Aflac 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2008. We have determined that the majority

of the unrealized losses on the investments in this sector

were caused by widening credit spreads, the downturn in

the global economic environment and, to a lesser extent,

changes in foreign exchange rates. Unrealized gains or

losses related to prevailing interest rate environments are

impacted by the remaining time to maturity of an investment.

Assuming no credit-related factors develop, as investments

near maturity, the unrealized gains or losses can be

expected to diminish. Based on our credit analysis, we

believe that our investments in this sector have the ability to

service their obligations to us.

Other Corporate Investments

As of December 31, 2009, 58% of the securities in the

other corporate sector in an unrealized loss position was

investment grade, compared with 70% at the end of 2008.

For any credit-related declines in market value, we perform

a more focused review of the related issuer’s credit ratings,

nancial statements and other available nancial data,

timeliness of payment, competitive environment and any

other signicant data related to the issuer. From those

reviews, we evaluate the issuers’ continued ability to service

our investments. We have determined that the majority

of the unrealized losses on the investments in the other

corporate sector were caused by widening credit spreads.

Also impacting the unrealized losses in this sector is the

decline in creditworthiness of certain issuers in the other

corporate sector. Based on our credit analysis, we believe

that our investments in this sector have the ability to service

their obligation to us.

Perpetual Securities

At December 31, 2009, 92% of our total investments in

perpetual securities in an unrealized loss position was

investment grade, compared with 96% at December

31, 2008. The decrease in investment-grade securities

was related to downgrades of investments we own. The

majority of our investments in Upper Tier II and Tier I

perpetual securities were in highly-rated global nancial

institutions. Upper Tier II securities have more debt-like

characteristics than Tier I securities and are senior to Tier

I securities, preferred stock, and common equity of the

issuer. Conversely, Tier I securities have more equity-like

characteristics, but are senior to the common equity of the

issuer. They may also be senior to certain preferred shares,

depending on the individual security, the issuer’s capital

structure and the regulatory jurisdiction of the issuer.

