Aflac 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

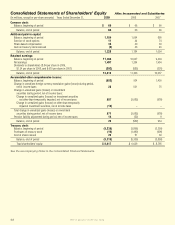

Consolidated Statements of Shareholders’ Equity Aac Incorporated and Subsidiaries

(In millions, except for per-share amounts) Years Ended December 31, 2009 2008 2007

Common stock:

Balance, beginning of period $ 66 $ 66 $ 66

Balance, end of period 66 66 66

Additional paid-in capital:

Balance, beginning of period 1,184 1,054 895

Exercise of stock options 11 44 74

Share-based compensation 35 40 39

Gain on treasury stock reissued (2) 46 46

Balance, end of period 1,228 1,184 1,054

Retained earnings:

Balance, beginning of period 11,306 10,637 9,304

Net earnings 1,497 1,254 1,634

Dividends to shareholders ($.84 per share in 2009,

$1.24 per share in 2008, and $.615 per share in 2007) (393) (585) (301)

Balance, end of period 12,410 11,306 10,637

Accumulated other comprehensive income:

Balance, beginning of period (582) 934 1,426

Change in unrealized foreign currency translation gains (losses) during period,

net of income taxes 26 621 75

Change in unrealized gains (losses) on investment

securities during period, net of income taxes:

Change in unrealized gains (losses) on investment securities

not other-than-temporarily impaired, net of income taxes 587 (2,085) (576)

Change in unrealized gains (losses) on other-than-temporarily

impaired investment securities, net of income taxes (16) – –

Total change in unrealized gains (losses) on investment

securities during period, net of income taxes 571 (2,085) (576)

Pension liability adjustment during period, net of income taxes 14 (52) 9

Balance, end of period 29 (582) 934

Treasury stock:

Balance, beginning of period (5,335) (3,896) (3,350)

Purchases of treasury stock (10) (1,490) (606)

Cost of shares issued 29 51 60

Balance, end of period (5,316) (5,335) (3,896)

Total shareholders’ equity $ 8,417 $ 6,639 $ 8,795

See the accompanying Notes to the Consolidated Financial Statements.

We’ve got you under our wing.

52