordingly,

affects both the recognition and measurement of other-

than-temporary impairment losses. As a result of market

conditions and the extent of changes in ratings on our

perpetual securities, we recognized other-than-temporary

impairment losses for perpetual securities being evaluated

under our equity impairment model of $729 million ($474

million after-tax) during 2009.

During our review of certain CMOs, we determined that

a portion of the other-than-temporary impairment of the

securities was credit-related. However, we concluded

a portion of the reduction in fair value below amortized

cost was due to non-credit factors, which we believe we

will recover. As a result, we recognized an impairment

charge in earnings for credit-related declines in value of

$24 million ($15 million after-tax) during 2009. We recorded

an unrealized loss in other comprehensive income of $26

million ($17 million after-tax) during 2009 for the portion of

the other-than-temporary impairment of these securities

resulting from non-credit factors. We recorded an unrealized

gain of $1 million in other comprehensive income for some

of these CMOs to reect the change in fair value subsequent

to their other-than-temporary impairment recognized earlier

in the year.

The other-than-temporary impairment losses recognized

during 2009, of which a portion was transferred to other

comprehensive income, related only to the other-than-

temporary impairment of certain of our investments in

CMOs. The other-than-temporary impairment charges

related to credit and all other factors other than credit were

determined using statistical modeling techniques. The model

projects expected cash ows from the underlying mortgage

pools assuming various economic recession scenarios

including, more signicantly, geographical and regional

home data, housing valuations, prepayment speeds,

and economic recession statistics. The following table

summarizes credit-related impairment losses on securities

for which other-than-temporary losses were recognized

during 2009 and only the amount related to credit loss was

recognized in earnings.

(In millions) 2009

Balance of credit loss impairments, beginning of period $ –

Credit losses for which an other-than-temporary impairment

was not previously recognized 24

Credit losses for which an other-than-temporary impairment

was previously recognized –

Balance of credit loss impairments, end of period $ 24

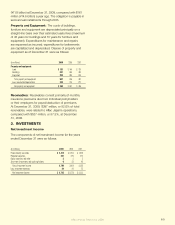

Unrealized Investment Gains and Losses

Information regarding changes in unrealized gains and

losses from investments for the years ended December 31

follows:

(In millions) 2009 2008 2007

Changes in unrealized gains (losses):

Debt securities:

Available for sale $ 170 $ (2,134) $ (838)

Transferred to held to maturity (31) (165) (35)

Perpetual securities:

Available for sale 736 (850) –

Equity securities (1) (3) (3)

Total change in unrealized gains (losses) $ 874 $ (3,152) $ (876)

Effect on Shareholders’ Equity

The net effect on shareholders’ equity of unrealized gains

and losses from investment securities at December 31

appears in the table at the top of the following page.

We’ve got you under our wing.

68