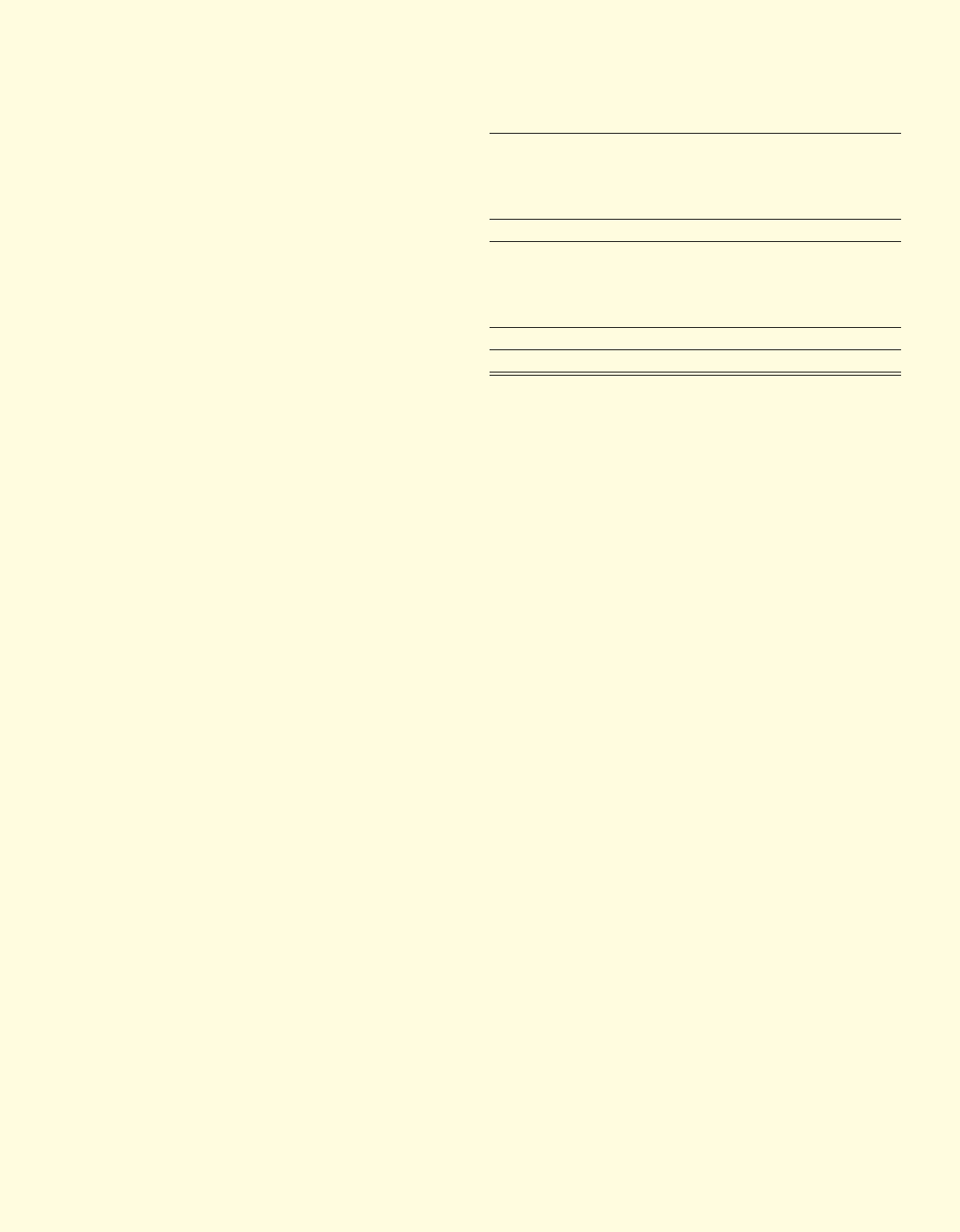

Details of our holdings of perpetual securities as of

December 31, 2009, appear in the table at the top of the

next column.

Perpetual Securities

Credit Amortized Fair Unrealized

(In millions) Rating Cost Value Gain (Loss)

Upper Tier II:

AA $ 1,074 $ 1,121 $ 47

A 2,514 2,552 38

BBB 774 780 6

BB 838 803 (35)

Total Upper Tier II 5,200 5,256 56

Tier I:

AA 329 255 (74)

A 1,308 1,027 (281)

BBB 275 208 (67)

BB or lower 442 517 75

Total Tier I 2,354 2,007 (347)

Total $ 7,554 $ 7,263 $ (291)

With the exception of the Icelandic bank securities that

we completely impaired in 2008 and our Tier I Lloyds

Banking Group plc dollar-denominated Tier I perpetual

securities (par value of $33 million at December 31, 2009),

all of the perpetual securities we own were current on

interest and principal payments at December 31, 2009.

Based on amortized cost as of December 31, 2009, the

geographic breakdown of our perpetual securities by issuer

was as follows: European countries, excluding the United

Kingdom (68%); the United Kingdom (14%); Japan (14%);

and Australia (4%). To determine any credit-related declines

in market value, we perform a more focused review of the

related issuer’s credit ratings, nancial statements and other

available nancial data, timeliness of payment, competitive

environment and any other signicant data related to

the issuer. From those reviews, we evaluate the issuer’s

continued ability to service our investment.

We have determined that the majority of our unrealized

losses in the perpetual security category was principally

due to widening credit spreads, largely as the result of the

contraction of liquidity in the capital markets. Based on our

reviews, we concluded that the ability of the issuers to service

our investment has not been compromised by these factors.

Unrealized gains or losses related to prevailing interest rate

environments are impacted by the remaining time to maturity

of an investment. Assuming no credit-related factors develop,

as the investments near economic maturity, the unrealized

gains or losses can be expected to diminish. Based on our

credit analyses, we believe that our investments in this sector

have the ability to service their obligations to us.

Qualied Special Purpose Entities (QSPEs) and

Variable Interest Entities (VIEs)

As part of our investment activities, we own investments in

QSPEs and VIEs. The table at the top of the following page

details our investments in these vehicles as of December 31.

Aflac Annual Report for 2009 71